Levitra enthält Vardenafil, das eine kürzere Wirkdauer als Tadalafil hat, dafür aber schnell einsetzt. Männer, die diskret bestellen möchten, suchen häufig nach levitra kaufen ohne rezept. Dabei spielt die rechtliche Lage in der Schweiz eine wichtige Rolle.

Prema.or.th

Harmonization and Standardization of the

ASEAN Medical Industry

"Healthcare is a priority for ASEAN. Countries must adhere to international

standards and not create their own … We know it is important, we see efforts to

harmonize, but progress is slow."

-Martin Hutagalung

Regional Director, US-ASEAN Business Council

Mason School of Business

The College of William & Mary

Table of Contents

3. Intellectual Property Rights ……………………………………………….19

vi. Regulatory Data Protection ……………………………………………36

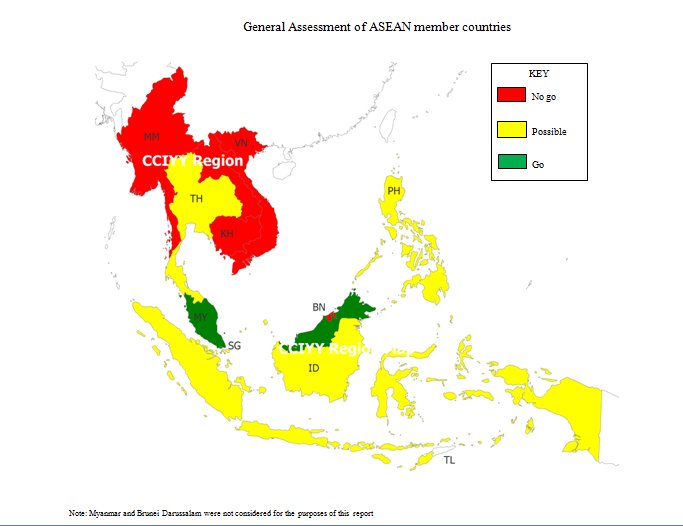

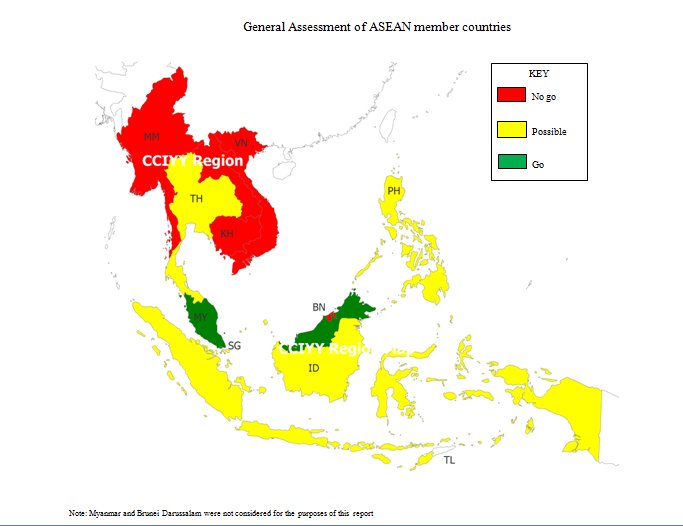

1. General Assessment of ASEAN Member Countries………………………….54

2. Top 10 Pharmaceutical Companies…………………………………………….54

5. Indonesia - Intellectual Property Rights……………………………………….56

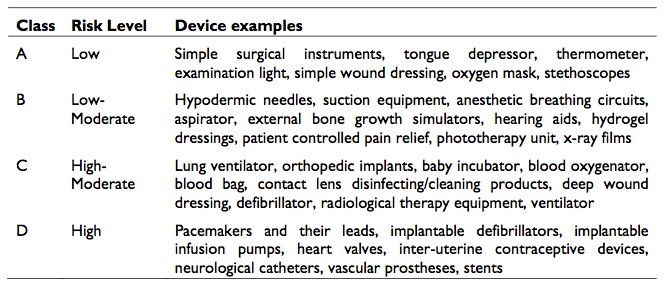

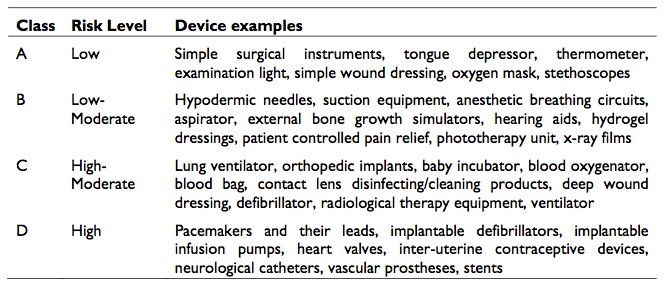

6. Malaysia - Medical Device Products ………………………………………….57

7. Malaysia - Medical Device Products – Risk Level…………………………….57

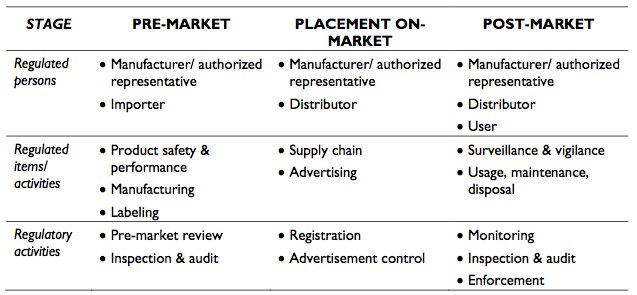

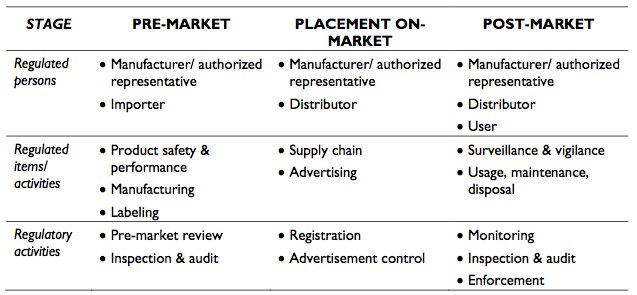

8. Malaysia - Medical Device Product Framework………………………………58

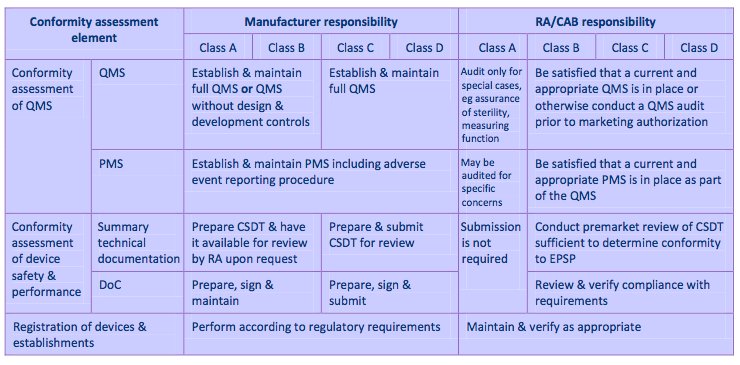

9. Malaysia – Medical Device Placement…………………………………….58

10. Malaysia – Incentive Program…………………………………………………59

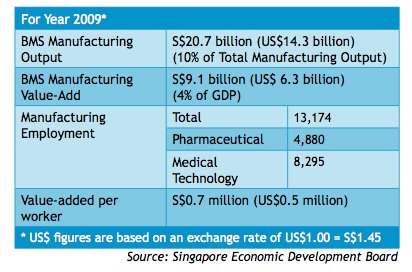

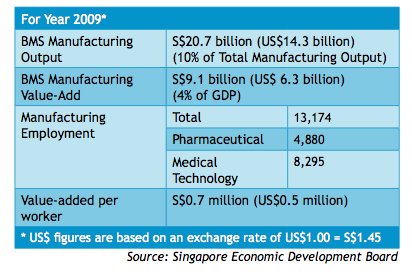

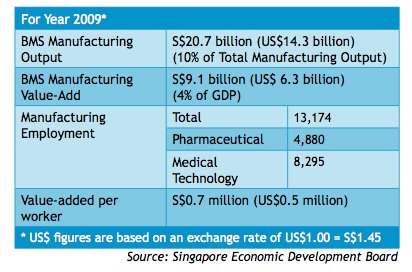

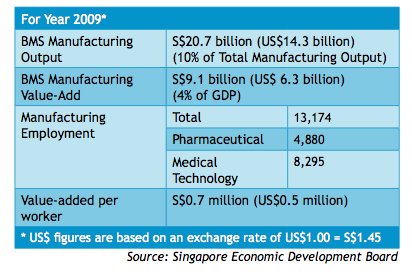

11. Singapore – Pharmaceutical Industry……………………………………….60

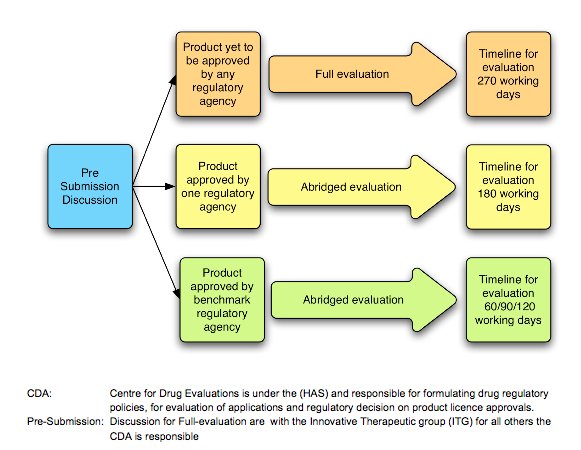

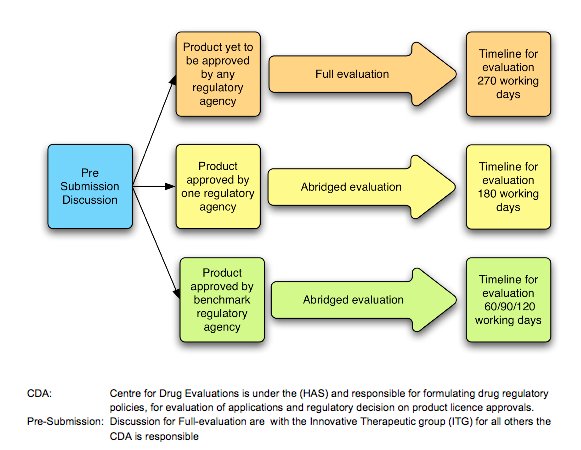

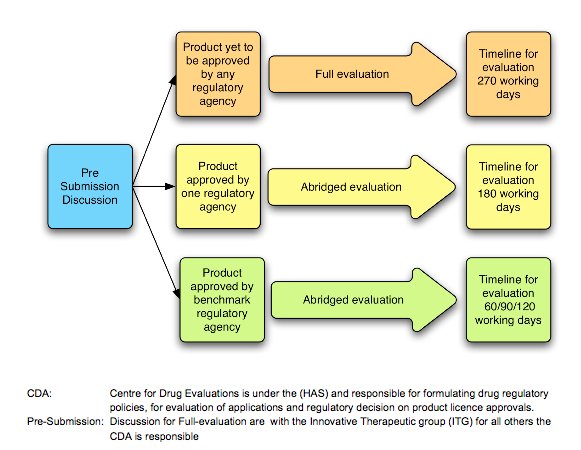

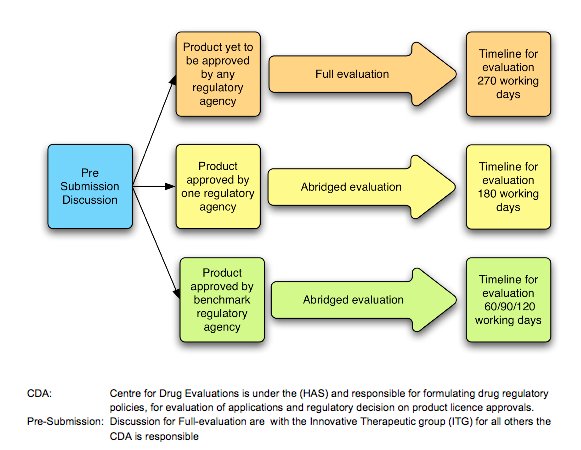

12. Singapore – Product License Approvals……………………………………….60

13. Singapore – Clinical Trial Certificate Issues………………………………….61

14. Singapore – Good Manufacturing Practice……………………………………62

15. Singapore – Post-Market Alert System……………………………………….63

17. ASEAN - ACTR Format………………………………………………………64

18. ASEAN - ACTD Organization……………………………………………….64

19. Thailand – Allowable Drugs in Hospitals/Clinics…………………………….65

20. Thailand – Intellectual Property Rights……………………………………….65

The Association of Southeast Asian Nations (ASEAN) was formed to provide its member countries with an avenue for discussing foreign affairs, growth, and peace in a cooperative environment. Lately, however, attention has shifted to focus on key areas of development, one of which is healthcare. Although there is some evidence of healthcare standardization occurring in the region, overall progress is slow given the infrastructure, institutional and economic disparities that exist between the ASEAN-6 and ASEAN-4 nations. Countries which have made the greatest advancements include Singapore and Malaysia, while Cambodia and Laos remain the least committed.1

Research from both primary and secondary sources reveals that there are five areas either where progress is occurring or are "hot topics" in the region. 2

Key areas of research include:

ASEAN Trade Agreement Good Practices Parallel Importation ASEAN Common Technical Dossier (ACTD) Mutual Recognition Agreement (MRA)

In addition to the harmonization areas uncovered, research also reveals several emerging trends in the region, which are of particular importance to multinational and local pharmaceutical companies. On one hand, foreign direct investment, public and private investments are making healthcare more accessible to rural populations in the remote regions of ASEAN. Such endeavors provide unique opportunities for pharmaceutical companies to expand their existing operations. Unfortunately, however, that opportunity comes at a price. With greater government intervention into the pricing of consumer medicines and limited to no Intellectual Property Right recognition in others, pharmaceutical companies must be both cognizant and wary when enlarging their presence in these areas. Admittedly, some of the biggest offenders such as Cambodia have made strides in battling against the unregistered and counterfeit drug markets, but such attempts have a limited impact in the overall scheme.

The hope is that with Indonesia receiving chairmanship of ASEAN from Vietnam, new perspectives will be articulated on ASEAN's road map to harmonization. But as recent events in the European Union have showcased, it is a tremendous endeavor – especially by 2015 – to bring together ten countries to benefit all as one.

1 For the purposes of this project, Myanmar and Brunei Darussalam were not examined.

2 Secondary sources include reputable databases and reports such as Business Monitor International, Factiva

EBSCOHost and ASEAN Economic Bulletin.

The Association of Southeast Asian Nations (ASEAN) was formed in 1967 to provide its member countries with an outlet for discussing foreign affairs, growth, and peace in a cooperative environment. Currently, the primary emphasis is on economic issues. The ASEAN member countries include: Thailand, Cambodia, Vietnam, Singapore, Philippines, Myanmar, Malaysia, Laos, Indonesia, and Brunei Darussalam (ASEAN Background). Exhibit 1 depicts ASEAN countries researched and a general assessment on entering the health care market in these countries based upon current political, economic and social conditions.

ASEAN and the United States

Progressive talks between the U.S. and ASEAN formally began in 1977. Initially, the focus was on markets, technology and energy resources, but beginning in 1990, the focus shifted towardtrade, investments and human resources. The U.S. currently participates in ASEAN consulting meetings such as the ASEAN Regional Forum (ARF) and the Post Ministerial Conferences (PMC). Through these meetings, the U.S. has been able to enhance its relationship with ASEAN, especially through trade. Total trade between ASEAN and the U.S. increased 10% from 2006 to 2008 and the total foreign direct investment flow to ASEAN nearly doubled. ASEAN has become the fastest growing export market and the U.S. is becoming its major trading partner.

U.S. and European Medical Products Industry

Business Monitor International has ranked the US number one in the pharmaceuticals market, with spending reaching US$306bn in 2009 (BMI, 2010). The Food and Drug Administration (FDA) is the regulatory regime in the United States. It was established in 1906, under the Department of Health and Human Services, and is considered the superior regulatory model worldwide. The healthcare arm of the FDA is responsible for protecting the public health by assuring the safety, efficacy, and security of human and veterinary drugs, biological products, and medical devices (U.S. Food, 2010). The FDA approval process is cumbersome and can cost millions of dollars for a company. On average, it takes 12 years and over US$350 million to get a new drug from laboratory onto the pharmacy shelf (Roth, 2010). The company, research institutions, and other organizations are responsible for all testing costs and providing supporting evidence to the FDA for their Investigational New Drug Application (IND). Based upon the evidence provided in the application, the FDA will decide if it is safe for the drug to be tested in humans. Only 1 in 1,000 drugs make it to human testing (Roth, 2010).

Due to healthcare reform initiatives in the US, many manufacturers may see pricing strategy changes in the near future due to expanding state insurance laws. Coverage for the poor and patients with pre-existing medical conditions will no longer be excluded by their insurers. Because drug manufacturers negotiate directly with insurers and healthcare providers for the

pricing of drugs, there are no formal regulations. Innovative drugs are priced at a premium until the patent expires, at which point competition from generic drug makers move into the arena.

Johnson & Johnson (J&J) is listed in the top ten for both medical devices and pharmaceuticals, but does not have a strong foothold in the vaccine area. That is about to change in late 2010 or early 2011. Dutch biotechnology vaccine group Crucell will have the remaining 82.5% of their company bought by Johnson & Johnson (Johnson & Johnson, 2010). Crucell has offices aroundthe world, but the two that are in the ASEAN countries are Malaysia and Viet Nam. With J&J having offices in these two countries, it may help not only with providing vaccines to thesecountries, but could also help influence the need for FDA approved drugs from US to fund local clinical trials in Viet Nam.

In April 2008, Switzerland and Singapore signed a memorandum of understanding (MoU) relating to therapeutic products and the collaboration of the two countries' pharmaceutical administrations. The agreement, which pertains to both pharmaceuticals and medical devices, will aim to encourage data and inspection exchange, in a bid to improve market surveillance, approvals processes and pharmacovigilance (Hollis, 2010). With Novartis the number three revenue generating pharmaceutical company in the world and having already had similar MoU'ssigned with US, Australia, and Canada there could be more MoU's signed with other ASEAN countries particularly Indonesia and Thailand.

The medical device industry has 4 major players (Medtronic, Boston Scientific, Haemonetics Corp, and Cyberonics, Inc.) that are all based out of the U.S. (BMI, 2010). Twelve major players dominant the pharmaceutical industry. Of those, 7 originate from the United States. A complete list is available in Exhibit 2. Each country regulates its pharmaceutical drugs in varying ways (Exhibit 3). For example, Germany allows its wholesalers and retailers to commit to any price over the manufacturers as well as allowing the product to be taxed afterwards. However, the UK's government handles the price points for their pharmaceuticals at certain benchmarks. On the manufacturing side, most countries adhere to a 20-year life span patent (Exhibit 4).

ASEAN proposed tariff regulations to encourage a free flow of capital to increase economic growth among the countries. The top four intra-exporters are Singapore, Malaysia, Thailand and Indonesia. The top three intra-importers are Singapore, Malaysia and Thailand. The average CEPT rate for ASEAN countries is 3.71%; however, Cambodia is the benchmark high with 9.3% and Singapore is the low with a nonexistent rate (Oktaviani, 2007). The ASEAN agreement was to lower the CEPT rates among the countries to encourage intra-ASEAN trade. On the other hand, these countries trade more outside of these countries than within because of the similarities of each country's products and services. Conflicting reports have been published about intellectual property rights (IPR) and foreign direct investments (FDI). Traditional research has shown that strong IPR increases FDI. Other research has shown that strong IPR inhibits

imitation, which brings in more FDI, but it is spread amongst competitors (Yang, 2008). Overall, FDI is expected to decrease. Countervailing has been present within ASEAN as a way to attract large company buyers to off-patent drugs (Ellison, 2010). Anti-dumping is also present in ASEAN as a measure to reduce surges of imports (Deardorff, 2005).

Cambodia suffers from high levels of corruption as evidenced by its 154th spot out of 178 countries on Transparency International's Corruption Perception Index (Transparency International, 2010). Corruption is particularly prevalent among civil servants, whose salaries remain lower than garment workers and are insufficient to cover basic needs. Moreover, in a recent report, the Cambodian economy ranked lowest out of 16 Asia Pacific markets studied (Research and Markets, 2010). Thus, the combination of a poor economy and low wages only encourages government officials and civil servants to resort to corruption.

Cambodia is also the dumping country of choice for foreign nations, especially since the EU placed dumping restrictions on China and Viet Nam. For example, back in 2006, it was well documented that a number of Taiwanese and Hong Kong shoemakers began building plants in Cambodia in order to sidestep EU regulations (Ho, 2006). Additionally, Cambodia has the highest tariffs in Southeast Asia for both imported and exported goods and does little trade with its neighboring countries. Cambodia has a CEPT rate of 9.3%, indicating that the country only exports 9.3% to other ASEAN countries. And like the Philippines, Cambodia has the lowest intra-ASEAN import intensity at 19% (Oktaviani, 2007).

While high levels of corruption, limited economic growth and prevalent anti-dumping puts Cambodia at a disadvantage compared to its ASEAN peers, other social and government elements further compound the problem. As a direct result of the Khmer Rouge atrocities committed in the 1970s, 60% of the population is under age 24 with the median age being 22.6 years old (Central Intelligence Agency, 2010). And because of the country's poor infrastructure that population is predominately rural. Led by Prime Minister Hun Sen and the Cambodia's People Party (CPP) Cambodia is politically stable, but the government is excessively bureaucratic, which slows down the decision making process and lacks transparency (Research and Markets, 2010).

On the plus side, Cambodia's pharmaceutical industry is predicted to grow by double digits –about 11.2% - over the next decade. Only in the past ten years has Cambodia experienced somewhat stabilized economic growth and political stability, which has allowed officials to put more effort into the country's healthcare program. But, the industry substantially lags behind more advanced nations such as Singapore (Research and Markets, 2010). In order to remedy that disparity, Cambodia is receiving high levels of foreign aid and foreign direct investment from South Korea and China. In 2008 Cambodia also received a $12.35 million grant from the World Bank for a trade development program. The aim of the grant is to develop trade policy, build performance monitoring systems and provide implementation support to the Ministry of Commerce in Cambodia (The World Bank, 2008).

Traditionally, Cambodia has not been viewed as an ideal country for vaccine trials or developments because the country's population is much lower compared to other ASEAN nations such as Indonesia or Thailand. Moreover, attempted vaccine trials have met with little success. Back in 2004 despite green lighting a trial for Gilead Sciences AIDS drug, Viread, the Cambodian government later halted the study. Even though Gilead Sciences was willing to sell the medication for $300 – a significant discount from the US price of $3,900 – the project was met with opposition from Cambodian sex workers who demanded additional counseling and free follow-up care if they became infected or suffered adverse side effects (Chase, 2004).

The Cambodian pharmaceutical market is currently quite small, with per capita expenditure on medicine and pharmaceutical products much lower compared to other countries. Cambodia, however, has a high growth potential over the next decade. IBM forecasts that the demand for drugs and drug consumption in Cambodia is expected to increase at a rate of 11.6% and willreach a level of $302 million by 2014. By 2019, the market will have expanded to $516 million (Research and Markets, 2010). As such Cambodia is increasingly becoming a target country for drug makers.

While the national health care budget in Cambodia is increasing, it is mostly an effect of higher foreign contribution levels. Such reliance on foreign money, however, leads to instability in the health care market because programs and agendas are pushed and are then abruptly curtailed when funds are no longer available. While policies have been constructed on paper to address this issue, there is no evidence of implementing these checks in order to prevent the situation from occurring (Park, 2010).

Even more troubling, however, is that the counterfeit drug market is an enormous problem in Cambodia. A number of reports have been published on the effect and damage that counterfeit drugs have had on the region. A Ministry of Health study in 2006 found 58% counterfeit and substandard anti-malaria drugs exist in licensed outlets and 75% in non-licensed outlets. A 2003 study performed by USP DQI discovered that 27% of 451 drug samples tested where counterfeit (USP revisiting medicare, 2006). A later survey conducted by C.T. Lon and associates found that 79% of the drugs were not registered ( Lon, et al. 2006) . Most troubling, however, is that the World Health Organization estimates that Cambodia has close to 2800 illegal medicines sellers and 1000 unregistered medical products (WHO, 2003).

Intellectual Property Rights

There is little to no respect for intellectual property rights in Cambodia as evidenced by number of counterfeit drugs in the region.

Because Cambodia has only been a relatively stable country for ten years, the infrastructure and income gap between Cambodia and ASEAN countries is much more pronounced. As such, Cambodia has opted not to sign several key ASEAN agreements and has made little progress on many of the health care agendas currently being propagated by the ASEAN council. While

leaders of ASEAN's four less developed member countries – Cambodia, Laos, Myanmar and Vietnam –met in November, 2010 in Phnom Penh, where they vowed to promote health care development projects any tangible results are at least five years away (Kyodo, 2010).

Despite only having a per capita income of $1,900, which ranks Cambodia 187th out of 227 countries tracked, there are some instances of health care advancements (Central Intelligence Agency, 2010). According to Ambassador at Large, Roland Eng, both public and private institutions are building hospitals and clinics in remote regions of the country to ensure health services are more accessible to rural populations. Such projects are meeting with success.

Additionally, there have been efforts made to crack down on the counterfeit drug trade. In 2008, over 200 raids were carried out across Southeast Asia, including Cambodia, which seized $6.6 million worth of counterfeit anti-HIV, anti-malaria, anti-tuberculosis drugs and other medications (The Telegraph, 2008). Also, Pharmelp, a company that aims to bring affordable equipment to detect counterfeit and substandard medicines to developing nations, is bringing its machines to Cambodia (Taylor, 2010). The equipment will be installed in February 2011 at the National Health Product Quality Control Center in Phnom Penh.

The market for pharmaceuticals in Indonesia has incredible growth potential. While Business Monitor International ranks the country 11th out of 17 for investment within the Southeast Asian market, the biggest growth sources come from its stable political system, year-over-year growth of the domestic pharmaceutical market, and the growth of an already large population. The main drawbacks are low spending on pharmaceuticals, higher levels of corruption, and a relatively small percentage of elderly in the country. With this in mind, there are several trends emerging within the Indonesian market ranging from increased collaboration with countries within ASEAN to the growth of the over-the-counter (OTC) and generic markets. (Indonesia Pharmaceuticals, 2010). Finally, one of the biggest trends taking place in Indonesia is the reliance on domestically produced and manufactured drugs. The biggest question arising from this movement centers on what specific steps Indonesia will take to continue to encourage domestic consumption of pharmaceuticals over foreign products.

The pharmaceutical industry in Indonesia is controlled by the Directorate General of Drug and Food Control (DG DFC) which falls under the Ministry of Health. This agency is in charge of everything from the control of production to providing licenses for drug imports. The DG DFC is responsible for monitoring and making changes to the National List of Essential Medicines (NLEM). The NLEM consists of medicines that the Ministry of Health decides are the most needed and most available. The Ministry of Health states, "the implementation of NLEM is meant to increase the efficacy, safety, rational use, and medicine management which altogether increase efficiency of available cost, which in turn extends coverage and increases the average quality of medicine prescriptions" (National List of Essential, 2008).

Within the Ministry of Health also lie the National Agency of Food and Drug Control (BTOM). This is similar to the Food and Drug Agency in the US. One of the biggest pushes by the government and BTOM has centered on the increased use of generic pharmaceuticals over brand names. The Indonesian government believes that due to the lower price and relatively equal effectiveness and safety of generics over name brands, more citizens will have access to medicines that they would not normally be able to afford. The push for generics has gone so far as to require all branded pharmaceutical products to print the generic name at least 80% as big as and directly below the trade name of the product. The hope is to spread the knowledge of generics to as many people as possible in the country. In order to guarantee the safety and equivalence of the generic drugs, the BPOM has required that any drug being submitted for generic approval must also submit bioequivalence and bioavailability data (Indonesia Pharmaceuticals, 2010).

Labeling

Labeling for pharmaceuticals in Indonesia requires that all labels be printed in the Indonesian

language. Some specific items that must be listed on all packaging for all pharmaceuticals

include the product name, the name and strength of active ingredients, the generic name (if

applicable, at 80% size of the brand name), the name of the manufacturer if it is an imported

drug, and the expiration date. While many of these requirements are in place, most are not being

enforced (ASEAN Labeling Requirements).

Quotas

The government of Indonesia does not have any quotas established to limit the imports of

pharmaceuticals. Currently, the government has the equivalent of $180 million allocated to

import pharmaceutical ingredients in case of an emergency. In such an event, the ingredients

would be used to produce generic pharmaceuticals that could then be sold to private or public

institutions (Indonesia: Supply and Demand, 2004). Without quotas in place, Indonesia has

instead controlled foreign drug companies through its somewhat difficult process of obtaining

import licenses (Indonesia: Supply and Demand, 2004).

Import Licenses

In 2008, the Ministry of Health set new guidelines for the registration and importation of

pharmaceuticals into Indonesia. Decree 1010/08 separates manufacturers from wholesalers in

order to protect consumers. Only Indonesian manufacturers are allowed to register

pharmaceutical products, and only wholesalers are allowed to distribute them within Indonesia.

Foreign companies can only register their products with Indonesian manufacturing companies

based in the country, and once they have done so, they are required to sell directly to

wholesalers. Regarding this policy, the Ministry of Health states, "This distinction is considered

to represent the least trade restrictive approach to achieve the legitimate goals set" (Global Trade

Alert, 2009). The "legitimate goals" refer to increasing consumer safety and quality of products

within Indonesia (Indonesia: Regulating Registration, 2009).

Harmonization

Many of the items touched on above can provide some proof to Indonesia's attempts at

harmonizing with ASEAN standards and collaborating with other countries in the region. Decree

1010/08 that established rules and procedures for import licenses was developed to be the least

imposing on trade in the region. One of ASEAN's main goals was to establish a region with free

trade. Indonesia can only be seen to be attempting to aid this goal through Decree 1010/08. The

government is trying to promote safe products and practices within its own country while

keeping trade in the region as unrestricted as possible. The lack of quotas for pharmaceuticals

can also be seen as an attempt at harmonization within ASEAN. Currently, Indonesia has a 10%

tariff on all imports of pharmaceuticals; however, by 2011, Indonesia will be required to cut this

to zero in accordance with the ASEAN free trade agreement (Indonesia Pharmaceuticals, 2010).

One of the biggest steps toward harmonization can be seen in labeling for pharmaceuticals. While many countries may not have exactly the same procedures and requirements, there are many trends seen throughout the region such as the distinction between what is required to be printed on the exterior carton verses a vial and the difference between requirements for domestically produced pharmaceutical products verses foreign products. If successful, labeling may be the first full step toward harmonization (ASEAN Labeling Requirements).

In the realm of intellectual property rights, Indonesia has taken a huge step in combating the country's serious counterfeiting problem. The National Anti-Counterfeiting Task Force was set up by the government in hopes of fighting a problem that results in almost 30% of all pharmaceuticals in the country being counterfeits. Indonesia still remains on the US trade association Pharmaceutical Research and Manufacturers of America's (PhRMA) Watch List, having been moved down from its Priority Watch List in 2007 (Indonesia Pharmaceuticals, 2010).

Finally, collaboration with other countries in ASEAN has begun as there has been a growing trend of foreign companies within ASEAN starting joint-ventures within Indonesia. One such example is the Singaporean Drug Company Innogene Kalbiotech and Malaysian research company Info Kinetics Sdn Bhd. The two companies have set up a research unit in a Jakarta hospital [names not released] to study bioavailability and bioequivalence within the Indonesian pharmaceutical space. The research will also be supported by Indonesian company PT Pharma Metric. This sort of collaboration can only lead to positive working relationships within ASEAN (Indonesia Pharmaceuticals, 2010).

Labeling

A regulation issue for ASEAN is whether or not medical device labels should all be in the

language of the country of where it is made or if labels need to be translated into all countries

where it is distributed.

Import/Export

Companies must obtain an import license from the Ministry of Industry and Trade. In order to

import products, a company also needs a permit from the Ministry of Health. There are hardly

any restrictions on imports into Indonesia. The registration of medical devices has been under the

National Agency of Drug and Food Control (known as BPOM in Indonesia) since 2001. The

general rules that Indonesia follows regarding imports are in keeping with World Trade

Organization standards. Any companies in Indonesia, whether it be a limited liability company, a

state-owned limited liability company or a cooperative company are able to obtain an import

license. The company must have adequate room and equipment to store serums and vaccines,

along with an arrangement with a laboratory appointed by the Ministry of Health. Recently

Indonesia has liberalized its trade regime in order to reduce protection. There are no quotas on

importing medical devices. Distributors have to register the medical device after which it usually takes 6 months to obtain a license (BMI, 2010).

Intellectual Property Rights

According to the National Agency of Drug and Food Control in Jakarta, Indonesia, patents last

for a period of 20 years. Agreement on Trade-Related Aspects of Intellectual Property Rights

(TRIP) will slow the introduction of generics, increase prices, and reduce access to various

medicines for many patients. In order to compensate the protection of the innovation of

medicines, testing and approval of generics are allowed before the patent expires (DGIPR,

Indonesia).

Indonesia's Intellectual Property Law creates significant barriers to promotion of foreign investment within the country. As of 2005, only drugs manufactured and produced within Indonesia are eligible for patent protection. Accordingly, drugs sold and registered with the Ministry of Health are able to be legally copied and distributed under a generic name by Indonesian countries. Additionally, applications for pharmaceutical product regulation can only be filed for by local companies, forcing foreign companies to invest in manufacturing centers within Indonesia, or pursuing joint-venture operations with Indonesian firms. Additionally, Indonesia – like other ASEAN countries – faces issues regarding law enforcement, resulting in a high number of counterfeit drugs in distribution (Ratanawijitrasin, 2005). Exhibit 5 details laws written to protect intellectual property.

Laos is a landlocked country in Southeast Asia and has little transparency regulations or the healthcare sector. Much of the data collected is outdated, but unfortunately, recent data is not available.

With the country's economic liberation in the 1980s, the private provisions of drugs increased dramatically. By 1997, 80% of pharmaceuticals available in Lao PDR were being provided by the private sector, mostly because of the development of private pharmacies.i Good Pharmacy Practices were developed and applied in a sample collection of Lao PDR pharmacies.ii There are three areas where quality seemed to be lower in districts than other districts further afield. The qualities and their percentages in each case are as follows:

Poor Dispensing Practices – 59%

Drugs not being labled – 47%

Different drugs being placed in the same package – 26%

Prices for drugs are not stable and can vary depending on districts. A research study on the price of four drugs revealed that prices varied very little in remote districts to as much as ten-fold in one district (Stenson, 2001).

The Ministry of Health is the lead regulator in Lao PDR. Unfortunately, they do not view pharmaceuticals, vaccines, or medical devices as a priority. Moreover, they do not see a high importance on Intellectual Property, parallel importation, counterfeits, or other issues of ASEAN harmonization. Instead, the three goals the Ministry of Health Lao PDR saw in 2003 were (Ministry of Health of Lao PDR):

By 2020-Free Health Care Services from state of underdevelopment, ensure the full HS coverage, justice and equity to increase quality of life of all Lao ethnic groups

By 2010-free the poverty of all Lao ethnic groups from the state of Laos

By 2005-the poverty of all Lao ethnic groups will be reduced in half of the current figure

According to Stenson, Syhakhang and Tomson, "the regulatory system seems to be focused on entry into the pharmaceutical retail market and dealing with basic issues of product quality and conditions of sale. An enforcement system including sanctions is being developed; other policy instruments such as information and economic means are hardly being used at all. The government presently faces a trade-off between quality of pharmaceutical services and geographical equity of access. The study shows that regulation is strongly influenced by the general socioeconomic context"(Stenson, 2001).

Intellectual Property Rights

Intellectual Property Rights are becoming more important in the global economic community. In January 1998, only a few countries, including Laos, did not have the full range of Intellectual Property laws on their statute books in accordance with the Paris and Berne Conventions (Endeshaw, 1998).

Malaysia score remains at 70 for market risk, which refers to a subjective assessment of the country's IP laws, policy and reimbursement regimes, as well as to the speed and efficiency of the approvals process. Despite the positive prospect of harmonization, however, the significant counterfeit drug industry, the difficulty in applying process patents, the lack of data exclusivity and generally poor regulatory enforcement will continue to pose major drawbacks to multinationals interested in Malaysia (BMI, 2010).

The manufacturing and marketing of pharmaceutical products in Malaysia are heavily regulated as in most developed countries. Medicines marketed in Malaysia are required to be registered by the Drug Control Authority (DCA) of the Ministry of Health. All manufacturers, importers andwholesalers are required to be licensed by the DCA. The registrations of prescription and OTC medicines require proof of efficacy, quality and safety, and are subjected to stringent screening and testing as well as regular and random post-marketing surveillance and testing. All manufacturers in Malaysia are subjected to regular and random inspection by DCA inspectors. Medicines are regulated under several acts such as: the Poisons Act, the Dangerous Drugs Act and the Drugs Act. Medicine advertisements require prior approval by the Medicines Advertisement Board. Malaysia is a member of the WTO and has acceded to the TRIPS agreement. Patents are registered and copyrights are protected (BMI, 2010).

Analytical method protocol for the testing of the raw materials (only the active pharmaceutical ingredients and preservatives if any) is used for injections. This should include the specifications and certificate of analysis. All analytical test procedures where possible should be in accordance with the official monograph of that ingredient in the latest edition of the official pharmacopoeia such as British Pharmacopoeia, United States Pharmacopoeia or World Health Organization(NPCB).

At present, Malaysian private clinics and pharmacies are not required to comply with standard labeling regulations. However, this means that most of the medicines, which are usually taken out of standard packs and repacked, do not come with appropriate usage and indication information. In October 2005, the Ministry of Health issued further guidance on the requirement that all registered pharmaceutical products be labeled with a Meditag, a hologram security patch. Labeling laws for dispensed medicines came under scrutiny in early 2006 for not providing clear information to patients, especially to those who receive more than one medication. Additionally, labels for generics medicines are also thought to be lacking, with professional groups lobbying

the government for appropriate changes in legislation, which would complement the recent efforts to make drug monitoring more effective (NPCB).

Packing/Storage

Containers used should afford protection to reference substances from moisture, light and

oxygen. From the point of stability, sealed glass ampoules are recommended. An important

matter to be considered when choosing suitable containers is their permeability to moisture.

Additional measures may be necessary to ensure long term integrity and stability. The filling of

reference substances into containers can be carried out in a glove box with facility for nitrogen

supply, where humidity is controlled.

Theoretically, the stability of the substances should be enhanced by keeping them at low temperatures but, for substances that contain water, storage below 00C may impair the stability. It should also be remembered that the relative humidity in normal refrigerators or cold-rooms may be high and, unless ampoules or other tightly closed containers are used, the improvement in stability may be more than offset by degradation due to the absorption of moisture. Storage at about +50C, with precautions to prevent such absorption, have proved satisfactory for most chemical reference substances.

The storage and maintenance of unopened containers of the chemical reference substance, in accordance with information provided, are integral to its suitability of use. To avoid any doubts concerning the integrity of opened containers, it is suggested that potential users obtain only the quantities of substances necessary for short-term need and obtain fresh stocks (held under controlled and known conditions) when needed. Long-term storage of substances in opened containers is to be avoided. Similarly, efforts should be made to avoid possible degradation, contamination and/or introduction of moisture during the repeated use of a substance (NPCB).

In May 2005, the Malaysian Medical Association implemented a guideline permitting doctors and hospitals to advertise their medical services. While the guideline have a number of restrictions, doctors and hospitals are able to advertise their medical specialties and any new or technologically advanced medical equipment. However, the advertisements are limited in their claims, prohibiting medical providers from exaggerating their abilities, asserting their achievements or ‘overselling' a product. Nevertheless, some hospitals have already taken advantage of this new advertising privilege through new product launches. The Ministry of Health intends to pass new regulations enabling legislation for these advertising rules. Under the new regulations, the Ministry must first clear claims that any pharmaceutical or medical device prevents or treats an illness or condition. Approval will also be necessary in order to sell a product commercially in Malaysia. The Ministry of Health hopes that this proposed regulation will allow for product testing in order to ensure the safety and effectiveness of products prior to their advertising within the country (BMI, 2010).

Intellectual Property Rights

Despite a major revision of patent law in 2001 and subsequent amendments in 2003, patent protection continues to be the cause of friction between the government and international drug manufacturers. While the government revised the period of protection for pharmaceuticals by increasing it to 20 years, it also implemented legal provisions that have come under heavy criticism from the industry. For example, the stipulation that limited the manufacturing, use and sale of a generic drug before the expiry of the original's patent are no longer considered patent infringement. Also, provisions allow the licensing and production of medicines by the government under certain conditions, without the patent holder's consent. The 2003 amendment attempted to make registering a patent easier and less expensive. Under this system, international patent applications may be made in any one of the countries of the Patent Co-operation Treaty, an initiative by the World Intellectual Property Organization (WIPO). Previously, the applicant had to make the application in each and every country where the patent was to be applicable. With procedures increasingly aligned with regional and international norms, it still did not address the issues at the center of the debate between government and industry.

In 2005, the United States Trade Representative (USTR) listed Malaysia as a Watch List country in its Special Report on Intellectual Property Protection.

The USTR and PhRMA criticized the Malaysian government on a number of points, including the level of counterfeiting taking place in the country (despite the introduction of holograms on pharmaceutical packaging), the difficulty in applying process patents, the lack of data exclusivity [which has not been aligned with the World Trade Organization (WTO)'s TRIPS agreement] and the overall poor standard of regulatory enforcement. Additionally, the association has criticized the lack of patent linkage as part of the registration process, which has led to instances of generic products being launched while original patents are still in effect.

In 2007, Malaysia remained on the Watch List, despite showing a solid commitment to strengthening IP protection and enforcement in 2006. However, the report welcomed the process of establishing a specialized IP court, which is designed to more effectively handle civil and criminal copyright cases. The US has indicated that it will continue to work with Malaysia to encourage full implementation of WIPO Internet Treaties. While international criticism of the current state of patent legislation is expected to continue, the government is unlikely to significantly amend the law in the short term, not wishing to further pressure the indigenous industry. In the meantime, financial gains from parallel trade, which is encouraged as a cheaper option for the state-funded healthcare, will continue to be made almost exclusively by the middle traders, thus not achieving its aim, but instead serving to further antagonize multinational pharmaceutical players. Consequently, Malaysia remained featured on the Watch List for 2008 as well as for 2009 (BMI, 2010). Only in 2010 was Malaysia removed from PhRMA's list (PhRMA, 2010).

More than 65% of Malaysia's pharmaceuticals and medical equipment are imported (mostly from the US, Japan and Germany), partly because most doctors are reluctant to switch to local brands because they perceive imported drugs as being higher quality, especially novel and specialist treatments. Most drugs produced by local companies are basic medicines, such as painkillers and antibiotics, since it is not economically feasible to target a specialized segment Increasing domestic demand, a significant proportion of which the local manufacturing industry will be unable to meet, will stimulate the growth of pharmaceutical imports over the next five years. The market will remain receptive to foreign products, particularly at the hi-tech end of the scale. The overall trade balance will increasingly shift in favor of imports throughout the forecast period, indicating sizeable business opportunities for foreign companies (MIDA).

In May 2007, as a sign of its strength in FTA negotiations with the US, Malaysia stated that it is seeking the right to issue compulsory licenses on patented drugs. While Malaysia is legally within its rights, as permitted by WTO rules, the country will be strongly discouraged to do so by the US, because the profits of multinational drug makers will be negatively impacted. Given that the average monthly wage in Malaysia is approximately US$1,000, compulsory licenses have made antiretroviral treatments affordable to the vast majority of the population. The USTR also kept Malaysia on the Watch List for 2010, pointing to the lack of resources and training that lead to a backlog at specialized IPR courts in the country. The report also highlighted the absence of effective protection against unauthorized disclosure or unfair commercial use of test data produced for product approval in the pharmaceutical market. The report also urged the development of an effective and prompt patent system for new pharmaceutical products.

Parallel imports have recently been legalized in a bid to cut costs in the public healthcare sector, undermining revenues on branded products. The practice is angering the multinational sector, with foreign players critical of the government's biased approach to regulatory and enforcement issues. Pharmaniaga Logistics Sdn Bhd (formerly known as Remedi Pharmaceuticals). This subsidiary of leading drug company Pharmaniaga is responsible for around 75% of medicines purchased by public healthcare institutions. The strict policy results in public prices being set below market prices, which is necessary, given that the government is responsible for around 60% of reimbursement amounts. Nevertheless, the country is considering price ceilings for selected essential drugs to improve access. Portending further reform, studies have found wide variability in the public and private sector prices of both patented drugs and generics. In the private sector, pricing is free in theory, although the government has increasingly been using the prices on the Ministry of Health drug list as a guideline when dealing with private companies. A full proposal for private-sector pricing regulation has yet to emerge. Out-of-pocket spending on drugs accounts for around 25% of the total, with private insurance covering some 15%. According to reports in the New Strait Times, around 15% of the population has private

insurance. Malaysia is committed to the ASEAN Common Effective Preferential Tariffs (CEPT) scheme under which all industrial goods traded within ASEAN are imposed import duties of 0% to 5%.

Increasing domestic demand, a significant proportion of which the local manufacturing industry will be unable to meet, will stimulate the growth of pharmaceutical imports over the next five years. The market will remain receptive to foreign products, particularly at the hi-tech end of the scale. The overall trade balance will increasingly shift further in favor of imports throughout the forecast period, indicating sizeable business opportunities for foreign companies (BMI, 2010).

Clinical Trial Exemption (CTX)

An approval by the DCA authorizing the applicant to manufacture any local product for the

purpose of clinical trial.

Clinical Trial Import License (CTIL)

A license in Form 4 in the schedule of The Control of Drugs and Cosmetics Regulations of 1984, authorizing the licensee to import any product for purposes of clinical trials, notwithstanding that the product is not a registered product. Prior to importation/manufacturing product locally, the investigator or sponsor is required to apply for CTIL/CTX from the Drug Control Authority (DCA). The following products will require a CTIL/CTX:

3.1 A product including placebo which are not registered with the DCA and are intended to be imported for clinical trial purpose.

3.2 A product with a marketing authorization when used or assembled (formulated or packaged) in a way different from the approved form and when used for unapproved indication / when use to gain further information about

an approved use for clinical trial purpose.

3.3 An unregistered product including placebo manufactured locally for the purpose of the clinical trial (Ismail, 2009).

Despite the introduction of holograms on pharmaceutical packaging, the level of counterfeit trade in Malaysia remains significant due to lax enforcement and other issues. A small – but not unimportant – proportion of drugs on the market are counterfeit (a 1997 study by the Ministry of Health found that 5.3% of sampled drugs fell into this category, although other estimates are at least double that amount), which has continued to represent a point of contention between the

government and the international industry. According to the Pharmaceutical Services Division, around 5.28% of all OTCs on sale in Malaysia were counterfeit in 2008, with slimming products accounting for around 10% of all illegal medicines seized in 2007. Enforcement work has become very challenging as these products use advanced technologies to avoid detection and exploit Malaysia's land and sea borders with Thailand and Indonesia.

In order to deter sales of imitation drugs, the government is looking to enforce stricter punishments for counterfeiters. Currently, most offences lead to prison sentences of no longer than five years, in addition to a fine of between MYR2,000 and MYR20,000 per infringement. After consulting with the Pharmaceutical Association of Malaysia, the Ministry of Domestic Trade and Consumer Affairs initiated calls for new legislation against the illegal trade.

The Malaysian International Chamber of Commerce recommended that the Trade Descriptions Act 1972, Sales of Drugs Act 1952 and the Poisons Act 1952 be amended so that there is a minimum fine for each counterfeit item and a mandatory jail sentence. A draft bill was expected in 2009, although no developments on the issue were reported by early 2010. Nevertheless – and despite the fact that the country has no legislation that specifically targets online counterfeiting –authorities (through a dedicated unit) have reportedly been successful with regard to reducing online sales of fake medicines (BMI, 2010).

All pharmaceutical products must be registered with the Drug Control Authority before it can be marketed in Malaysia. A foreign company wishing to bring pharmaceutical products into Malaysia would first have to appoint a local agent to be the holder of the registration certificate. The appointed agent would then be responsible for all matters pertaining to the registration of the products. There are specific forms to complete during the process of registration. Under the labeling requirements for products registered with the Drug Control Authority, the name and address of the actual manufacturer must be declared on the label.

At point of entry, imported products without holograms are a signal to the enforcement officers regarding its authenticity. Enforcement will not be carried out at the point of entry. Over the past decade, the DCA has cancelled or suspended 213 generic drug registrations for failing bioequivalence examinations. In 2008-2009, the authority rejected 66 new product applications because they did not include the required data (BMI, 2010).

Malaysia has played an important role in the global medical devices industry, as both an importer and exporter. While the country is actively seeking investment and shows promise as a growing market, it is important to understand the regulations and practices in place. Importers will find a growing market for high-end medical equipment while companies looking to position manufacturing facilities in Malaysia will find an encouraging and accommodating host.

Companies should be most concerned with Malaysia's vague policy on parallel importation of patented products.

Malaysia's primary focus within the medical device industry has traditionally been the manufacturing and exporting of medical gloves and catheters, accounting for 60% and 80% of the world market respectively (Industries in Malaysia, 2010). For a full list of products manufactured in Malaysia, please refer to Exhibit 6. The Ministry of Health Malaysia (MOH) oversees the Medical Device Bureau (MDB) with the following objectives, "One is to protect the public health and safety and, two, to ensure that new technology is made available for use for patients in a timely manner and at the same time facilitating trades and medical device industry ("Medical device bureau," 2010). Current growth in the market is expected to remain at 9.5% per year until 2015 at which the market is expected to reach US$1.7 billion ("Medical device bureau", 2010).

The medical device industry in Malaysia is largely self-regulated, although significant changes are expected soon. Medical devices are encouraged to conform to "internationally recognized quality standards such as the Food and Drug Administration (United States), Department of Health (United Kingdom) and Bundesgesundheitsamt (Germany)" (Industries in Malaysia,2010).

Intellectual Property Rights

Malaysia, a member of the World Intellectual Property Organization (WIPO) and a signatory to the Paris Convention and Berne Convention, is also a signatory to the Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPS) under the World Trade Organization and therefore considered in conformance with international standards per periodic review (Invest in Malaysia: Intellectual, 2010).

While IPR are in place and have viable means of enforcement, it is important to note that foreign organizations/applicants wishing to apply must find a registered patent or trademark agent in Malaysia to act on their behalf. Products may be patented for the duration of 20 years. Trademarks are protected for ten years, and can be renewed every ten years, as specified by the Trade Marks Act of 1976 and Trade Marks Regulations of 1997. In the last decade, there seems to be no significant change in trademark policy, and it is important to note that patented products in other country markets can also be imported under the parallel import model. This can have significant implications for medical devices and other pharmaceuticals, which may rely on their patents to generate revenue for extensive R&D costs. While the government has officially stated that Malaysia will prohibit the registration of well-known trademarks by unauthorized parties to prevent counterfeits, the only official position on the issue of parallel imports is that the government can, "Prohibit exploitation of patents for reasons of public order or morality (Invest in Malaysia: Intellectual, 2010)."

The MDB runs the Voluntary Registration of Medical Devices Establishments (MeDVER), which applies to manufactures, importers, and distributors of medical devices. Companies should note that the Medical Devices Bill, expected to pass into law by the end of 2010, would make registration required and increase government oversight.

Although the current level of enforcement of the regulatory system is unknown, a comprehensive publication of all guidance notes is available with the Medical Device Bureau. The guidance publication contains "classification, essential principles of safety and performance, risk management, labeling and packaging, conformity assessment, nomenclature, quality management system, clinical evidence, recall, incident investigation and adverse event reporting, effective operation and maintenance management as well as disposal" (Medical device bureau2008).

Significant points within the guidance notes are the establishment of classification influencing regulatory importance, steps for placement of medical devices on the Malaysia market, and essential principles of safety and performance. The definition and examples of medical device classifications are available in Exhibit 7. A summary of the regulations relating to pre-market, placement on market and post-market are provided in Exhibit 8.

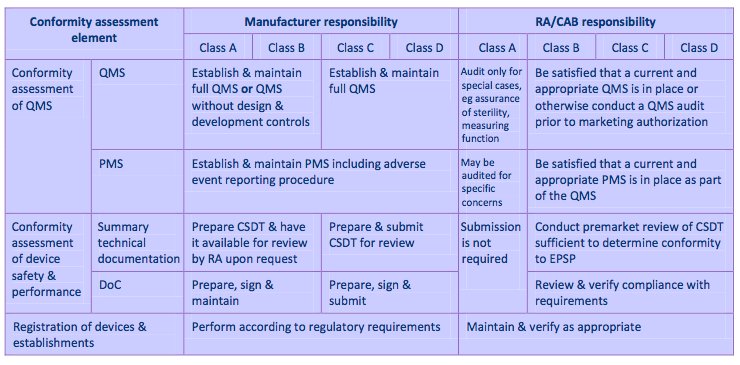

The placement of medical devices on the Malaysian market is dependent on a process of evaluation and approval known as a conformity assessment and includes 1) Conformity of the Quality Management System (QMS) and System for Post-Market Surveillance (PMS) 2) Conformity Assessment of Medical Device Safety and Performance through summary technical documentation and Declaration of Conformity (DoC) and 3) Registration of medical devices and establishments; there are three parties involved in the conformity assessment: the manufacturer of the medical device, Conformity Assessment Body (CAB), and the Regulatory Authority (RA) (Ministry of Health). For a figure summarizing the conformity assessment system, please see Exhibit 9.

The MDB is working with SIRM Berhad, formally the Standards and Industrial Research Institute of Malaysia (wholly owned by the Malaysian Government), to develop medical device standards (Medical device bureau, 2008). These standards and future regulatory guidelines are currently part of the Medical Devices Bill. In addition to the creation of the Medical Devices Bureau and Medical Devices Bill to develop a regulatory system, Malaysia also offers a variety of incentive programs for foreign corporations.

There are a variety of incentives for manufacturing companies doing business in Malaysia. Manufacturing companies will benefit from Pioneer Status and the Investment Tax Allowance, which are detailed in Exhibit 10. As of 2009, the corporate tax rate and maximum individual tax rate were reduced to 25% and 27% respectively (Why Malaysia: supportive, 2010).

Exports also receive a tax exemption "on statutory income equivalent to 10% of the value of increased exports, provided that the goods exported attain at least 30% value-added; or a tax exemption on statutory income equivalent to 15% of the value of increased exports, provided that the goods exported attain at least 50% value-added" (Invest in Malaysia: incentives, 2010).

Malaysia's current commitment to ASEAN harmonization remains verbal until the passage of the Medical Devices Bill and subsequent actions. In theory, Malaysia has agreed to align their regulations to those published by the ASEAN Harmonization Working Party (AHWP) and the Global Harmonization Work Force (Industries in Malaysia, 2010).

Malaysia has committed to harmonization by providing guidance notes for Medical Device regulation adapted from the Global Harmonization Task Force (GHTF). The GHTF is an international body representing Europe, Asia-Pacific, and North America with the goal to create "a global consultative partnership aimed at harmonizing medical device regulatory practices"(GHTF: overview and, 2007).

Malaysia also hopes to play a lead role in the ASEAN and other Asian regions by developing "the common submission dossier template for medical devices market approval and formalization of a post-market alert system for ASEAN and Asia" (Medical device bureau,2010).

Despite a major revision of patent law in 2001 and subsequent amendments in 2003, patent protection continues to be the cause of friction between the government and international drug manufacturers. While the government revised the period of protection for pharmaceuticals (increasing it to 20 years) following pressure from the international pharmaceutical community, it also implemented legal provisions that have come under heavy criticism from the industry (BMI, 2010).

Despite the introduction of holograms on pharmaceutical packaging, the level of counterfeit trade in Malaysia remains significant due to lax enforcement and other issues (NPCB).

By the end of 2006, Malaysia, Singapore, Thailand, Indonesia and Vietnam succeeded in harmonizing their pharmaceutical exports as part of the ASEAN Common Technical Dossiers (ACTD) program (BMI, 2010).

BMI's Pharmaceuticals & Healthcare Business Environment Ratings (BERs) reveal that Malaysia is a fairly attractive proposition to multinational drug makers. The country scores 55.7 out of 100, which is above both the regional (54.2) and global (51.9) averages. Indicating the developed nature of the DCA, Malaysia scores 7out of 10 for its approvals process, intellectual property laws and policy/reimbursement (BMI, 2010).

The expiry of patents on 47 drugs with high sales figures in the next five years is a chance for manufacturers to produce generic versions. Presently, generics are poorly promoted in Malaysia, with branded drugs generally viewed as superior in quality (BMI, 2010).

Other growth drivers are the rising quality of generics, cost-containment needs and implementation of the ASEAN Free Trade Area (AFTA) agreement, with products from signatory countries to be exempt from import barriers and tariffs. The flow of imports is expected to increase, tightening competition and pushing local manufacturers to create competitive advantages (BMI, 2010).

The Philippines is a middle-income country with imbalanced distribution of economic growth and productive resources. The Philippines consists of a large and growing population with currently low levels of drug consumption. In recent years, the government has been strongly committed to providing greater access to medicines. As economic growth strengths, total health spending is expected to increase reaching US$9.9 billion in 2013 (Philippines Healthcare Report, 2009). The country spent around US$2.58 billion on pharmaceuticals in 2009, up by over 200% compared to 2003 (Philippines Pharmaceuticals, 2010).

Primary healthcare services in rural areas are of a basic standard due to the lack of infrastructure and investment. The country is a major provider of healthcare workers and medical staff internationally. A significant proportion of overseas Filipino workers are doctors and nurses. ASEAN Mutual Recognition Agreement (MRA) allows health professionals to practice in other ASEAN-10 countries without having to obtain another license. The negative aspect of this is that healthcare provision in the Philippines is being undermined by the departure of so many medical professionals to work overseas (Philippines Healthcare Report, 2009). The Philippines Health Insurance Corporation (PhilHealth) had more than 80 million beneficiaries in 2009 which is equivalent to about eight out of ten Filipinos. Many poorer families still do not have PhilHealth cards entitling them to health services. Out-of-pocket spending has increased in the past few years, reflecting budgetary constraints on government expenditure (Philippines Healthcare Report, 2009).

Pharmaceuticals

Medicaments containing antibiotics or their derivates are #73 out of the top 93 imports into the

Philippines. However, pharmaceuticals cost more relative to drug prices in other Asian

countries. Furthermore, pharmaceutical consumption per head in the Philippines is still

relatively low.

In 2009, spending on generics has reached US$361 million and the market share

increased to about 14% from 12% in 2008. Key drivers of the generics sector are the increasing

need for low-cost drugs, budgetary increases, new legislation, patent expirations and the push to

increase compliance with public-sector generic prescribing and substitution (Philippines

Pharmaceuticals, 2010).

The 1988 Generics Act has had little positive impact on the generics market; in fact, generics drug sales only account for 10% of the medicine market. Patent protection is a major concern for multinational pharmaceutical companies with operations in the Philippines. The Philippines wasone of the top two IPR offenders according to PHrMA in 2009 because of the Universally Accessible Cheaper & Quality Medicines Act passed in June, 2008. The law aims to increase the use of affordable generic medicines while also reducing the country's reliance on foreign patented medicines by permitting health authorities to import patented drugs from other countries and to allow local drug producers to register their own versions of patented drugs once the

original patent has expired. Furthermore, the legislation makes it more difficult for patent holders to renew their patents (Philippines Healthcare Report, 2009).

According to a September 2008 statement by a senior lawmaker, corrupt practices in the drug procurement system are a cause of high-priced medicines. In November 2010, the National Bureau of Investigation (NBI) seized P25 million worth of fake medicines imported from India, Pakistan and Singapore (Araneta, 2010). A report from the Commission on Audit states that the Department of Health has a weak purchasing and monitoring system, which results in incorrect maintenance of medicine inventories and the frequent expiration of medicines. In August 2010, Samahan Laban sa Pekeng Gamot, a healthcare advocacy group, blamed the government and its policies on counterfeit drugs for worsening the problem of counterfeit drugs.

The Philippines relies heavily on foreign drugs, which account for about 75% of the market by value (Philippines Pharmaceuticals, 2010). The top manufacturers selling products in the Philippines include Wyeth, Bristol-Myers Squibb, Abbott Laboratories, Pfizer, Schering Plough, Eli Lilly and Merck Sharp & Dohme, all of the US, GlaxoSmithKline and AstraZeneca of the UK, Roche and Novartis of Switzerland, Boehringer Ingelheim and Bayer Pharama of Germany and sanofiaventis of France (Philippines Healthcare Report, 2009).

The Expanded Program on Immunization (EPI) in the Philippines began in 1979 and was launched in cooperation with the WHO. EPI has responded to the Universal Child Immunization goal with a set of standards for child immunization. Immunization is performed weekly, monthly, and quarterly in the Philippines depending on the area of the country (Philippines Healthcare Report, 2009).

Regulation of medical equipment is controlled by the Bureau of Health Devices and Technology (BHDT). The BHDT ensures the safety, efficacy and quality of medical devices and is the government contact for importers looking to sell their products in the Philippines.

The Philippines represents a modest but growing proposition for medical device manufacturers. Long-term drivers of the market include strong economic growth, a rapidly expanding and aging population, and development of the private hospital sector and the upgrade of government healthcare facilities. Medical device expenditure is projected to reach US$361 million by 2014. The public healthcare system is due for modernization but no extensive plans to upgrade facilities have been announced (Philippines Pharmaceuticals, 2010).

Local production of medical devices is almost non-existent and limited to low-end devices such as surgical gloves, syringes and needles. The Philippines mainly imports medical devices from the US due to its historical ties with the country. The next leading importers are Germany, Japan

and Singapore. However, India and China are expected to sell more products to the Philippines in the near future. The Philippines imposes a 3% tariff duty and a 10% VAT on imported medical equipment. Medical equipment in the Philippines must have a Good Manufacturing Practice (GMP) certificate.

Pharmaceuticals

Singapore's pharmaceutical industry remains one of the country's strongest components of its

biomedical sciences sector since 1997 (Exhibit 11). It is the fourth pillar of manufacturing in

Singapore, including electronics, chemicals and engineering (Yeo). The rapidly growing city-

state has developed into one of Asia's fastest growing bio-clusters to develop new medicines for

regional and global markets. Today, Singapore is leading the way in the global manufacturing of

innovative medicines and is now home to over 4,300 researchers, more than 50 companies and

30 public sector institutes with more than a billion dollars per year dedicated to research and

development (SEDB, 2010).

The Centre for Drug Administration (CDA), under the Ministry of Health and Health Sciences Authority, is the main regulatory committee which monitors the quality and safety of all pharmaceutical production and imports. CDA also evaluates the applications and decides on product license approvals (Exhibit 12). Despite its relatively small – in regional terms –pharmaceutical market of US$560 million, Singapore still remains an attraction for multinational companies due to its well-developed economy and high per capita spending (BMI, 2010). Pharmaceutical market forecasts indicate the pharmaceutical market will reach US$601 million and have a compound annual growth rate of 3.26% by 2014.

Clinical Trials

The Medicines Act of 1978 and the Medicines Regulation of 1998 are the statutory legislations

governing clinical trials in Singapore. The legislations demand that any investigator who is

partaking in a clinical trial must comply with Good Clinical Practice (GCP), and obtain both

ethical and regulatory approvals including a Clinical Trial Certificate (CTC) by the HSA. CTCs

are required by the National Pharmaceutical Administration (NPA) and are valid for up to two

years (HSA August 4, 2010). The Medical Clinical Research Committee (MCRC) is the

committee which advises on the licensing of the clinical trials. Along with stringent requirements

from HSA and NPA, clinical investigators are required to follow a set of ethical and scientific

standards for conducting clinical trials called Singapore Guideline for Good Clinical Practices

(SGGCP). Any person who fails to comply with the regulations as set forth by the Medicines Act

shall be liable on conviction to a fine of $5,000 or to imprisonment or both (1978).

According to Business Monitor International's report, "Singapore: Pharmaceutical & Healthcare, September 10, 2010," Singapore is leading the way in clinical trials. Over the next five years, Singapore plans to double the number of studies regarding Phase I trials. According to ClinicalTrials.gov, the city-state conducted 625 clinical trials as of February 2010. Exhibit 13shows the number of clinical trial certificates issued by the HSA within the past decade (HSA,2010).

The HSA forces all pharmaceutical manufacturers to adhere to the Good Manufacturing Practice (GMP) and Good Distribution Practice (GDP) guidelines as set forth by ASEAN to increase harmonization efforts. GMP for Medicinal Products are guidelines for manufacturers to ensure that all medicinal products are "consistently produced and controlled to the quality standards appropriate to their intended use and as required by the marketing authorization or product specification (ASEAN, 2006). Please refer to Exhibit 14 for excerpts from the official GMP guidelines as provided by HSA on their website. According to GMP, all packages must be traceable, provide consistent quality, provide product protection and offer child-resistant protection when applicable (Lithgow, 2002).

HSA also requires all pharmaceutical products to show the following on labels (1987):- name of the person to whom the product is to be administered.

- name of the registered pharmacy where the medicine is supplied.

- date upon which the product is dispensed.

- the direction for use.

- name of the medicinal product being either the appropriate non-proprietary name. - quantitative particulars of the active ingredients in the medicinal product.

In terms of packaging and labeling, Singapore is fully harmonized with ASEAN's GMP and GDP guidelines, according to an interview with Senior Regulatory Representative from the Health Sciences Authority, Evelyn Lee. Lee stated that Singapore is not looking to modify these guidelines anytime soon.

Marketing Requirements

There are four types of medicinal advertisements and sales promotion permits required by HSA:

still media, sound media, light & sound media and sales promotions (HSA, 2009). All permits

approved by the HSA are valid for one year and all advertisements are required to print the

permit number on advertisements and promotional items. All marketing requirements are

controlled under the Medicines Act of 1975 and its subsidiary Medicines Regulation Act of 1977

and the Singapore Code of Advertising Practices (SCAP), drawn up by the Advertising

Standards of Authority of Singapore. The objective of these legislations is to ensure that all sales,

promotions and advertisements are truthful and do not mislead or induce unnecessary use of the

medicinal product by the public (HSA, 2008).

As part of ASEAN harmonization scheme, Singapore has established Mutual Recognition Agreement (MRA) on the Post-Marketing Alert System (PMA). The objective of the PMA is to establish an efficient and effective system of alert on post-marketing issues which affect the pharmaceutical quality and safety. According to ASEAN, PMA is compulsory for all its member countries. This system also supports the International Medicinal Anti-Counterfeiting Taskforce

Program or IMPACT, as established by the World Health Organization, WHO (Laetzel, 2007). Exhibit 15 shows the Post-Market Alert System statistics for 2007 (Hui-Keng, 2009).

Intellectual Property Rights

Among the Southeast Asian countries, Singapore is one of the most advanced regarding

Intellectual Property laws. Singapore is a member of the World Intellectual Property

Organization (WIPO), THE World Trade Organization (WTO) and Trade-Related Intellectual

Property Rights (TRIPS). TRIPS requires all member countries to provide patent protection to

last for 20 years in all fields of technology, copyright to last for at least 50 years from the date of

publication and WTO members to allow patents in processes. Singapore also adheres to the

standards of protection as stated by the Berne and Paris Conventions (IDA, 2009).

BMI's 2010 report on Singapore's Pharmaceutical Industry suggests that there are still many concerns regarding Intellectual Property Rights and parallel trade which are pending the integration of the present healthcare and medicines acts. Singapore has passed several IP bills, including an amendment to the Medicines Act to protect pharmaceutical innovation which further tightens domestic regulations. BMI also suggests in their fourth quarter report that Singapore is not likely to exercise the TRIPS agreement, which enables the export of cheaper versions of patented medicines to address public health problems due to its close ties with surrounding countries.

However, a different message is conveyed by the Info-communications Development Authority of Singapore (IDA) and the Intellectual Property Office of Singapore (IPOS). These government offices indicate that they are working hard to "strike a balance between the property protection of owners of creative works and increased public access to intellectual property." Singapore'sintellectual property governing bodies have ensured that the intellectual property laws are harmonized globally. In 1999, The Copyright Act (Chapter 63) was amended to reinforce the city-state's commitment to provide a strong and conducive Intellectual Property Rights regime while promoting the growth of a knowledge-based economy (IDA, 2009).

Parallel Trade

All imported pharmaceuticals require the approval of the Health Sciences Authority of

Singapore. According to HSA, import license will only be issued to importers who have been

authorized by the product license holder to import licensed products on their behalf. Along with

a license, importers must also comply with HSA's Good Distribution Practice (GDP) guidelines

in order to be granted approval. HSA's regulatory Inspectors audit distributors in accordance

with the HSA Guidance Notes on Good Distribution Practice (HSA, 2010).

Despite such explicit requirements and guidelines, some sources reveal that parallel trade is still a concern in Singapore. One resource suggests that Singapore's legislations actually support parallel importation and that there are no legal and practical impediments against such trade. The

authors suggest that this is due to the fact that, "Singapore is a small domestic market and the costs of proving an alleged infringement of the consent of the copyright owner as against the benefits of a small domestic market." Sections 32 and 33 of the Singapore Copyrights Act (Chapter 63) allows for parallel importation as long as the importer can show that the product he/she is importing was made with the consent or license of the copyright owner (Partners, 2001). According to Maskus, Singapore prefers an open regime when it comes to parallel importation "because of their nature as centers of entrepot trade" (Maskus, 2001).

However, according to an interview with Senior Regulatory Specialist at HSA, Evelyn Lee, there are strict guidelines and criteria set forth by the HSA which require all new distributors of pharmaceuticals to apply for a distribution license. In order to eliminate parallel importation, licenses will only be given to wholesalers that are approved by the original licensed party. All guidelines and application for licenses for imported pharmaceuticals are available on HSA's website. It was also stated that IPRs also eliminate parallel trade (Zaman, 2010). According to research done by Frank Langer, IPR owners can take action against the parallel trading party for infringing on copyright or trademark issues. Furthermore, the license holder can include a restriction notice in licensing and purchasing agreements in order to prevent parallel trade. But Langer also suggests that this protection is subject to whether it is considered anticompetitive by prevailing competitive laws (Muller-Langer, 2007).

Despite parallel trade and intellectual property issues, Singapore's prescription Drug Market Forecast is forecasted to remain stable, with sales expecting reach US$ 579 million by 2014 (BMI, 2010).

Regulatory Data Protection

According to an interview with Senior Regulatory Specialist, Evelyn Lee, there is no

harmonization effort in place for RPD as far as ASEAN is concerned. However, Singapore does

have data protection for all pharmaceuticals. All new licenses are protected for 5 years and any

new application that infringes on the data protection is not accepted by the HSA. HSA has a

surveillance group in place to check and make sure all pharmaceutical data is protected.

Government Participation

The government of Singapore has taken an active role in setting legislations and guidelines for

the sale, advertising, clinical trials, manufacturing, and distribution of pharmaceutical products.

HSA adheres to the following legislations as set forth by the government of Singapore:

Medicines Act, Health Products Act, Poison Act, Medicine Act for Sales and Advertisements,

Sale of Drugs Act and Smoking Act. All legislations regarding medicinal products can be

obtained from the Singapore Statutes Online website.

In efforts to harmonize with ASEAN, Singapore is a member of ASEAN's Pharmaceutical Product Working Group, PPWG, formed in 1999. PPWG's objective is to harmonize

pharmaceutical regulations across ASEAN and to facilitate the ASEAN Free Trade Agreement (AFTA) while promoting product quality, efficacy and safety (Javroongrit, 2006). PPWG seeks to harmonize pharmaceutical regulations by trading information on existing regulations, conducting comparative studies, studying harmonization procedures and regulatory systems. In efforts to further harmonization among ASEAN member countries, PPWG has established ASEAN Common Technical Requirements (ACTR) and ASEAN Common Technical Dossier (ACTD) for all pharmaceutical products. Exhibit 16 shows ASEANs Harmonization Milestones from 1999 to 2009 (Hui-Keng, 2009).

ACTR is a set of written materials intended to guide the applicants to prepare application dossiers in a way that is consistent with ASEAN Drug Regulatory Authority. ACTD is a part of marketing authorization application dossier which requires all applicants to provide a letter of authorization, certification, labeling information, product information and proper language for the product (Haq). Exhibits 17 and 18 show the ACTR format and the ACTD structure ASEAN countries must adhere to for all new pharmaceutical products (Javroongrit, 2006).

Along with PPWG, ASEAN Consultative Committee of Standards and Quality (ACCSQ) initiated efforts to harmonize regulatory requirements among ASEAN member countries. Singapore and ASEAN have signed the AFTA to eliminate tariff on imported goods. The ASEAN member countries are to apply a tariff rate of 0 to 5%. This is known as the Common Effective Preferential Tariff, CEPT (Ratanawijitrasin, 2005). All ASEAN countries have agreed to enact a zero tariff on virtually all imported goods by 2010 (SECRETARIAT 2010).

An interview with Evelyn Lee, Senior Regulatory Specialist for HSA, indicated that Singapore has fully implemented the ACTR and ACTD dossier in efforts to increase harmonization with ASEAN and its member countries in April 2004. Lee stated that Singapore has no near-future plans to change or modify these policies.