Introduction

TABLE OF CONTENTS Revised 10/23/06

INTRODUCTION

Introduction . 1

Anthem

Mission and Philosophy . 3

UNDER 65 PRODUCT AND NETWORK DESCRIPTIONS

Blue Access ® PPO/ Alliance . 4

Access Choice PPO/ AllianceChoice . 4

Preferred® HMO/ BlueCHOICE. 4

UNDER 65 PRODUCTS Blue

Access /Blue Access Choice . 5

Access Economy/ Blue Access Choice Economy . 5

Blue Access Value/ Blue Access Choice Value . 5

Preferred® HMO . 6

HIPAA Blue Access . 6

Blue Short Term . 6

Lumenos® Consumer Driven Health Plans . 6

Specialty Products

Blue Preferred Term LifeTM . 7

UNDER 65 UNDERWRITING GUIDELINES

Adding Benefits (Upgrades) . 8

Address and Billing Changes . 9

Determination . 9

Attending Physician's Statement (APS) . 9

Billing and Payment Options . 10

Cancellation . 10

Certificate or Policy Delivery . 11

Child Only Policy . 11

Completion of the Application . 11

Death of a Certificate Holder. 12

Declination . 12

Deleting Benefits (Downgrades) . 12

Dependents Who Reach Age Limitation . 13

Divorce . 13 Dual

Effective Date Assignment . 14

Eligibility . 15 Full-Time

UNDER 65 UNDERWRITING GUIDELINES (Continued) List

Marriage . 16 Medical

Questionnaires. 17

Pregnancy . 18 Premium

Requirements .18-19

Reinstatements . 19 Rate

Increases/Renewals . 20

Requirements . 20

Surviving Spouse/ Dependents. 20

Tobacco/Non-Tobacco

Underwriting Opinion Form . 21

MEDICAL CONDITIONS AND RATING GUIDE

Medical Conditions and Rating Guide. 22 Key Points to Remember . 22 Medical Condition Ratings .23-32 Medical Conditions That Are A Decline.33-34 Medication Denials. 35

HEIGHT AND WEIGHT BUILD CHARTS

Males-Ages 13 & Over . 36

Females-Ages 13 & Over. 36

Super Preferred Build Chart. 37

MEDICAL QUESTIONNAIRES

Abnormal Pap Smear . 38

Arthritis . 41 Asthma/Allergy . 42

Attention Deficit Disorder . 43

Back/Spinal . 44

Colitis/Irritable Bowel Syndrome . 45

Diabetes . 46 Digestive . 47 Ear/Otitis . 48 Endometriosis . 49 Fibromyalgia. 50 Gout . 51

Heart Murmur/Mitral Valve Prolapse . 52

Hypertension . 53 Kidney/Urinary

Migraine . 56 Seizure/Epilepsy . 57 Thyroid . 58 Tumor/Cyst. 59 Ulcer. 60

ONLINE AGENT TOOLS

Introduction/Overview of Tools . 61

Individual Producer Site .62-63

Anthem Rate Generator (Rating CD) .64-65

AgentConnect and AgentServices .66-67

Agent Registration for Voice Signature . 68

Agent Data Entry and Voice Signature .69-70

VAMI (View and Administer Member Information) . 71

Online Order Entry System (Materials) .72-73

MISCELLANEOUS FORMS Application

Product Transition Chart.75

Underwriting Opinion Form . 78

OVER 65 PRODUCTS

Medicare Supplement Plans . 79

BlueMedicare Rx (Part D) . 80

Balance Budget Act (BBA) . 81

Medicare Supplement Guide. 83

IMPORTANT CONTACTS. 85

INTRODUCTION

The Individual Business Unit at Anthem Blue Cross and Blue Shield offers a diverse suite of

individual health coverage products exclusively to direct-pay consumers. This manual provides

guidelines intended to help writing agents solicit, write, and submit applications for individual

health coverage in the state of Missouri.

It is important to remember that these guidelines are for informational purposes only, and

should not be interpreted as a guarantee of underwriting action on any specific case. The

agent and applicant should be aware that the final decision regarding all underwriting actions-

including insurability, rating, and effective date assignment-will always be determined by the

Medical Underwriting department following a thorough assessment of each applicant's

morbidity risk. Various sources of information are used for assessing this risk; however, the

most important source is the application. Therefore, it is important to make sure each

application is complete and accurate.

The information contained in this manual is intended for internal use only and may not be

copied or distributed in any manner. The benefit descriptions are intended to be a brief

overview of some benefits available to Anthem members.

For Internal Use Only

ANTHEM BLUE CROSS AND BLUE SHIELD

Anthem Overview

Anthem, Inc. and WellPoint Health Networks, Inc. completed their merger on November 30, 2004.

WellPoint, Inc. serves approximately 34 million members though its Blue Cross and Blue

Shield operations in 14 states and its non-Blue branded operations in other states. The

company has over 42,000 associates nationwide.

About WellPoint, Inc.

WellPoint, Inc. is the largest publicly traded commercial health benefits company in terms

commercial membership in the United States. Headquartered in Indianapolis, Indiana,

WellPoint is an independent licensee of the Blue Cross and Blue Shield Association and

serves its members as the Blue Cross licensee for California; the Blue Cross and Blue Shield

licensee for Colorado, Connecticut, Georgia, Indiana, Kentucky, Maine, Missouri (excluding 30

counties in the Kansas City area), Nevada, New Hampshire, New York (as Blue Cross Blue

Shield in 10 New York City metropolitan and surrounding counties and as Blue Cross or Blue

Shield in selected upstate counties only), Ohio, Virginia (excluding the Northern Virginia

suburbs of Washington, D. C.) and Wisconsin and through HealthLink and UniCare. Additional

information about WellPoint is available at www.wellpoint.com.

Missouri

Anthem Blue Cross and Blue Shield is the trade name for, in most of Missouri, Healthy

Alliance® Life Insurance Company (HALIC), HMO Missouri, Inc., and RightCHOICE® Managed

Care, Inc. (RIT) (RIT, with certain affiliates, administers non-HMO benefits underwritten by

HALIC and HMO benefits underwritten by HMO Missouri, Inc.). These companies are

independent licensees of the Blue Cross and Blue Shield Association. Blue Cross and Blue

Shield are registered marks of the Blue Cross and Blue Shield Association.

For Internal Use Only

Mission and Philosophy

Our mission is to improve the lives of the people we serve and the health of our communities. At Anthem, we believe health care coverage should actually help people stay healthy. That's why we go beyond simply providing coverage. We help support and encourage our members' wellness by:

• Offering large provider networks that include many of the best physicians,

specialists, and hospitals in each area we serve.

• Encouraging members to have important preventive and health maintenance

• Including coverage for preventive and health maintenance care in many plan

• Providing programs to help members proactively manage chronic health

We work with physicians, hospitals, and other providers to help ensure that care is accessible, coordinated, timely, and provided in a manner and setting that promotes positive patient-provider relationships.1 1 Blue Cross and Blue Shield Association,

Brand Talk

MISSOURI PRODUCT AND NETWORK DESCRIPTIONS

B

LUE ACCESS PPO/ ALLIANCE

Blue Access is a preferred provider organization (PPO) product that utilizes the comprehensive Alliance network of physicians and hospitals. This plan does not require members to select a primary care physician (PCP) or obtain referrals. Blue Access features two levels of benefits: Network and Non-Network. Network care is paid at a higher benefit level. Non-network care is paid at a lower benefit level. Therefore, members have a greater financial responsibility if they obtain care at non-network providers. Blue Access members have access to network providers nationally and worldwide through BlueCard®.

BLUE ACCESS CHOICE PPO/ ALLIANCECHOICE

Blue Access Choice is a Missouri preferred provider organization (PPO) product that utilizes the select

AllianceChoice network of physicians and hospitals. The product is sold only in the city of St. Louis and

the following counties: St. Louis, St. Francois, St. Charles, Warren, Franklin, and Jefferson. This plan

does not require members to select a primary care physician (PCP) or obtain referrals. Blue Accesssm

Choice features two levels of benefits: Network and Non-Network. Network care is paid at a higher

benefit level. Non-Network care is paid at a lower benefit level. Therefore, members have a greater

financial responsibility if they obtain care non-network providers. Blue Access Choice members have

access to network providers nationally and worldwide through BlueCard®.

B

LUE PREFERRED HMO/ BLUECHOICE

Our Blue Preferred HMO product utilizes the BlueCHOICE network of physicians and hospitals, which

is available in approximately two-thirds of the Missouri plan area, including the St. Louis metro area,

Central and Southwest Missouri. This plan is an Open Access HMO, meaning no referrals or primary

care physician (PCP) selections are required. The product covers Network care only. Therefore, the

member has 100% financial responsibility for Non-Network care, except emergency services.

Members also have access to network providers nationally and worldwide through BlueCard®, for

urgent and emergency care situations.

Same Widespread Provider Networks

Previous Network Name

New! Network Name

AccessSM / Alliance

Blue AccessSM Choice/ AllianceChoice

Blue Preferred® HMO/ BlueCHOICE

Under 65 Health Insurance Product Overview

Blue Access® / Blue Access Choice

Blue Access and Blue Access Choice are PPO products designed to offer a broad range of benefits at an affordable monthly premium. Each offers three different plan options, with a choice of deductible levels. All plans have an unlimited lifetime maximum and offer network and non-network benefits. An Optional Maternity Rider is available. There are also 3 Rx options. All plans have a $25 office visit copay that applies to both primary and specialty care. The plan options and deductible levels are:

• Blue Access/ Choice 100 - 0% member coinsurance with deductibles of $500, $1,000, $2,500,

$5,000, $7,500 and $10,000.

• Blue Access/ Choice 90 – 10% member coinsurance with deductibles of $250, $500, $1,000

• Blue Access/ Choice 80 – 20% member coinsurance with deductibles of $500, $1,000, $2,500,

$5,000 and $7,500.

Blue Access Economy / Blue Access Choice Economy

Blue Accesss/ Blue Access Choice Economy are PPO products designed to help consumers obtain affordable health care coverage. These products have 4 deductible levels to help consumers tailor the monthly premium to their needs.

• Deductibles of $1,000, $1,500, $2,500 and $5,000.

• 30% coinsurance after deductible on covered services.

• 3 Rx options

• $30 copay for the first 3 office visits, then deductible and coinsurance for the fourth and any

subsequent visits.

Blue Access Value / Blue Access Choice Value

Blue Access Value/ Blue Access Choice Value are PPO products that can help consumers afford the protection they need against unexpected medical bills. These products feature 4 deductible options and comprehensive inpatient hospitalization benefits, but have more limited outpatient benefits to help lower the overall premium. The plan options are:

• Deductibles of $2,000, $3,000, $5,000, $10,000

• 30% coinsurance after deductible on covered services

• 3 Rx options

• $30 copay for the first 2 office visits. The third, and any subsequent visits, the member is

responsible for 100% of the billed charge.

Blue Preferred® HMO

The Blue Preferred HMO is an open access HMO product that offers low out-of-pocket cost and no annual deductible. The plan offers:

• $25 copay for office visits

• $150 copay for emergency room services

• 10% member coinsurance for other services, such as inpatient hospital care

HIPAA Blue Access

HIPAA Blue Access is a guarantee issue product for eligible individuals who may not qualify for our regular plans because of their health. Applicants must be able to answer "yes" to the 5 HIPAA eligibility questions listed on the application. The plans are:

• HIPAA Blue Access 100 - $1,000 deductible, 0% member coinsurance, Rx $15/$30/$60/25%

• HIPAA Blue Access 80 - $1,000 deductible, 20% member coinsurance, Rx $15 generic only

• Blue Preferred HMO 90 – no annual deductible, 10% member coinsurance, Rx

Blue Short-Term

For individuals who are temporarily without health coverage, Bluesm Short-Term is an affordable plan

designed to provide protection from unexpected health care expenses for a short period of time (30-180

days). This product provides a choice of five deductibles and 20% member coinsurance. The deductible

options are: $250, $500, $1,000, $2,500 and $5,000.

Lumenos® Consumer Driven Health Plans (CDHP)

Anthem's Lumenos Consumer Driven Health Plans provide innovative coverage that will help

customers improve and maintain their health and provide greater control over their health care dollars.

Three Lumenos CDHP plans are available for effective dates of January 1, 2007 and later. All offer

100% coverage for nationally recommended preventive care services and provide members with

access to online tools and information they can use to become more informed and knowledgeable

health care consumers.

Lumenos Health Savings Account Plan (Lumenos HSA) combines a tax-advantaged member-

funded Health Savings Account with a qualified high deductible health plan (HDHP).

• 0% and 20% coinsurance options available • Individual/family deductible options (0% coinsurance): $1,500/$3,000, $3,000/$6,000,

• Individual/family deductible options (20% coinsurance): $1,500/$3,000, $3,000/$6,000

Lumenos Health Incentive Account Plus (Lumenos HIA Plus) combines traditional health coverage

with a plan-funded Health Incentive Account, along with additional dollar incentives if members use

certain tools and services to maintain and improve their health.

• 0% and 20% coinsurance options available • Individual/family deductible options (0% coinsurance): $2,500/$5,000, $5,000/$10,000,

• Individual/family deductible options (20% coinsurance): $2,500/$5,000

Anthem HIA funding: For Lumenos HIA Plus only, Anthem contributes the following amounts

annually to the Health Incentive Account:

• $500 for individual plans, allocated quarterly

• $1,000 for family plans, allocated quarterly

Healthy rewards incentives: Additional Anthem contributions to the Health Incentive Account can

be earned by participating in the following incentive programs:

• Completing or updating an online Health Assessment: $50 per family, per year.

• Enrolling in and graduating from the Personal Health Coach program: $100 for enrolling and

$100 for graduating.

• Completing our Smoking Cessation Program: $50 per covered person, per lifetime.

• Completing our Weight Management Program: $50 per covered person, per lifetime

Lumenos Health Incentive Account (Lumenos HIA) provides traditional health coverage and Health

Incentive Account funded by specified dollar incentives members can earn if they use certain tools and

services to improve and maintain their health.

• 0% and 20% coinsurance options available • Individual/family deductible options (0% coinsurance): $1,000/$2,000, $2,500/$5,000,

• Individual/family deductible options (20% coinsurance): $1,000/$2,000, $2,500/$5,000

Healthy rewards incentives: Anthem contributions to the Health Incentive Account can be earned

by participating in the following incentive programs:

• Completing or updating an online Health Assessment: $50 per family, per year.

• Enrolling in and graduating from the Personal Health Coach program: $100 for enrolling and

$100 for graduating.

• Completing our Smoking Cessation Program: $50 per covered person, per lifetime.

• Completing our Weight Management Program: $50 per covered person, per lifetime

LUE PREFERRED TERM LIFE

Blue Preferred Term LifeTM offers consumers affordable life insurance coverage for a specified period of

time. It is available with most Anthem Individual medical plans. There are no additional forms to fill out.

• Benefit Options are: $15,000, $25,000 and $50,000

Note: Please refer to the Life section for enrollment guidelines.

D

Dental Blue helps cover the cost of maintaining good oral health, an important component of overall health and well being. Dental Blue pays the full cost of diagnostic and preventive care when a network provider is used. It can also help offset the cost of major dental care. The plan can be purchased in conjunction with a medical benefits plan, or as a stand-alone product. Plan highlights:

• Diagnostic and Preventive Care – no deductible and no waiting period when performed by a

network provider

• Basic Dental Care - $50 annual deductible and six (6) month waiting period

• Major Dental Care - $50 annual deductible and twelve (12) month waiting period

Note: Please refer to the Dental section for enrollment guidelines.

UNDER 65 GUIDELINES

Adding Benefits (Upgrades)

Members can upgrade or downgrade benefits twice per year: once at renewal and once more

within 12 months. To add benefits (upgrades) an application must be sent to Underwriting. In

order to secure an effective date, the application must be received by the requested effective

date. Otherwise, the effective date will be assigned by Underwriting for a future date.

Agent Tips - Members may qualify for a better rate tier if they were:

1. Previously issued as tobacco users and are now 12 months tobacco free. 2. Previously issued at a higher tier due to build, but have maintained a lower weight for 12

3. Previously issued at a higher rate due to a medical condition that has now been resolved

or has not required treatment for a specified period of time.

A Change of Coverage application must be filled out and is subject to complete Medical

Underwriting.

Adding Dependents

Any current member may add a "newly acquired" dependent due to birth, adoption, marriage, or

legal guardianship within 31 days of the qualifying event (i.e., date of birth, date of adoption,

date of marriage, or date of legal guardianship placement).

Newborns or Newly Adopted Children

Coverage is guarantee issue for the first 31 days for dependents who are newborns and newly

adopted children of the primary policyholder or spouse. In order to continue coverage past the

31st day, the policyholder must direct Anthem to add the dependent either by calling Customer

Service or submitting the request in writing. The newborn will be added at the existing family risk

tier. In the case of newly adopted children, a copy of the document awarding the policyholder or

spouse court-appointed custody must be provided. In addition, an affidavit attesting to the

adoption must be completed and accompany the application.

If notification is not received within 31 days, coverage will not be extended beyond the 31st day.

To obtain coverage after the 31st day, a new application, indicating "add dependent(s) to current

coverage," must be submitted and full underwriting will be required. In order to secure an

effective date, the application must be received by the effective date requested. When

completing the application, please take the following steps:

• In Section A, check the box: "add dependent (s) to current coverage" and provide the

current policy number

• Provide the member's name, social security number, and address in Section B

• Section D must be completed

• Complete Section K – answer all medical questions for all members being added

Moving a newborn to a ‘child only' policy requires submitting an application to Underwriting. In this case, unlike adding a newborn to an existing family policy, the first 31 days are not free. If approved, the newborn will receive the next available effective date following receipt of the application.

Other Dependents

Adding a dependent other than a newborn or newly adopted child (e.g., dependents as a result

of marriage or court-appointed legal guardianship) requires a new application. The dependent is

subject to full medical underwriting and the effective date will be assigned according to the

regulations set forth under the Effective Date Assignment section of this guide.

For dependents added as the result of marriage, the application must be received within 31

days of the qualifying event (i.e., date of marriage) in order for coverage to be effective as of the

date of the qualifying event. The dependents will be subject to full underwriting. The addition of

dependents as a result of marriage may result in a new policy risk tier.

For dependents added as a result of court-appointed legal guardianship (if the legal guardian is

someone other than the natural parent of the child(ren), proof of the guardianship will be

required, (i.e., court-appointed custody and affidavit) and must be submitted with the

application.

If the application and required proof are submitted within the first 31 days of

guardianship placement, adding the dependent is guarantee issue, and the dependent will be

added at the existing policy risk tier. Full medical underwriting will be required if the application

is submitted more than 31 days after the qualifying event.

Note: The affidavit required for adoptions and court-appointed guardianships can be

found in the Miscellaneous Forms section of this manual.

Address and Billing Changes

Members may make address, billing, and automatic bank draft changes verbally by contacting

Customer Service; by submitting a written request; or by contacting their agent. Automatic

deductions will begin on the next billing period after the receipt date of the request to use bank

draft.

Age Determination

The applicant's age on the effective date of coverage will determine the correct rate. If the

effective date is changed, the rate could also change. Premium due to age increases will be

effective at the member's annual renewal of the policy.

Attending Physician's Statement (APS)

Medical records and an APS may be requested by Underwriting to supplement the information

on the application. An APS may be requested if the application indicates a condition that

requires more detailed information or if medical conditions are not fully explained on the

application and/or medical questionnaires. An APS may also be requested based on internal

claims information.

A

mandatory APS will be requested if an applicant is over age 55 and

is not replacing prior

coverage. Underwriting will send the request to the applicant and notify the agent if medical

records are needed. It is the applicant's responsibility to have these records sent to Anthem.

The applicant is also responsible for any costs incurred in obtaining medical records.

Billing and Payment Options

The first month's initial premium is

required with the application. Once the underwriting process

is complete and the applicant's final rate has been determined, any remaining balance due will

be included in the next month's bill.

Billing Options: Members may choose paper billing or automatic bank drafts either monthly,

quarterly, semi-annually, or annually.

Payment Options:

Initial payments can be made by credit card (MasterCard, Visa, Discover, or American Express), a one-time automatic bank draft, or by check.

Subsequent/Ongoing payments can be made by automatic bank draft, paper check, or over the phone by calling Customer Service for a one-time credit card or bank draft. Members may also issue an electronic check through their bank's website.

Cancellation

All new policies may be cancelled by the applicant, back to the effective date of coverage, if the

cancellation request is submitted within 31 days after the applicant receives the contract or

certificate, or accesses it online, whichever is earlier. If no claims have been submitted, Anthem

will refund all premiums to the applicant.

A policy will be automatically cancelled when the member transfers to another Anthem

Individual plan. The cancellation will be effective at midnight on the day prior to the effective

date of the new coverage.

Note: Individual policies are not automatically cancelled when transferring to or from an Anthem

Group plan. In this case, the member must request cancellation of the Individual coverage. If a

member moves out of state, medical and dental coverage will be transferred to another Blue

plan; however Life coverage (if any) will continue.

All other cancellation requests must be received 30 days in advance of the cancellation date. If

proper notification is not given, the member will be asked to pay the final month's bill or have the

policy lapse for nonpayment if payment is not made. Customer Service will accept cancellation

requests verbally over the phone; the customer can also submit a written request to cancel

coverage.

Members with multiple policies (i.e., medical, dental, and/or life coverage) must specify which

policies are to be cancelled. The other policies will remain effective. If the member does not

specify which policies should be cancelled, all active coverage will be cancelled.

Life Policies only: Life coverage will be automatically cancelled on the last day of the month in

which a covered member turns age 65. Eligible spouses and dependents under age 65 may

continue their coverage under the Life Insurance policy.

Note: See "Death of a Policyholder" for policies related to death cancellations.

Certificate of Coverage or Policy Delivery

The member will receive, along with their ID cards, instructions on how to obtain their certificate

of coverage or policy via the internet. The member will also receive a postcard that can be

returned if a paper copy of the certificate is requested.

Child Only Policy

Coverage may be written for a child(ren) only. The parent and/or guardian must sign the

application and is considered to have contracted with Anthem Blue Cross and Blue Shield to

provide insurance to the covered child(ren). Applications may be submitted for a child(ren) only

if the child(ren) are under age 18. Newborns cannot be written on a Child Only Policy until they

have been released from the hospital. If approved by Underwriting, the youngest child will be

enrolled as the policyholder.

Completion of the Application

The most important source of underwriting information is the application. The underwriting

process can often be completed with a simple review of the application. Each question on the

application must be

specifically answered by each applicant and all responses must be

accurately and completely recorded on the application. All applications must be completed in

ink and the writing agent must verify that the applicant answered the questions, and signed and

dated the application. The applicant must initial any erasures or corrections. All "YES" answers

to medical questions

must be fully explained along with the name, address and telephone

number of all doctors consulted by the applicant.

Conditional Coverage

Coverage does not become effective until Underwriting approves the application. Therefore, an

applicant's current coverage should not be cancelled until they receive an approval from

Anthem Blue Cross and Blue Shield.

Note: See Effective Date Assignment section for information on available effective dates.

Counter Offers

Anthem Blue Cross and Blue Shield may decline one family member, but offer coverage to others. Or, the applicant may be extended a counter offer for coverage that may include a different rate, plan, or higher deductible level. Counter offer letters for a higher rate band only will offer alternatives for higher deductibles, along with the premiums for those deductibles. Counter offer letters will be mailed to the applicant for approval and signature. The agent will also be copied on the letter. The applicant must sign and return the counter offer letter to the Underwriting Department within 15 business days of the date on the letter. Some applicants may also accept the counter offer using voice signature capability. The applicant will be instructed in the letter to call a specific telephone number to accept the offer. Only applicants who receive this number in their letter have the option to use the voice signature. Applicants who wish to downgrade benefits or request a future effective date can indicate this on the counter offer letter and return it in writing to the Underwriting Department. All plans may be offered without drug coverage as a counter offer from Underwriting.

Death of a Certificate Holder

Written or telephone notification to Anthem Blue Cross and Blue Shield is required after the

death of a policyholder. Termination of the policy will be effective the day after the policyholder's

death; this is to ensure eligible benefits are paid up to the date of death and any unused

premiums will be refunded. If Anthem Blue Cross and Blue Shield is notified of the death of the

policyholder after 91 days following the date of death, a copy of the death certificate will be

required for a refund of any unused premiums.

Declination

If a health condition(s) or other underwriting criteria makes it impossible for coverage to be

offered on any basis, the application is declined, any initial payment submitted with the

application will not be processed. If the initial payment is submitted via check, the original check

will be destroyed and will not be returned to the applicant. The applicant will receive a letter from

Anthem Blue Cross and Blue Shield advising them of the reason for declination. Agents are sent

a copy of the declination letter as well.

Deleting Benefits (Downgrades)

Any deletion of benefits (including an increase in the deductible level or removal of an optional

rider) is considered a ‘downgrade' in benefits. Policyholders can upgrade or downgrade benefits

twice per year: once at renewal and once more within 12 months. Policyholders can make

changes by calling their agent, contacting Customer Service, or completing a

Downgrade/Policy Change Form. The change will be effective on the first day of the month after

notification is received by Anthem Blue Cross and Blue Shield, or on a specified future date if

requested by the policyholder.

Note: The Downgrade/Policy Change Form can be found in the Miscellaneous section of this

manual as well as on the Individual Producer Site.

Dental Coverage

Dental Bluesm, a dental PPO product, is available as a stand-alone product in addition to medical coverage. This product provides coverage for Diagnostic and Preventive Care, as well as Basic and Major Dental Care. There is no waiting period for Diagnostic and Preventive Care. There is a 6-month waiting period for Basic Dental Services, and a 12-month waiting period for Major Dental Care. The applicant must be covered for dental before a spouse or any dependents can be eligible for dental coverage. If dental coverage is requested for children, all of the dependents must be covered and a premium will be charged for each child. Each member with active dental coverage will be charged a premium. Members who cancel their medical coverage may keep dental coverage active, if they wish. For combined billing, dental must have the same renewal date as Medical. If both medical and dental coverage is requested, one application should be submitted for both plans rather than submitting separate medical and dental applications.

Dependent Coverage

Eligible dependents of the policyholder or spouse include unmarried children up to the end of

the calendar year in which they turn 19, or to the end of the calendar year in which they turn 24

if they qualify as full-time students. Premium is charged for up to 3 dependent children on a

medical policy. On the application, the primary applicant will be asked to list all dependents

beginning with the eldest.

Dependents Who Reach Age Limitation

A covered dependent who loses eligibility upon attaining the maximum age may apply for

his/her own coverage. A new application must be completed by the dependent and received

within 31 days of losing eligibility. If the application is received within the 31-day period, the

applicant will be guaranteed the same plan (or similar plan if the original plan is no longer

offered), with no lapse in coverage. Pre-existing credit and credit for any deductible amount met

under the original plan will be applied to the new plan.

If the application is received after the 31-day period, the applicant will be subject to Medical

Underwriting approval. Coverage will begin according to the regulations set forth under the

Effective Date Assignment section of this guide.

Divorce

When a covered person (including a dependent) loses coverage due to divorce, he or she may

apply for his or her own coverage. A new application must be completed and received within 31

days of losing eligibility. If the application is received within the 31-day period, the applicant will

be guaranteed the same plan (or similar plan if the same plan is no longer offered), with no

lapse in coverage. Pre-existing credit and credit for any deductible amount met under the

original plan will be applied to the new plan.

If the application is received after the 31-day period, the applicant will be subject to medical

underwriting approval. Coverage will begin according to the regulations set forth under the

Effective Date Assignment section of this guide.

Dual Coverage

If an Anthem Blue Cross and Blue Shield individual member has health coverage under another policy once his/her Anthem individual policy is effective, and the member stated that no other health coverage would be in effect on the effective date of the Anthem policy, Anthem reserves the right to terminate the Anthem coverage. Rescission of the Anthem individual coverage will be retroactive up to 90 days or the policy effective date, at Anthem's discretion.

Effective Date Assignment

Applications will be assigned an effective date of either the 1st or the 15th of the month following the application received date. Exceptions for other dates can be made for continuous coverage only. Continuous coverage is defined as no break in coverage from a policy in effect immediately prior. If the application is received by Anthem within 10 days of the signature date and the signature date was on or prior to the requested effective date, coverage will begin on the date requested. (This applies as long as the requested effective date is not more than 90 days after the application signature date.) If the application is received by Anthem after 10 days following the signature date, and the signature date was on or prior to the requested effective date, coverage will begin on the next available effective date.

Example:

Application received within

Requested effective date June 1st

Signature date May 27th

10 days of signature date

Anthem received June 6th

Member will receive June 1st effective date

Application received after

Requested effective date June 1st

10 days of signature date

Signature date May 27th

Anthem received June 9th

Member will receive June 15th effective date (the next available date)

NOTE: In cases where an application is closed because Anthem did not receive requested

information, and subsequently the information is received, the original requested effective date

cannot be honored and a new effective day will be assigned. The new effective date will be the

next available effective date (1st or 15th) after the information is received. The signature on the

application is only valid for 90 days.

Short-Term

The application must be received by the requested effective date. If no effective date is

requested, the coverage, if approved, will be effective on the received date. The effective date

cannot be more than 90 days after the application signature date. Short-term coverage can be

selected in daily increments, with a minimum of 30 days of coverage and a maximum of 180

days at one time.

Short-Term coverage is not renewable; however, individuals may purchase additional Short-

Term policies, up to a maximum of 360 days of total coverage within a 12-month period.

Applicants must be able to answer "NO" to the current medical questions on the application. A

new application must be completed and sent to Anthem for approval, along with the appropriate

premium.

Any condition that occurred during an earlier contract term will be treated as a pre-existing

condition under subsequent contracts.

Please refer to the pre-existing condition section for

additional information on.

Short-Term policies can be cancelled if the policyholder requests cancellation 30 days prior to

the cancellation date.

Applicants who meet the following criteria are eligible to apply for individual coverage:

; Cannot be eligible for Medicare.

; Must be between the ages of "newborn" and age 64. Persons over age 65

who are not

eligible for Part A of Medicare may be considered for an Individual under 65 policy and are subject to full medical underwriting. To be considered for coverage, the applicant must provide a reason for not being eligible for Medicare.

; Must be a resident of the state in which they are applying for coverage.

; Cannot currently pregnant or an expectant parent.

; Must be a legal U.S. resident

If an existing member moves out of state, he or she may lose eligibility and coverage may be

terminated.

Full-Time Students

Coverage for full-time students within the age limit (age 24) continues as long as they are

enrolled in an accredited educational facility and are classified as full-time students by the

school. Coverage ends when they no longer meet the eligibility guidelines for dependents;

however, they may be eligible for guaranteed acceptance for the same coverage (or similar

coverage if the same coverage is no longer offered), or lesser benefits if Anthem Blue Cross

and Blue Shield is notified within 31 days of the loss of eligibility. This applies only to

dependents coming off their parents' Individual policies. Pre-existing credit met under the

original plan will be applied to the new plan. Refer to the contract for specific eligibility

information.

ID Cards

New members will receive ID cards approximately 3 to 5 days after enrollment, along with

instructions on how to obtain a certificate of coverage. New members will also receive a

separate Welcome letter shortly thereafter.

Life Coverage

Health coverage applicants may apply for the Preferred Choice Term Life coverage. New

applicants must meet Anthem's medical underwriting guidelines to qualify. Term Life coverage

is not offered as a stand alone product.

The benefit options are: $15,000, $25,000, and $50,000. The $50,000 option is not available to

applicants under the age of 19. If the $50,000 option is selected by an approved applicant under

the age of 19, coverage will default to $25,000. Applicants under the age of one year are not

eligible for Life Insurance.

If Term Life coverage is selected for dependent children,

all of the dependent children must be

insured for the same benefit amount.

Active Term Life coverage will be automatically cancelled on the last day of the month of the

covered member's 65th birthday. Spouses and dependents may continue Term Life coverage, if

eligible.

List Bill

Criteria for List Billing

¾ List billing is a billing option for Individual coverage that allows premiums to be paid through

a third party (such as an employer) for a group of individuals. It is not intended for use by families. List bill arrangements must consist of a minimum of 2 members in order to be set up and maintained. Covered individuals must pay 100% of their own premium. The third party only facilitates payment of the individual health insurance premium.

Applying for Coverage

¾ The "Request for List Billing Arrangement" form must be completed and all individuals to be

enrolled in the List Bill arrangement must be listed.

¾ Each individual must then complete an individual application for coverage and sign the

Permission to Provide List Bill Arrangement form. A copy of the authorization form must be attached to each application. Failure to comply will result in delays in the enrollment process. The writing agent must sign the "Request for List Billing Arrangement."

¾ All individual applicants must request the same billing due date and bill cycle (monthly,

quarterly, semi-annual, annually).

¾ Please do not submit payment with application.

Adding to an Existing List Bill

¾ To add a new member to an existing List Billed account, the individual must complete an

individual application for coverage and attach a copy of the "Request for List Billing Arrangement" form (including the name of the new member), and the "Permission to Provide List Bill Arrangement" form (Disclaimer) and send the completed forms to the writing agent. This form must include the Parent Group Number found on the monthly bill summary. Please note that the billing date for a new member will be the same as the other Group members on the arrangement (i.e., 1st or the 15th of the month).

¾ In order to add a dependent to an existing individual policy, the policyholder must submit an

application to Anthem through his or her agent. The same effective date will apply: 1st or the 15th of the month.

Cancellation of List Bill Affiliation

¾ Cancellation of a List Bill account must be received by Anthem in writing from the list bill

administrator 30 days prior to the cancellation date requested. If the cancellation is due to a death, and the cancellation notice is received 90 days after the death, a copy of the death certificate Is required

¾ Upon cancellation of a List Billed account, all individual policyholders billed within that

arrangement will begin receiving monthly billings statements at their home address. Any refunds due will be issued directly to the policyholder.

Marriage

Current members who wish to add a spouse due to marriage must submit a new application. The spouse is subject to full medical underwriting. Both the current member and the spouse must sign the application. The new application must be received by Anthem Blue Cross and Blue Shield within 31 days of marriage in order for coverage to begin on the date of marriage. If the application is after 31 days of marriage and Underwriting approves the application, the effective date will be the next available effective date (1st or 15th of the month).

Medical Questionnaires

Medical questionnaires should be used to supplement "yes" answers indicated on the application. Questionnaires should be completed, signed and dated by the applicant; however, an agent may obtain the applicant's information over the telephone, sign and date the questionnaire, and indicate with whom they spoke. In most cases, an Attending Physician's Statement (APS) is not necessary if a questionnaire is fully completed and submitted. Agents may obtain the questionnaires listed below in the Medical Questionnaire section of this manual or from the Individual Producer website:

Abnormal Pap Smear

Seizure/Epilepsy

Attention Deficit Disorder

Heart Murmur/MVP

Colitis/Irritable Bowel

Member Self Serve

Members have the ability to manage their health benefits any time, day or night, through the anthem.com website. Members should select the member tab, and enter their home state. Members who log in to MyAnthem and select

MyServices will be able to:

• find a doctor or hospital

• order a new ID card

• view benefits

• check a claim status

• check the formulary

Plan Transfers

If a current Anthem Blue Cross and Blue Shield member moves outside the state of residence in which the policy is held, the Blue Cross and Blue Shield Association, an association of independently licensed Blue Cross and Blue Shield plans, requires the member to transfer to a local plan in the new state of residence. It is the policyholder's responsibility to apply for a new policy within that state. A letter will be sent to the member requesting permission to send a letter to the other plan. Medical and dental coverages may be transferred to another Blue plan; however, Term Life coverage can remain active with Anthem unless the policyholder requests cancellation. Dental policies will be cancelled and transferred to the new local plan.

Coverage is NOT available to any applicant if the applicant or spouse is currently pregnant

(whether or not they are to be covered on the policy), or

IF they are an expectant parent;

however, children of the expectant parent(s), or sibling of an expectant minor, may be written

independently.

Premium Requirements

The first month's premium must accompany the application. Initial payments can be made via

credit card (MasterCard, Visa, Discover, or American Express), check or authorization for a one-

time bank draft.

If the initial premium is submitted via check, we will convert that check to a one-time bank

draft/electronic transaction and destroy the original check; however the premium amount will not

be deducted from the applicant's bank account unless and until the application is approved. If

the application is declined, the applicant will receive a declination letter indicating the reason

coverage was denied.

For subsequent premium payments, applicants have two billing options – (1) automatic bank

draft and (2) paper billing. Members can choose to be billed monthly, quarterly, semi-annually or

annually. If premiums will be paid by a third-party administrator, a list bill arrangement may be a

third billing option. See the List Bill Section of this manual for additional information.

Automatic Bank Draft: Premium payments will be automatically deducted from a checking or

savings account. Applicants requesting Automatic Bank Draft must complete and sign the Automatic

Bank Draft Authorization section included on the application. If premium payments will be deducted

from a checking account, a voided check (not a deposit slip) must accompany the application. If

premium payments will be deducted from a savings account, a blank deposit slip showing the Routing

Number of the financial institution must accompany the application. Members can also request

Automatic Bank Draft for an existing policy by calling Customer Service and providing their bank

account information.

Although every effort is made to set up Automatic Bank Draft payments with the appropriate financial

institution as quickly as possible, processing delays sometimes occur. If Automatic Bank Draft is

requested on a new application and a processing delay prevents Anthem from collecting any initial

premium(s), the initial Automatic Bank Draft payment, once established, will include the current

premium and any back premiums owed as a result of the delay. In this event, members will receive a

letter notifying them of the total initial Bank Draft amount, and giving them the option of canceling the

withdrawal. Members who request Automatic Bank Draft on an existing policy may receive a direct bill

at their home address if the policy is not paid up through the current billing period at the time the

Automatic Bank Draft becomes effective.

Bill Direct: Billed at the member's home address monthly, quarterly, semi-annually or annually.

List Bill: If an individual applicant will be making premium payments through his or her employer (via

payroll deduction) Anthem can arrange to bill the employer directly each month via a list bill. The List

Bill option requires 2 or more employees to be set up.

See the List Bill section of this manual for

additional information. Short-Term

Advance Payment: Full premium for the entire term of coverage in the form of check, money order or

credit card.

Automatic Bank Draft for Monthly Billing: $10 additional monthly fee will be assessed (Short-Term

product only).

Monthly Billing: $10 additional monthly fee will be assessed (Short-Term product only). (At least one

month's premium is required with the application)

Pre-Existing Conditions

All Plans excluding Short Term and Blue Preferred HMO

A pre-existing condition is defined as any condition that was diagnosed or treated within 12

months prior to the effective date of coverage, or that produced symptoms within 12 months

prior to the effective date of coverage, that would have caused an ordinarily prudent person to

seek medical diagnosis or treatment.

Pre-existing conditions are only covered after the coverage has been in-force for 12 consecutive

months following the effective date of coverage. Credit for a prior carrier's coverage may be

given, if that coverage was continuous to a date not more than 63 days prior to Anthem's receipt

of a completed application.

Prior coverage can be from a group, individual, or short-term contract. (Medicaid qualifies as

prior coverage) but it must be a major medical type policy. To apply for pre-existing credit, the

applicant must complete the section for prior coverage information on the application. Credit is

not available if the prior coverage was an indemnity plan, hospital only plan, or supplemental

policy.

Short-Term

A pre-existing condition is defined as any condition that was diagnosed or treated within 24

months prior to the effective date of coverage, or that produced symptoms within 24 months

prior to the effective date of coverage, that would have caused an ordinarily prudent person to

seek medial diagnosis or treatment. For Short-Term policies only, a Pre-existing condition is

also defined as any condition that occurred during an earlier contract term.

Pregnancy on the effective date of coverage is also considered a pre-existing condition. Pre-

existing conditions are not covered for the term of the certificate.

Blue Preferred HMO

No waiting period for pre-existing conditions applies to members on this policy.

If a current member allows his/her contract to lapse and wishes reinstatement, he/she will be automatically eligible if the following guidelines are met: 1. Request for reinstatement is received within 90 days of the cancellation date and money is

received in full by the 90th day after the members paid to date.

2. No more than one previous cancellation for non-payment on current, continuous coverage

within the last 12 months.

3. No more than three bad checks in the past 12 months. If a member does not fall within above guidelines, a new application for coverage must be completed and Medical Underwriting will apply. If approved, a new effective date for coverage will be established.

Rate Increases/Renewals

Members are typically notified at least 30 days in advance of any intended rate increases.

Approximately 15 days prior to the customer notification, agents will receive a listing of their

client members who will be affected by the rate increase. Renewals occur approximately 12

months from the policy effective date. Renewal dates for all members will be the first of the

month in which the policies were originally effective. For example, a policy with a July 15th

effective date will have a July 1st annual renewal date. On the renewal date, the policyholder will

receive applicable age and product rate changes.

Signature Requirements

The primary applicant (and spouse, if applying), must sign and date the application. The

parent/guardian of a dependent child applying must sign and date the application. Failure to

obtain any of the above signatures will result in the return of the application. The application will

expire 90 days from the signature date if health coverage has not been approved by the end of

the 90-day period.

Surviving Spouse/Dependents

If a covered spouse or dependents (if any) lose coverage due to the death of the primary

policyholder, the spouse may continue the contract in his/her name. Anthem must receive

notification within 31 days following the primary policyholder's date of death.

If notification is received after the 31-day period, a new application must be submitted and the

applicant will be subject to Medical Underwriting approval. If approved, coverage will begin on

the next available effective date (1st or 15th), or a later date if requested.

Telephone Interviews

The applicant should be aware that the Underwriting Department may conduct a telephone

interview to verify information on the application, or to obtain additional details or missing

information for the purpose of underwriting.

Tier Rating

Anthem offers tier-rated coverage on all Under 65 Products, except Short-Term products. Super Preferred, Preferred, Standard 1, Standard 2, Modified 1 rates are available based upon health status, height/weight proportion, and tobacco usage. Generally, underwriters will permit tobacco users with no other ratable health history for any plan at a risk tier of Standard 1; however, approval and final rate tier placement is always determined by Medical Underwriting. Any changes to the rate quoted by the applicant's agent, will be communicated to the applicant and agent by the Underwriting Department. This will be a counteroffer letter, which must be signed by the applicant and returned to the Underwriting Department within 15 business days of the date on the letter. In order to qualify for the Super Preferred risk tier, the applicant and/or spouse must complete the Healthy Lifestyle section on the application. The Super Preferred rate is only available for an applicant and spouse 18 years of age or older. The applicant(s) must be able to answer "yes" to

all the questions and fall within a restricted build chart.

(This chart can be found in the

height;/weight section of this manual) The Healthy Lifestyle questions are in addition to the other

medical questions on the application. The Super Preferred Rate is a quotable rate. Children are

not eligible.

The tiers equate as follows:

decrease/

Please indicate on the application the tier you have quoted for all applicants dependents.

Tobacco/ Non-Tobacco Use Rate

Preferred rates may be available to any applicant, spouse or dependent that has not used ANY

form of tobacco products within the past twelve (12) months.

Generally, tobacco users (applicant and spouse) with no other ratable health history are eligible

for any plan at a risk of Standard 1.

Generally, non-tobacco users (applicant and spouse), with no other ongoing medical conditions

and no tobacco use for at least 3 years are eligible for any plan at a Super Preferred tier.

Note: Please refer to the section titled Tier Rating for all other rating tiers.

Underwriting Opinion Form

The Underwriting Opinion Form is designed to be used when agents face a difficult question

that may not be addressed in the Medical Condition Guide or if there is uncertainty as to

whether we would consider the application or decline coverage.

Underwriting will make a determination based only on the information provided on this form, and

then return the form to the agent. If an application is submitted following the return of an

Underwriting Opinion Form, please attach form to your completed application.

Withdraw Application

To withdraw an application, Anthem Blue Cross and Blue Shield must be notified by the applicant or agent. The request can be submitted in writing, by fax, or by calling Anthem.

MEDICAL CONDITIONS AND RATING GUIDE

Introduction

Medical Underwriting is the process of estimating the morbidity risk of an applicant for health coverage. Various sources are used for estimating this risk; however, the most important is the application. This guide is intended to help the writing agent solicit and write applications for coverage, and should not be interpreted as a guarantee of underwriting action on any one specific case. The agent and applicant must be aware that the final decision regarding insurability and possible effective dates is always made by the Medical Underwriting Department. This section includes some medical conditions and the probable underwriting action for applicants with such conditions. This is not an all-inclusive list and final decisions will be

determined by Medical Underwriting. Medical conditions preceded by a "#" designate that a Medical Questionnaire is required. These questionnaires should be completed and submitted with the application. Conditions are classified and rated as follows:

Super Preferred Rate Band

(Only available for applicant and

spouse/Healthy Lifestyle Questionnaire required)

Preferred Rate Band

(non-tobacco use)

Standard One Rate Band

(tobacco use)

Standard Two Rate Band

Modified Rate Band

Individual Consideration

Medical Records may be required

Cost of Medication

KEY POINTS TO REMEMBER • Decisions for applicants contemplating surgery will be postponed until surgery is completed.

• Applicants with several conditions may be declined due to the combination of conditions.

• Please refer to the Build Chart for applicants, spouses, and all dependents to determine the

"baseline" rate band

before factoring in any medical conditions.

• Decisions for expectant parents will be postponed until after delivery.

• All ratings will depend on the benefit plan and deductible selected.

• If health information is discovered that is not on the application, it will be referenced as PHI

(Protected Health Information) and cannot be released to the agent per HIPAA guidelines. Correspondence will be handled between the applicant and Underwriting.

• Prescription drug usage will be rated for dosage and cost. This could result in an offer of no

prescription coverage.

MEDICAL CONDITION RATINGS

Condition

On Accutane/Amnesteem/Claravis/Sotret. DEC Others, rate based on medications . STD 1/COM

Acquired Immune Deficiency Syndrome or Aids Related Complex . DEC

#

Alcohol / Drug Dependency

< 5 years since last treatment . DEC > 5 years since last treatment . IC/APS

#

Allergy

Mild (seasonal), minimal prescription usage . PREF Mild (seasonal), multiple medications . STD 1/COM Moderate year round and/or allergy shots . STD 1/STD 2/COM Severe (Allergy Shots/Multiple Medications) ER visits.IC/MOD 1/COM

Alzheimer's. DEC

Amputation (not caused by disease)

Fingers / toes . PREF Other limbs or with prosthesis .MOD1

Angina. DEC

#

Anxiety (Mental Health Questionnaire)

Current treatment with medication . STD1/COM Medication and/or current counseling sessions w/weekly, bi-weekly visits. DEC Hospitalization within 1 year. DEC Others . IC

#

Arthritis

Osteoarthritis, no med/OTC med, in hip, knee, shoulder .STD1 Osteoarthritis, no med/OTC, other sites. PREF Osteoarthritis, on prescription medication or no med/OTC in spine or neck . MOD1/COM Rheumatoid Arthritis. DEC With joint replacement done age 60-64 and over one year ago .MOD1 With joint replacement done under age 60 or under one year ago . DEC

Ascites, (all cases). DEC

Acute attack within 6 months . DEC Acute attack > 6 months, meds as needed or meds taken w/in one year.STD1 Acute attack > 6 months, meds taken daily . MOD1/COM No medication or treatment > one year. PREF

MEDICAL CONDITION RATINGS

Condition

#

Attention Deficit Disorder (ADD)

Rated based on medication .COM

#

Back Strain/Sprain

Single occurrence, < 1 year, full recovery .STD1 Recurrent episodes or with ongoing chiropractic care . IC/APS

#

Bronchitis (Allergy and/or Asthma Questionnaire)

Mild, Single Occurrence, Not Hospitalized, Full Recovery . PREF Moderate, recurrent episodes, infrequent attacks . IC/STD1 Severe, with hospitalization and/or numerous attacks/medications . DEC Chronic bronchitis within 2 years . DEC

Bursitis

Single occurrence <1 year .STD1 Unresolved, current treatment. DEC

#

Cancer (Tumor Questionnaire)

Metastatic Cancer . DEC Internal Cancer < 5 years last treatment . DEC Others .STD1

Carpel Tunnel Syndrome

Unoperated With Symptoms within 1 year . DEC Unoperated no symptoms within 1 year . PREF Operated, resolved. PREF

Cataracts

Unoperated .MOD1Operated, released from care . PREF

Cerebral Palsy

< age 20 . DEC > age 20 . IC/APS

Cholesterol (fasting)

Diet Controlled, < 200 .PRE No medication, reading 200 – 260 or with medication . MOD1/COM Reading > 260 or with or without medication . DEC

Cirrhosis of the liver . DEC

Chronic Fatigue Syndrome. IC

Chronic Obstructive Pulmonary Disease

(COPD, Emphysema) . DEC

MEDICAL CONDITION RATINGS

Condition

#

Colitis

Mild, Irritable Bowel Syndrome, normal weight .STD1 Moderate, recurrent episodes . IC/MOD1 Severe, chronic, underweight. DEC Ulcerative Colitis (Crohn's Disease). DEC

Coronary Insufficiency

Angina within 5 years . DEC Angioplasty within 5 years. DEC Bypass Grafting (CABG) within 5 years . DEC Myocardial Infarction (Heart Attack) within 5 years . DEC Any of above after 5 years . IC

Coronary Occlusion

Angina . DEC Angioplasty. DEC Bypass Grafting (CABG) . DEC Myocardial Infarction (Heart Attack) . DEC

Crohn's Disease . DEC

Cystic Fibrosis . DEC

Cystitis

Single episode, recovered. PREF Recurrent episodes .STD1

#

Depression, not Manic or Psychotic (Mental Health Questionnaire)

Current treatment with medication . STD1/COM Medication and/or current counseling sessions w/weekly, bi-weekly visits. DEC Hospitalization within 1 year. DEC Others . IC

Deviated Septum

Not Operated, with symptoms .MOD1 Operated, full recovery . PREF

#

Diabetes

Diet controlled, adult onset, excellent control, no other related conditions .STD 1/APS Oral medication, excellent control, no other related conditions. MOD 1/APS Diet/Oral/Insulin, Fair to Poor control or with other related conditions . DEC Juvenile Diabetes. DEC

Disc Disorders (see Spinal Disorders)

Diverticulitis / Diverticulosis . STD1 to MOD1

MEDICAL CONDITION RATINGS

Condition

Drug Treatment - See Alcohol/Drug Dependency

Emphysema. DEC

#

Endometriosis

No current symptoms or symptoms controlled .STD1 Current symptoms or laser treatment < 1 year. DEC Operated (hysterectomy) . PREF

#

Epilepsy (Seizure/Epilepsy Questionnaire)

Any Seizure < 3 Years . DEC Grand Mal, no seizure > 5 years .MOD1 Others, no seizure > 3 years .STD2

#

Fibrocystic Breast Disease (Tumor/Cyst Questionnaire)

Benign, definite diagnosis, treatment/testing < 1 year .STD1 Benign, definite diagnosis, treatment/testing > 1 year . PREF

#

Fibromyalgia

No medication or symptoms within the year . PREF Use of anti-depressant medication(s) . MOD 1/COM Chronic with pain/narcotic medication. DEC

Friedreich's ataxia . DEC

Gallbladder Disease

Unoperated, with Current Symptoms . DEC Operated, complete recovery . PREF

<5 years . DEC 5 – 8 years, no complications.MOD1 > 8 years, no complications.STD1

Gastric Reflux (GERD)

Single Episode, No Medication . PREF On maintenance medication .COM

Glaucoma

Mild, controlled by drops .STD2 With past surgery .MOD1

#

Gout

No attack/treatment within 2 years. PREF

With attack/treatment within 2 years…………………………………………. STD2/COM

MEDICAL CONDITION RATINGS

Condition

#

Graves Disease (see Thyroid Disorders)

Heart Attack (Myocardial Infarction) within 5 years . DEC

After 5 years. IC

#

Heart Murmur

Insignificant/asymptomatic, no treatment .STD1 Others . IC/APS

Heart Palpitations

Symptoms controlled, no surgery within 6 months.STD2 Symptoms uncontrolled or surgery in last 6 months . DEC

Hemophilia. DEC

Hemorrhoids

Unoperated, with symptoms < 2 years.STD1 Operated, full recovery . PREF

Hepatitis

A and B, within one year .IC/APS A and B, over one year . PREF C/Chronic or Alcoholic. DEC

Unoperated, with current symptoms . DEC Operated complete recovery . PREF1 Hiatal, unoperated, no medication in last year .STD1 Hiatal, unoperated, with medication in last year. MOD1/COM

Diagnosed within one year or on daily medication . MOD1/COM No medication or medication with outbreaks only . STD1/COM

#

High Blood Pressure (Hypertension Questionnaire)

Uncontrolled, Malignant, or over 3 medications . DEC Well controlled, 2-3 medications . STD2/ MOD1 Well controlled, one medication .STD1/ STD 2

Hodgkin's Disease

Within 10 years . DEC Over 10 years.STD1

Huntington's

Chorea . DEC

MEDICAL CONDITION RATINGS

Condition

#

Hyperthyroidism (see Thyroid Disorders)

Mild, controlled .STD1 Severe or uncontrolled . IC

Benign Cause. PREF Due to Cancer (non metastatic) < 10 years . DEC

Infertility Treatment (current). DEC

Interstitial Cystitis

Chronic. MOD1/COM No symptoms/treatment >1 year . PREF

#

Irritable Bowel Syndrome (See Colitis)

Joint Replacement

Done age 60-64 and over one year ago .MOD1 Done under age 60 or under one year ago . DEC

Kidney Failure or Dialysis . DEC

#

Kidney Stones

Multiple within one year. DEC Multiple > one year OR one episode within year.STD1 After one year. PREF

Leukemia

Within 10 years . DEC Over 10 years.STD1

Maintenance Medications for any condition

Will be underwritten based on number of medications and costs . IC/COM

#

Melanoma (Tumor/Cyst Questionnaire)

Within 10 years . DEC Over 10 years.STD1

Metastatic

Cancer . DEC

Meningitis (viral or bacterial)

MEDICAL CONDITION RATINGS

Condition

Menstrual Disorders . IC

#

Migraines

Infrequent, one per year or less often . PREF Moderate to severe with chronic medication . MOD 1/DEC

#

Mitral Valve Prolapse (MVP) (Heart Murmur / Mitral Valve Prolapse Questionnaire)

No Symptoms Or Treatment Required(except antibiotics with dental work) . PREF

No symptoms within last 2 years, controlled on medication.STD1

With symptoms within last 2 years . DEC

Motor or Sensory Aphasia . DEC

Multiple Sclerosis . DEC

Muscular Dystrophy . DEC

Myasthenia Gravis . DEC

Myotonia . DEC

Obesity (see Height/Weight Build Charts)

Obsessive Compulsive Disorder. DEC

Open Heart Surgery within 5 years . DEC

After 5 years. IC

Organ Transplant Recipient/Candidate . DEC

No history of fractures . STD1/COM With history of fractures . DEC

#

Otitis Media (Ear/Otitis Questionnaire)

Single Episode, Recovered . PREF Multiple episodes .STD1

Single episode, resolved . PREF Single episode, unresolved or recurrent episodes .MOD1

Pacemaker Implantation. DEC

Palpitations (see Heart Palpitations

Pancreatitis

Single episode, > 1 year, no residuals . IC/APS Recurrent/multiple episodes/alcoholic. DEC

MEDICAL CONDITION RATINGS

Condition

#

Pap Smears (Cervical Dysplasia, Cervicitis)

Class I or II - clean pap obtained . PREF Clean pap NOT obtained . DEC Class III or more .IC/DEC

Parkinson's Disease . DEC

#

Peptic Ulcer (Ulcer Questionnaire)

Unoperated, current symptoms . DEC Unoperated, no current symptoms, current treatment . STD2/COM Operated within one year, resolved .STD1 Operated more than one year, resolved . PREF

Phlebitis

Current symptoms or treatment . DEC No current symptoms/treatment but symptoms/treatment within 3 years .MOD1 No symptoms/treatment within past 3 years .STD1

Polycystic Kidney Disease. DEC

Polycystic Ovaries

Both ovaries removed . PREF No current symptoms on glucophage/hypoglycemic med.MOD1 No current symptoms on hormone replacement or BCP.STD1 With current symptoms . DEC

Pregnancy

Premature Infant

Birth to one year of age . IC/APS

Prostate Disorders (Benign)

Hypertrophy (BPH),unoperated, no symptoms on medication . STD1/COM Hypertrophy (BPH),unoperated, current symptoms . MOD1/COM Operated, complete recovery . PREF

Elevated PSA, no follow-up or repeat test . DEC

Elevated PSA, follow-up test normal .STD1 Prostate Disorders (Malignant) <5 years. DEC

Prostatitis

Acute within one year, resolved, no current symptoms or treatment .STD1 Acute within one year, unresolved or Chronic within 1 year.MOD1 Chronic after 1 year.STD2

MEDICAL CONDITION RATINGS

Condition

#

Psychotic Disorders (Mental Health Questionnaire)

Psychosis / Schizophrenia . DEC Manic Depression / Bipolar . DEC

All others, severe but not Psychotic or Manic…………………………………………. DEC

Quadriplegia (Paralysis) . DEC

#

Rheumatoid Arthritis (see Arthritis). DEC

Skin

Basal cell . PREF Squamous cell within 1 year .MOD1 Squamous cell, 1 to 5 years .STD1 Squamous cell, over 5 years . PREF

Skin Disorders (psoriasis, rosacea)

Infrequent attacks, no regular meds.STD1 Moderate/maintenance meds, not Methotrexate or Plaquenil. STD2/COM Severe/ultralight therapy or use of Methotrexate or Plaquenil . DEC

Sleep Apnea

Normal height/weight, controlled on CPAP .MOD1 Others .STD1

#

Spinal Disorders (Back Pain Questionnaire)

Mild Curvature (Scoliosis), No Symptoms Or Treatment .STD1 Moderate to severe curvature, unoperated or operated <1 year. DEC Operated to repair curvature, complete recovery,1-3 years.MOD1 Operated to repair curvature, complete recovery,>3 years.STD1 Disc disorder, unoperated, < 5 years . DEC Disc disorder, operated < 1 year . DEC Disc disorder, operated, full recovery, 1-3 years.MOD1 Disc disorder, operated, full recovery, >3 years.STD1

Stroke (Cerebral Infarction, Hemorrhage, Embolism, Thrombosis) witihin 5 years . DEC

After 5 years. IC

Syringomyelia . DEC

Temporomandibular Joint Syndrome (TMJ)

Unoperated . IC Operated, no residuals, recovered . PREF

Tendonitis

Current treatment . DEC Resolved < 1 year .STD1 Resolved > 1 year . PREF

MEDICAL CONDITION RATINGS

Condition

#

Thyroid Disorders

Hyperthyroidism, Adequately Controlled . PREF Graves Disease, I-131 or operated, recovered . PREF Goiter, present . IC

Tonsillitis

Single episode, fully recovered . PREF Chronic, requiring surgery . DEC

Varicose Veins

Operated < 2 years .STD1 Operated, > 2 years complete recovery . PREF Unoperated, current symptoms/treatment.MOD1

Wilson's Disease . DEC

MISSOURI DECLINES

• Connective Tissue Disease,

Poliomyelitis(current)

• Leukemia < 10 years

Leukoencephalopathy

AIDS/AIDS Related Complex

• Alcohol/Drug

attack, bypass, etc.)

• Within 5 years of treatment

• Mediterranean

• Cushing's Syndrome w/in 5

(Thalassemia Major)

Melanoma, within 10 years

Dermatomyositis

• Aneurysm (Cerebral or

Diabetes, Insulin dependent

Angina within 5 years

Drug Treatment w/in 5 years

Ankylosis(current)

• Neiman Pick Disease (Lipidosis)

Any condition for which

testing or surgery is

• Endocarditis

Neurofibromatosis

Occlusion of Cerebral Arteries

Epilepsy / any seizure < 3

• Aphasia, Motor or Sensory

• Open Heart Surgery within 5

• Arthritis - Rheumatoid

• Organ Transplant recipient

• Osteogenesis

• Gallbladder Disease /

Atresia(current)

Gastric Bypass w/in 5 years

Brain Damage (Organic)

• Glomerulonephritis

• Buerger's Disease

(Thromboangitis

Disease-coronary

• Burkett's Tumor (Malignant

• Pneumoconiosis

• Cancer-Most internal < 5

• Heart Attack within 5 years

• Pneumocystis

years last treatment

Pneumocystis carnii infections

• Cardiomyopathy

• Polyarteritis

Hemochromatosis

• Polycythemia

• Cerebral Palsy under age 20

• Hepatitis, chronic or C

• Polymyositis

Charcot-Marie Tooth Disease

• Post-Inflammatory

Hodgkin's Disease < 10

(COPD/Emphysema)

• Psychosis Organic Brain

Cirrhosis of Liver

• Huntington's

Pulmonary Heart Disease,

Cleft Lip / Palate Uncorrected

• Hydrocephalus

• Hydronephrosis, present or

Pulmonary Embolism, current

• Quadriplegia

• Congestive Heart Failure

Failure/dialysis

• Reyes Syndrome within one

• Rheumatoid Arthritis • Saracoma,

• Schizophrenia • Scleroderma • Senile, Pre-Senile Organic

• Shunts • Sickle Cell Anemia • Silicosis

• Spinocerebellar

• Stents • Stroke within 5 years • Syringomyelia • Tabes

(Cerebral Lipidosis)

• TIA – Transcient Ischemic

Attack within 5 years

• Transplanted

• Thalassemia,

• Thromboangitis

Thrombocytopenia Purpura

• Transient Organic Psychotic

• Transposition of the great

• Tuberculosis

Recklinghasusen's

Disease (Neurofibromatosis)

• Werlhof's Disease (Purpura,

Thrombocytopenia)

• Wilson's Disease

Medication Denials

Application is denied if any applicant is taking or has taken any of the following medications within the last twelve months*: Abacavir

Hydroxychloroquine

Lymphocyte Immune

* Any medication not on this list should be investigated in order to determine the underlying medical condition for which the medication was prescribed.

** Will consider after off medication for 3 months. *** Will consider after off medication for 6 months.

MISSOURI

BUILD CHART – MALES AGES 13 AND OVER

Preferred

Standard 1

Standard 2

Modified 1

BUILD CHART - FEMALES

AGES 13 AND OVER

Preferred

Standard 1

Standard 2

Modified 1

Super Preferred Healthy Lifestyle Questions and Build Chart

Online Capabilities Introduction

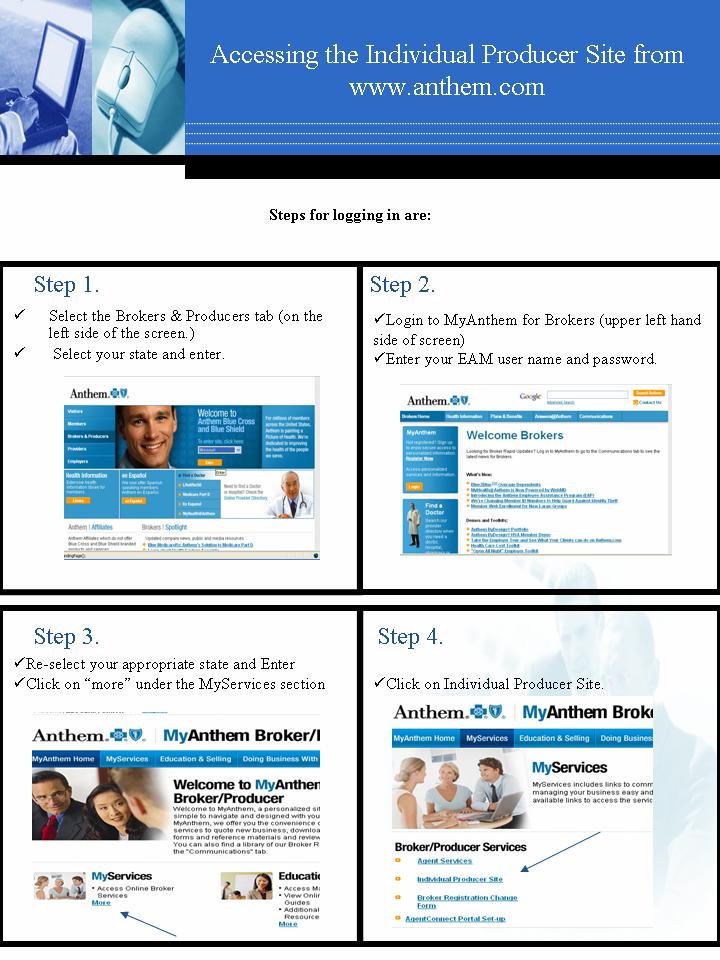

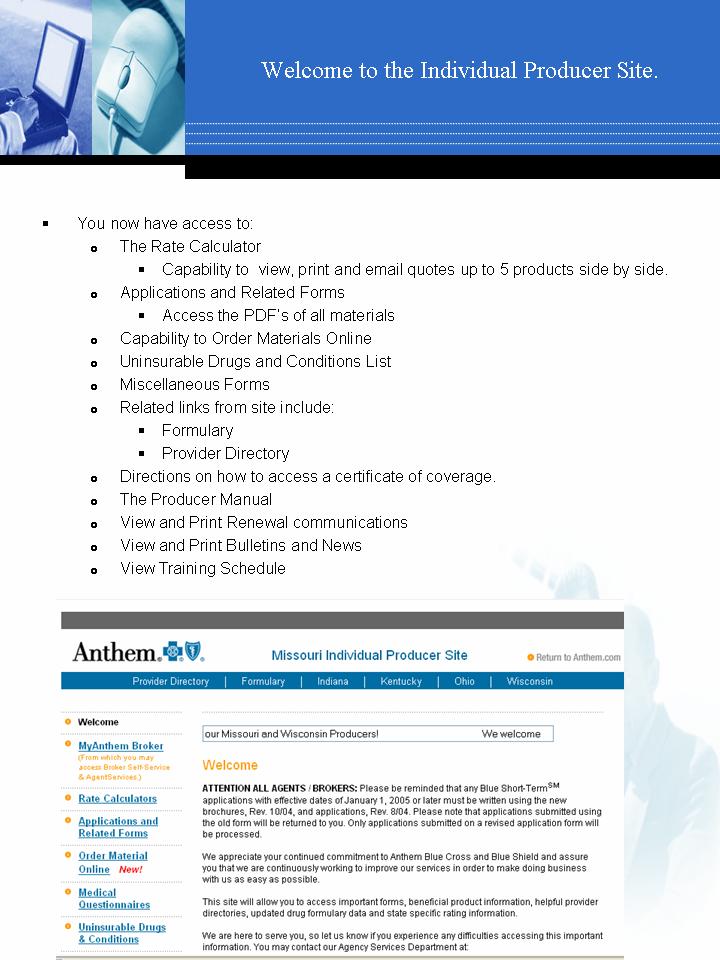

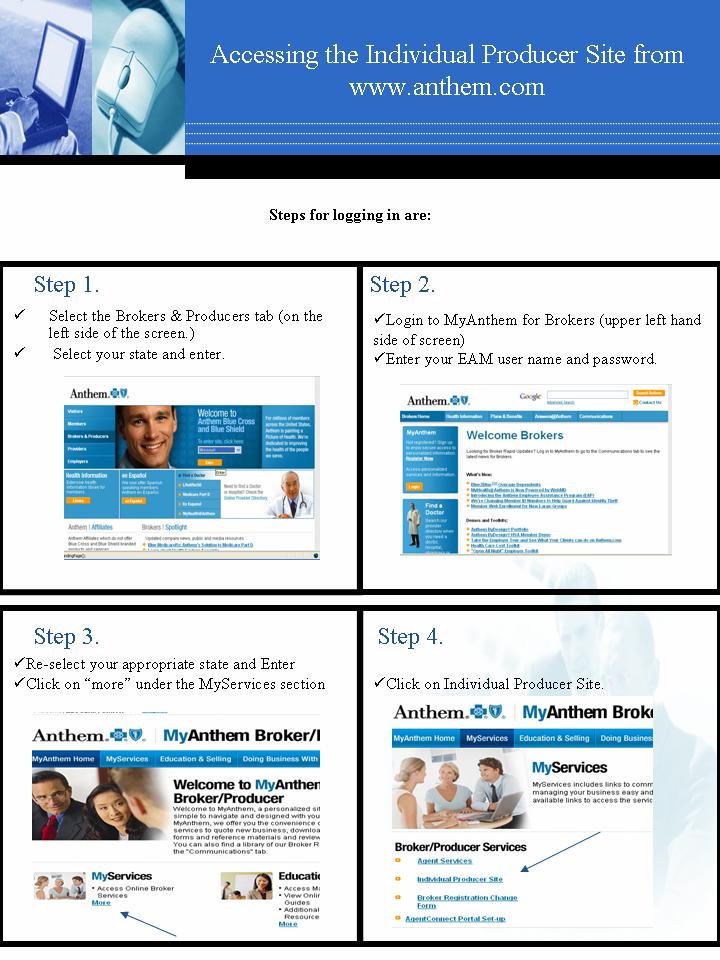

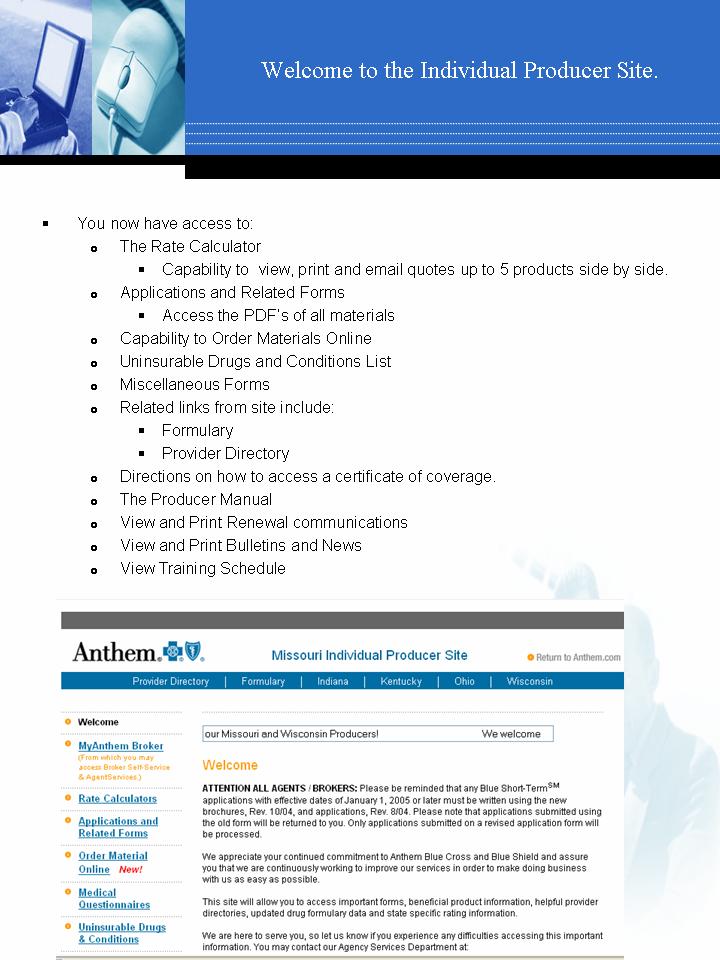

The purpose of this section is to guide you through the various online tools that are available to you, the agent/broker. These tools will assist you with:

• Helping you find a suitable plan for your clients and apply for coverage online

• Monitoring your business

• View and update member information

Overview of Rating Tools

The

Individual Producer Site can be accessed via and will allow you to

quote rates, order materials, view PDFs of all materials, read broker news, and access any

information needed to write Individual products. You can save and email quotes to your clients

as well. Utilizing this site does require that you have an internet connection at all times.

Refer to page 62-63 for steps to accessing this tool.

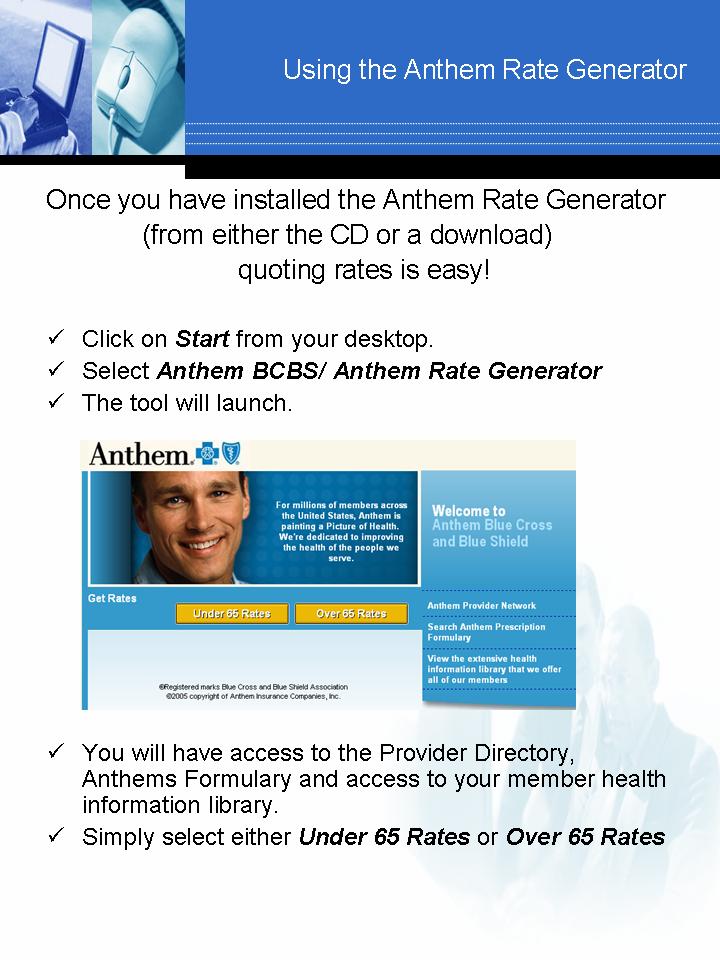

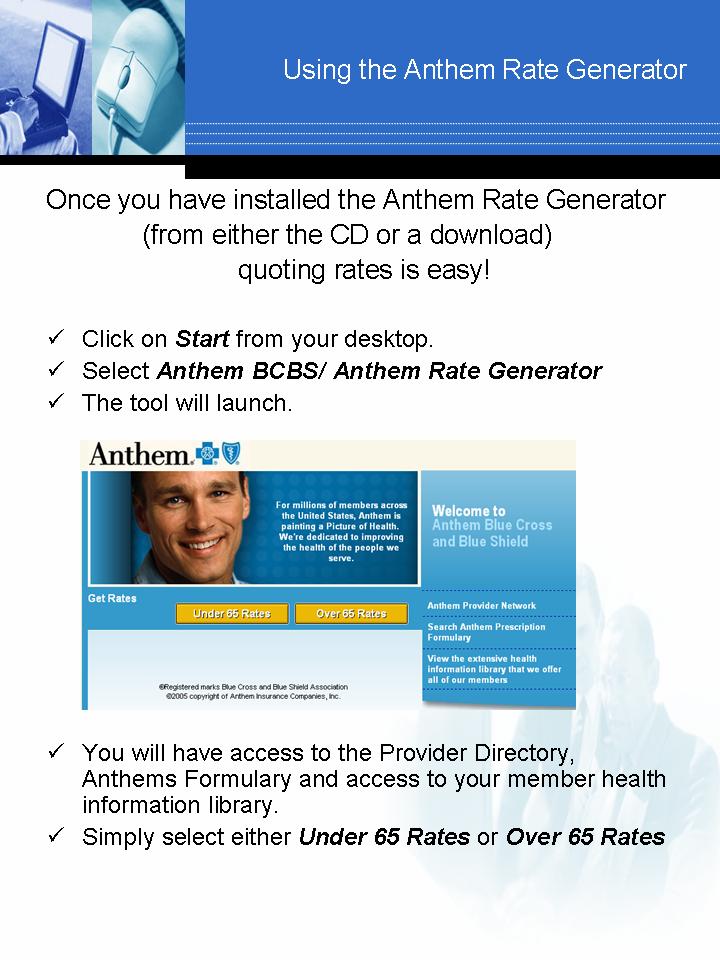

The

Anthem Rate Generator can be installed to your computer from a CD or a download.

(Please contact Producer Support for the link)Once this tool has been installed on your

computer, you have capability to quote products, save/store the quotes, and email them to your

clients. Updating the software is also easy. You will receive a communication when rates

change and when the new rates are available to be installed. Simply follow the instructions and

the new rates will be updated to your computer. Utilizing this rating tool requires only that you

have and internet connection; therefore this tool can be used from your laptop while in a client's

home to make sure you have the most up-to-date rates.

Refer to page 64-65 on steps to using this tool.

Overview of Other Tools

Help your clients find a plan and apply for coverage online via our

AgentConnect tool, a

co-branded website featuring your own personal information .66-67

Monitor your business and view your clients' applications, billing information etc., via our

AgentServices tool. 66-67

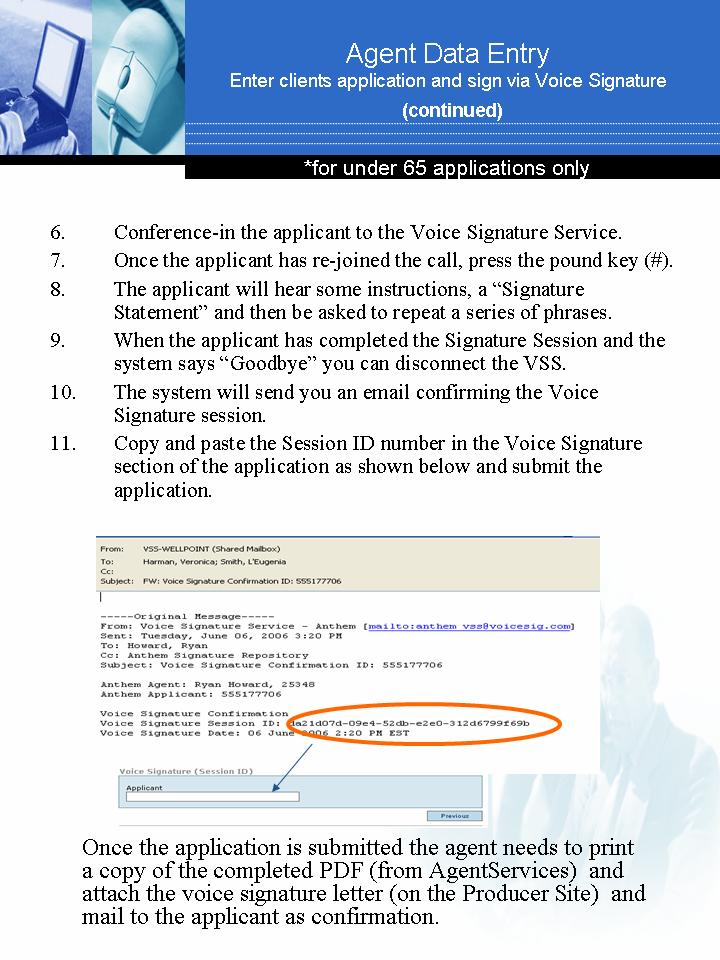

Instructions for

Voice Signature Agent Registration . 68

Enter and submit your clients' applications for them and

attach a voice signature……… .69-70

View your clients' certificates/contracts and order a new id with

VAMI… ………. 71

Order your own supplies through our

Anthem Online Order Entry System (OES) and receive

notification when materials are shipped. 72-73