Levitra enthält Vardenafil, das eine kürzere Wirkdauer als Tadalafil hat, dafür aber schnell einsetzt. Männer, die diskret bestellen möchten, suchen häufig nach levitra kaufen ohne rezept. Dabei spielt die rechtliche Lage in der Schweiz eine wichtige Rolle.

357

Discussion Paper No. 357

Authorized Generic Entry prior

to Patent Expiry: Reassessing

Incentives for Independent

*University of Munich

Financial support from the Deutsche Forschungsgemeinschaft through SFB/TR 15 is gratefully acknowledged.

Sonderforschungsbereich/Transregio 15 www.sfbtr15.de

Universität Mannheim Freie Universität Berlin Humboldt-Universität zu Berlin Ludwig-Maximilians-Universität München

Rheinische Friedrich-Wilhelms-Universität Bonn Zentrum für Europäische Wirtschaftsforschung Mannheim

Speaker: Prof. Dr. Urs Schweizer. Department of Economics University of Bonn D-53113 Bonn,

Phone: +49(0228)739220 Fax: +49(0228)739221

Authorized Generic Entry prior to Patent Expiry:

Reassessing Incentives for Independent Generic Entry

Munich Graduate School of Economics, University of Munich

Patent holders attempt to mitigate the loss of monopoly power by authorizing

generic entry prior to patent expiry (early entry). Off-patent competition may beadversely affected if early entry substantially lowers the attractiveness of subsequentgeneric entry. This study assesses the impact of early entry, examining generic entrydecisions made in the course of recent patent expiries. Using micro data and accountingfor the endogeneity of early entry, I estimate recursive bivariate probit models of entry.

Early entry has no significant impact on the likelihood of generic entry. Rent-seekingrather than strategic entry-deterrence motives drive early entry decisions.

Keywords: Generic Entry, Early Entry, Anticompetitive Practices.

JEL Classification Numbers: L41, I11, O34, C35.

Acknowledgements: I would like to thank seminar participants at the DRUID-DIME2009 Winter Ph.D. Conference, at the CEPR 2009 Applied IO School, at the AnnualCCC Conference 2009, at the EEA Annual Congress 2009, the EARIE Annual Confer-ence 2009 and at the NBER Productivity Lunch Seminar (April 2010) for their helpfulcomments. I am deeply grateful to Dietmar Harhoff, Georg von Graevenitz, JoachimWinter for their advice and suggestions. All remaining errors are my own. Finally, Iwould like to thank Insight Health for providing data. The statements, findings, con-clusions, views and opinions contained and expressed in this article are not necessarilythose of Insight Health or any of its affiliated or subsidiary entities. This paper waswritten with the financial support of the SFB Transregio 15 financed by the DFG.

∗Address: Kaulbachstr. 45, Room# 307, 80539 Munich, Germany, telephone: +49-89-2180-5761; Mail

to: MGSE, Kaulbachstrasse 45, 80539 Munich, Germany; E-mail:

[email protected].

As blockbuster drugs lose patent protection and drug pipelines have run dry, "Big

Pharma" seeks ways to limit profit erosion following generic entry.1 One increasingly com-

mon practice has become the introduction of a generic version of the original drug prior to

the loss of exclusivity – expiry of patent or supplementary protection certificate (SPC)2 –, ei-

ther through a subsidiary or licensee/supply partner (early entry). The increasing frequency

of early entry has raised policy concerns (FTC, 2002; EUC, 2008; FTC, 2009; EUC, 2009).

First-movers enjoy a sustainable competitive advantage over subsequent entrants (Caves

et al., 1991; Grabowski and Vernon, 1992; Hollis, 2002), and anticipated early entry may

reduce incentives for generic entry and put at risk drug expenditure savings. The prevailing

assumption is that generic firms anticipate early entry based on drug markets' characteristics

and past experiences. A few empirical studies (Hollis, 2003; Reiffen and Ward, 2007; Berndt

et al., 2007a,b) investigate the impact of early entry – exogenously given – on generic entry,

arriving at different conclusions. Berndt et al. (2007a) concede that authorized generic entry

prior to patent expiry may reduce incentives to generic firms, yet they emphasize that there

is no comprehensive empirical evidence based on recent data that would show early entry

to have had a delaying or deterring effect on generic entry. Except for the study by Berndt

et al. (2007a), peer-reviewed analyses rely on data from the late 80s, early and mid 90s. This

study is the first to employ recent micro data to examine generic and early entry decisions.

The previous debate has largely centered on the effect of anticipated authorized generic

entry on generic firms' incentives to pursue paragraph IV challenges prior to patent expiry.

In the U.S., the first generic manufacturer to file for market approval with a successful para-

graph IV certification (claim of patent non-infringement or patent invalidity) is granted a

180-day exclusivity period where no other generic firm (except for the authorized generic)

is entitled to market the same version of the drug. If authorized generic entry drastically

lowered generic firms' incentives to file paragraph IV certifications, generic entry could be

delayed. The 180-day exclusivity period is an institutional feature specific to the U.S. phar-

1 The Economist, January 24th 2008: "The bitterest pill".

2 A certificate that allows for an extension of market exclusivity for up to five years after patent protection

which – depending on the life cycle of the drug – is granted by the national patent office.

maceutical market. Moreover, only a fraction of generic applications seek entry prior to

patent expiry.3 Whether early entry broadly impaired generic entry in recent years, remains

an open question. Providing a complete answer to this question requires the modeling of

original drug producers' early entry decisions which are endogenous. Original drug producers

appear to decide on early arrangements on a case-by-case basis most often in the year prior

to loss of exclusivity (EUC, 2009). Hollis and Liang (2006); FTC (2009) emphasize that set

of drug markets experiencing early entry is not a random selection of markets.

This study accounts for the endogeneity of early entry and provides comprehensive em-

pirical evidence on the impact of early entry on generic entry decisions made in the course

of recent patent expiries. The analysis relies on a unique micro data set comprising German

pharmaceutical market and exclusivity data (patents and SPCs) for the German pharmaceu-

tical market, the second largest generic drug market in the world, experiencing the largest

number of early entries of all European generic drug markets between 2000 and 2007 (EUC,

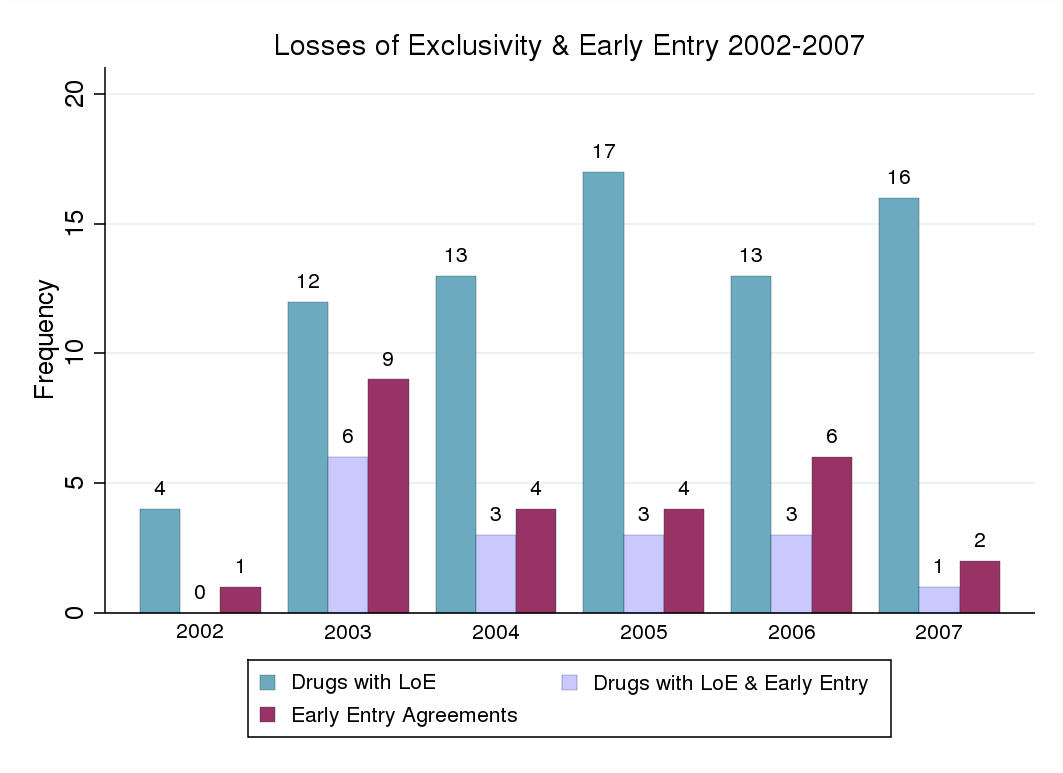

2009). 75 substances4 lost exclusivity (patent or SPC protection) between 2002 and 2007.

By the end of 2007, 87 generic firms entered in 48 markets5, resulting in a total of 724 market

entries6 by independent generic firms. Of the 48 drug markets experiencing generic entry,

16 markets were affected by early entry from 2002 to 2007. Early entry occurred on average

four months prior to loss of exclusivity. I estimate univariate and recursive bivariate probit

models of entry to quantify the impact of early entry. Treating early entry as exogenous

(univariate probit model) may give rise to a selection problem and inconsistent estimates

if early entry occurs in markets that are more attractive than given market characteristics

suggest, or in other words, if there is a spurious correlation between early entry and generic

entry decisions. Bivariate probit estimates indicate that early entry decisions are endoge-

neous. The identification strategy in the bivariate probit model relies on the assumption of

normality and the fact that I model sequential entry decisions. Exclusion restrictions are

3 From 1998 to 2000, 20% of generic applications included a paragraph IV certificate (FTC, 2002).

4 Throughout the paper the term substance is equivalently used for mono-substance, i.e. a substance that

contains one active ingredient only. As the allocation of all relevant patents and supplementary protectioncertificates to mono-substances is delicate, the analysis is confined to mono-substances.

5 Other studies report similar rates of generic entry, e.g. Magazzini et al. (2004).

6 As one firm typically enters in more than one market, this yields 724 generic entries in total.

not necessarily required to achieve identification in recursive bivariate probit models (Wilde,

2000; Greene, 2008). I do impose one exclusion restriction to improve identification. As

early entry decisions are arguably motivated by pioneers' financial distress, I add a count

of each original drug producers' further losses of exclusivity between 2002 and 2007 as an

instrumental variable to the early entry equation. As Evans and Schwab (1995), I provide

tentative empirical evidence on the suitability of the instrument, showing that the instru-

mental variable has no significant effect on generic entry decisions. Determining the average

marginal effect of early entry in the bivariate probit model, I compute the average change in

the probability of generic entry conditional on early entry having and having not occured.

Standard errors are computed using the delta-method (Papke and Wooldridge, 2005). Re-

gardless of the identifying assumption made, early entry turns out to have no significant

impact on the probability of generic entry. Originators appear to authorize generic entry

prior to loss of exclusivity to extract generic profits rather than to deter generic entry. Drugs'

pre-entry market size has a significant, and comparably the strongest impact on generic entry

decisions. A 1% increase in pre-entry revenues induces on average a 14-18% increase in the

likelihood of generic entry. Furthermore, I find that the number of off-patent substitute ac-

tive ingredients has a negative impact on entry, whereas the length of the exclusivity period

and firms' therapeutic and drug form experience influence generic entry decisions positively.

The organization of the paper is as follows: Section 2 provides relevant industry in-

formation. Section 3 reviews the literature on early entry. Section 4 describes the data,

and Section 5 specifies the empirical implementation. Section 6 presents and discusses the

empirical findings. Concluding remarks follow in Section 7.

Industry Background

With a market size of e 4.5 Bn. and a generic penetration (efficiency7) rate of about 20%

(68%) as of 2007, Germany is the second largest generic drug market in the world, and the

largest generic drug market in Europe, experiencing the largest number of generic and early

7 The generic efficiency rate indicates the fraction of multi-source drug prescriptions dispensed as generic.

Own calculations based on Insight Health prescription data.

entries between 2000 and 2007 (EUC, 2009). Hence, it is one of the most important phar-

maceutical markets to examine when seeking insights into generic and early entry decisions.

The following paragraph outlines the market approval process of generic drugs in Germany,

the dynamics of generic competition and the underlying market regulations.

Generic drugs are therapeutically equivalent to off-patent, original drugs, i.e. they con-

tain the same active ingredient, they have identical quality and performance characteristics,

the same strength and the same or a similar route of administration. Generic drugs are most

frequently marketed as INN-generics, i.e. the international-non-proprietary name (INN) of

the active ingredient and a company suffix identify the generic product. The originator's

market share typically drops quickly after generic entry. The case of Pfizer's bestseller drug

Norvasc (INN: Amlodipine) illustrated in Appendix [A-1] is only one prominent example.

As a result of price competition and lower R&D outlays, generic firms offer substantial price

discounts of up to 80% and more. Instead of safety and efficacy tests generic firms run

bioequivalence studies8 which are cheaper and faster to conduct (on average four months).

Generic entry is usually permitted as soon as the original drug goes off-patent. Originators

may apply within six month of the drug's market approval for a supplementary protection

certificate which extend the exclusivity period by up to five years if granted by the national

patent office. Generic entry may occur prior to patent or SPC expiry.9 In the event of

early entry, a generic version of the original drug may be marketed either through a generic

subsidiary or licensee/supply partner.10 Independent generic firms file abridged applications

for market approval, referring to the reviews of experts and clinical test results obtained in

the course of the original drug's approval process. Current law entitles generic firms to cite

such documents without notice or permission of the originator eight years after the origi-

nal drug's market entry11 (data exclusivity period).12 If the data exclusivity period elapsed,

8 Generic manufacturers prove in bioequivalence studies that the rate and extent of absorption of the

active ingredient is identical to that of the reference drug.

9 EUC (2008), pp. 11, 246; The Economist, August 6th 2009: "Friends for Life"; "Something Rotten".

10 Original drug producers appear to decide on early arrangements on a case-by-case basis most often in

the year prior to loss of exclusivity to generate substantial profits (EUC, 2009).

11 Given time and cost-intensive clinical trials and a lengthy approval process, market entry of the original

drug typically occurs 10-12 years after patent application.

12 With the implementation of the Bolar provision in German law, "working under patent" became legal.

For applications filed in Germany prior to November 2005 the data exclusivity period amounts to 10 years.

prescription drugs. If doctors do not exclude substitution, a pharmacist generally will have

to sell one of the three cheapest generic drugs to the patient. If a more expensive product is

sold instead, the pharmacist incurs the difference in price. Since January 2004, dispensing

fees on prescription drugs15 consist largely of a fixed component.16 As a result, incentives

to sell high-priced drugs have been reduced. In the same year, reimbursement practices

were altered. Patients covered by statutory health insurance have to make a co-payment for

each drug they purchase. The co-payment amounts to 10% of the retail price, the minimum

contribution is e 5 and e 10 is the maximum. As most drugs are sold in packages priced

below e 50, patients are often inclined not to search for a cheaper drug with the same

active ingredient (Accenture, 2005). In addition to the co-payment that patients covered by

statutory health insurance must make, they are reimbursed up to a reference price only. As

of May 2006, co-payments become obsolete if a drug product is priced 30% or more below

the reference price.17 As a result, generic firms often set prices close to, or 30% below, the

reference price18. In April 2007 the Statuatory Health Insurance Competition Reinforcement

Act was enforced, authorizing rebate contracts. Ever since statutory insurance providers may

contract with drug manufacturers that offer the lowest price for a particular drug product.

Thereafter, pharmacists are to provide patients with the drug of the manufacturer their

insurance provider has contracted with. Except for rebate contracts, previous regulations

seem to have provided generally few incentives to switch between identical generic drugs as

long as price differences are minor, conferring a sustainable advantage to generic first-movers.

Literature Review

The distinctive features of competition in off-patent drug markets have attracted the

attention of various economists. Previous empirical studies prove pre-entry market size

(Morton, 1999; Saha et al., 2006), firm and drug characteristics (Morton, 1999), and the

brand-name drug's goodwill stock (Hurwitz and Caves, 1988; Hudson, 2000) to be impor-

15 Around 78% of pharmaceutical sales are made on prescription drugs (BPI Pharma-Daten 2008).

16 Pharmacies receive a fixed fee of e 8.10 on each product sold, plus 3% of the product's purchase price.

17 To secure fair competition practices, manufacturers are also prohibited from giving discounts in kind to

pharmacies since May 2006. Financial rebates are restricted to non-prescription drugs.

18 AOK Press Release June, 2006 (accessed Dec 11th 2008); see also Accenture (2005).

tant influencing factors of generic entry. A few empirical studies address the issue of early

entry – also known as authorized, branded or pseudo-generic entry – gauging its potentially

anti-competitive impact on independent generic entry. Early entry is a common phenomenon

in both Europe and the USA. Generic first-movers have been shown to enjoy a long-lasting

advantage over subsequent generic entrants (Caves et al., 1991; Grabowski and Vernon, 1992;

Hollis, 2002).19 Not only can the first generic entrant serve the market for a longer period

of time – with fewer competitors and higher generic profits after patent expiry – but it can

also capture and sustain a substantially larger market share over a period of several years.

On these grounds early entry may drastically reduce incentives for generic entry and harm

off-patent competition. Prior studies draw different conclusions about the effect of early en-

try on generic entry decisions. Whereas Hollis (2003) argues that early entry has a deterring

effect on generic entry and substantial welfare effects, Reiffen and Ward (2007) and Berndt

et al. (2007a) hold a more moderate view on the ultimate impact of early entry.

Hollis (2003) explains that patients' unwillingness to switch between medications, search

and "persuasion" costs on parts of doctors, and the administrative costs of pharmacies when

stocking several (identical) generic drugs result in switching costs. Switching costs are not

easy to overcome as generic drugs are bio-equivalent and generic competitors match prices

immediately as soon as one entrant lowers its price. Referring to a related study (Hollis,

2002) establishing evidence on generic first-mover advantages in Canada, he concludes that

brand-controlled pseudo-generics substantially lower incentives for generic entry.

Reiffen and Ward (2007) examine the motivation of original drug manufacturers in the

USA to introduce authorized generics pre-patent expiry, addressing the issue of entry deter-

rence. Based on structural estimates from earlier empirical studies (Caves et al., 1991; Reiffen

and Ward, 2005), they calculate the effect of authorized generic entry on generic industry

profits and the number of generic entrants in equilibrium, which in turn affects generic and

brand prices, and eventually original drug producers' profits. Their calculation shows that

the anticipation of (exogeneously given) authorized generic entry crowds out between 1.7 to

2.4 generic entrants regardless of drugs' market size. Reiffen and Ward (2007) argue that

19 Berndt et al. (2002) provide similar evidence for Rx-to-OTC switches of antiulcer and heartburn drugs.

original drug producers introduce authorized generics in large drug markets fueled by rent-

seeking motives, i.e. to capture generic profits without substantially affecting the number

of generic entrants or generic prices. In small and medium-sized markets on the contrary,

entry deterrence motives play an important role as the impact on generic entry and prices is

relatively large. Reiffen and Ward (2007) argue that early entry is least problematic (from

the standpoint of social welfare) and also most profitable in high-revenue drug markets.

Recent evidence on the consumer welfare effects of authorized generic entry in the USA

has been provided by Berndt et al. (2007a,b). The studies examine the impact of (exoge-

neously given) authorized generic entry on the filing of Abbreviated New Drug Approvals

(ANDA)20 with a paragraph IV certification (claim of patent non-infringement or invalidity),

i.e. they look at generic entrants' incentives to enter timely and not necessarily at the actual

market entry decision. Under the Hatch-Waxman Act of 1984, the first generic firm to file

an ANDA with a successful paragraph IV certification may be granted a 180-day exclusivity

period where no other generic firm (except for the authorized generic) is entitled to market

the same version of the drug. Berndt et al. (2007b) point out that several factors besides

authorized generic entry may limit the profitability of the 180-day exclusivity period.21 They

show that in spite of the increase in authorized generics since 2003, there is little change in

the total number of paragraph IV certifications, paragraph IV certifications per drug, and

timing of filings relative to approvals of new chemical entities. Based on a review of de-

scriptive statistics, they conclude that the effect of authorized generic entry on independent

generic entry and consumer welfare in the U.S. is likely to be small. Berndt et al. (2007a)

emphasize also that there is no comprehensive empirical evidence based on recent data that

would show early entry to have had a delaying or deterring effect on generic entry.

Through a matching of national pharmaceutical market and exclusivity data, a unique

data set has been created, tracking substances' losses of exclusivity and generic entry between

20 Abbreviated New Drug Approval: application process for generic entrants in the USA, where therapeutic

equivalence to the original drug and quality of the manufacturing process has to be proven.

21 Multiple entrants are awarded 180-day exclusivity given they apply for the same dose at the same day.

2002 and 2007. Insight Health provides pharmaceutical market, patent and SPC data.22

The pharmaceutical market data comprise information on drugs23, medical products and

manufacturers. Additionally, they provide product-level information on prices, turnover and

revenues generated in the German retail segment. Exclusivity data give information about

patent holders, originators, the date of patent and SPC application, the date of first market

approval. The analysis is limited to human medications containing one active ingredient to

ensure a high matching quality of pharmaceutical and exclusivity data.24 Moreover, it is

confined to data on retail revenues, i.e. wholesale and direct purchase transactions of public

pharmacies. I disregard hospitals sales due to data availability constraints. In Europe, the

turnover generated with prescription medications is significantly larger in the retail segment.

In 2007 the retail turnover was approximately three times as large as the turnover generated

in the hospital segment(EUC, 2008). As a result of quantity discounts, prices charged to

hospitals are also typically much lower than retail prices. Thus, for the vast majority of drugs

in this study (prescription drugs), retail revenues provide a sufficiently reliable measure of

markets' attractiveness. Furthermore, I have not been able to obtain data on advertising

expenditures. Pharmaceutical firms spend a substantial fraction of profits on advertising25,

yet these data are private and for researchers almost impossible to acquire. Pre-expiration

brand advertising may not be a barrier to generic entry (Morton, 2000) – original drug

producers' intensity of advertising decreases drastically as exclusivity expires (Berndt et al.,

2003; Janakiraman et al., 2008; EUC, 2009)–, and generic advertising may be rare (Scherer,

2000; Berndt et al., 2003), the lack of advertising data is certainly a limitation of this study.

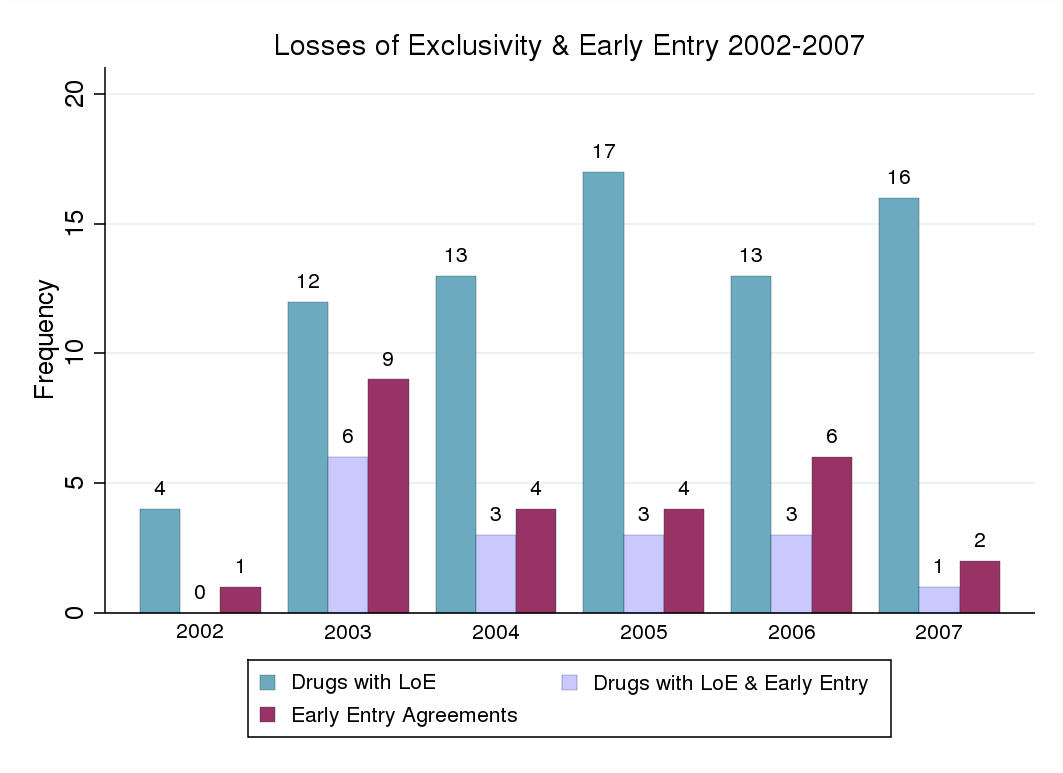

79 drugs experienced a loss of exclusivity between 2002 and 2007. Four drugs are ex-

cluded from the sample given their uncommon routes of administration (lung, eye and sys-

22 Insight Health has obtained exclusivity data from the national patent and trademark office since 2005. I

accessed the PATDPASPC, Esp@cent Patent, Derwent and Open Drug database, Thomson's Current PatentGazette, the FDA Orangebook, and online patent expiry reports to complement and verify the data.

23 Strength, drug form and therapeutic field(s) of indication are specified. The drug form classification

follows the New Form Code (NFC) Classification established by the European Pharmaceutical Market Re-search Association (EphMRA), the classification of therapeutic fields in turn rests upon the AnatomicalTherapeutic Chemical (ATC) Classification System which was introduced by the WHO in 1976.

24 The consistency of generic entry and exclusivity data was verified. If generic entry occurred prior to

patent or SPC expiry, investigations were carried out to find evidence on early entry or patent invaliditycases that would explain entry prior to the official date of patent or SPC expiry.

25 Direct advertising of prescription medications to consumers is illegal in the European Union.

temic use)26, confining the analysis to 75 markets with a predominantly oral, topical or

parenteral drug form use. SPC extensions were granted for 60 drugs. By the end of 2007,

87 generic firms entered in 48 out of the 75 markets27, resulting in a total of 724 generic

entries.28 As generic firms tend to focus on high revenue markets several entry opportunities

attract no entry (Morton, 1999; Hollis, 2003). Of the 48 drug markets experiencing generic

entry, 16 were affected by early entry – on average four months prior to loss of exclusivity.

Licensing/supply agreements were the preferred mode to arrange for early entry. A generic

version of the original drug was launched through a generic subsidiary in the case of two

drugs only. A total of 26 early entries took place as originators would often cooperate with

two generic firms. Table 1 outlines important characteristics of the 75 entry opportunities

arising between 2002 and 2007: pre-entry market revenues (in e Mio., evaluated at producer

prices, two years prior to loss of exclusivity), the extent of generic entry, the duration of

monopoly (number of years from original drug's market approval to loss of exclusivity) and

the number of off-patent drugs available (substitutes) treating the same indication(s)29.

Table 1: Generic Entry Opportunities (2002–2007)

Pre-Entry Market Size

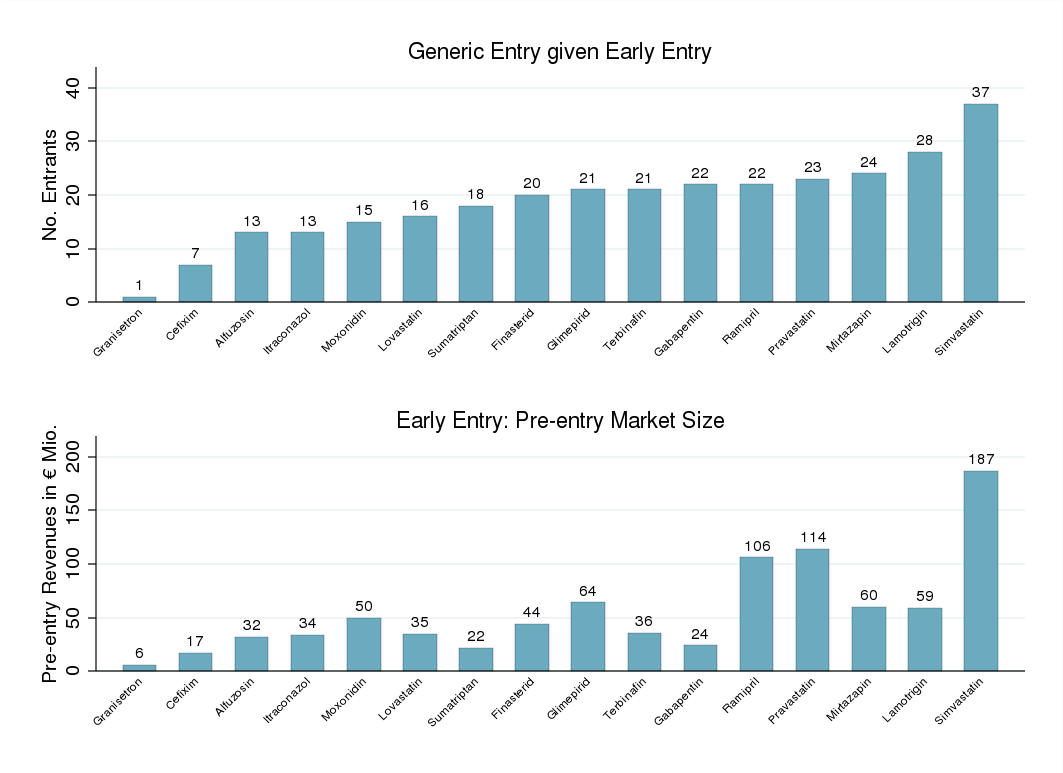

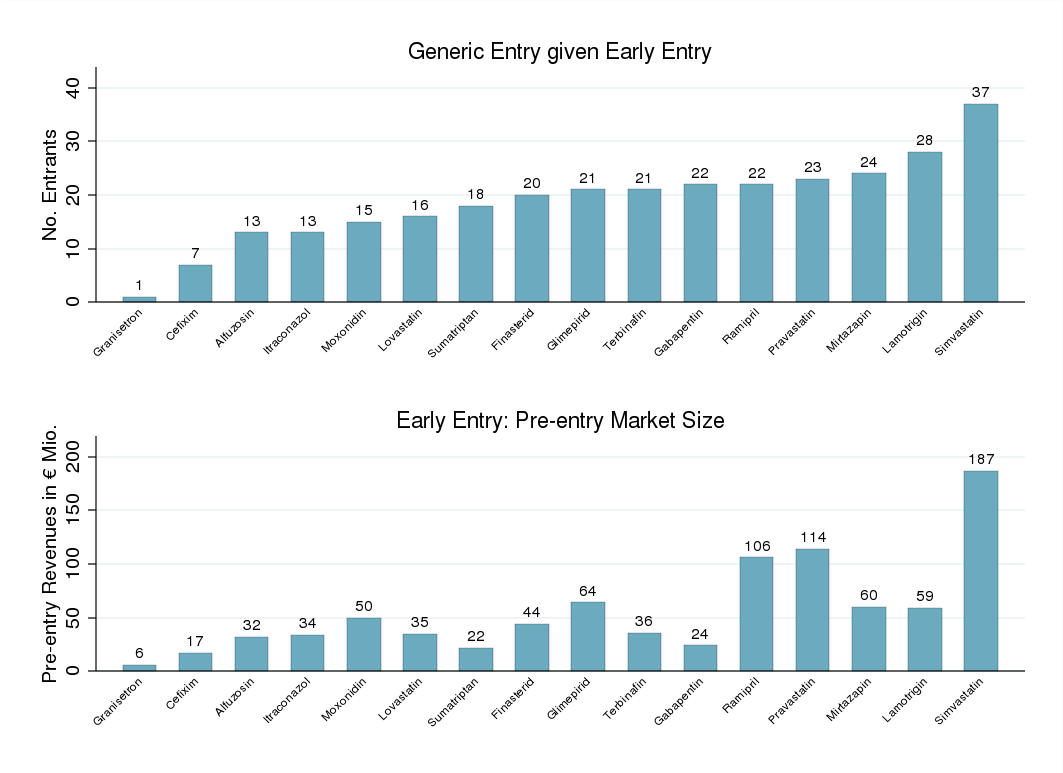

Notably, very small markets experience no generic entry. The average pre-entry market size

of drug markets experiencing generic entry amounts to of e 47.8 Mio. Also, early entry

appears to be focused on high revenue markets comparing either mean or median pre-entry

market sizes of the given markets. Grouping the 25 smallest, the 25 intermediate-sized and

25 largest drug markets with an average pre-entry market size of e 2.2 Mio., e 17.6 Mio. and

e 78.3 Mio., I find evidence for a monotonic relationship between generic entry (early entry)

and pre-entry market size. Generic entry (early entry) occurs in 4 (1) small-revenue, in 21

26 Only Formoterol attracts generic entry (route of administration: lung).

27 Other studies report similar rates of generic entry, e.g. Magazzini et al. (2004).

28 As one firm typically enters in more than one market, this yields 724 generic entries.

29 Therapeutic fields are classified by the ATC System at the second level of aggregation (ATC2).

(4) intermediate-sized and in 23 (11) high-revenue markets. Differences in the duration of

monopoly are generally minor. Original drug producers exclusively supplied drug markets for

approximately 12 years on average. Generic entrants also appear to enter more "crowded"

(profitable) therapeutic fields. The number of available, off-patent drugs (substitutes) treat-

ing the same indication(s) – a measure of the intensity of off-patent competition prior to

generic entry – tends to be larger in the 48 markets experiencing generic entry. Appendix

[A-2] illustrates the patterns of losses of exclusivity, generic entry and early entry from 2002

to 2007 and it sketches the highly left-skewed distribution of pre-entry market sizes.

The unit of observation in the analysis is the market entry decision of a generic firm.

Observing firms that decided to enter, one remains agnostic about those firms which refrained

from entry. For an examination of generic entry decisions, negative entry decisions (zero-

entries) need to be accounted for, however. As in Morton (1999), sets of potential entrants are

constructed for each substance to identify generic firms that could have entered but decided

not to do so.30 The pharmaceutical data set lists around 985 firms that supplied the German

pharmaceutical market between 1999 and 2007. By restricting the set of potential entrants

to manufacturing firms (no re-import31) with at least half of the retail form portfolio being

classified as "generic", 395 firms remain. By limiting the set of potential entrants further

to those firms with a portfolio of at least 50 retail forms the number of firms is reduced to

101. These 101 firms manufactured 94.4% of all generic retail forms available on the German

market between 1999 and 2007. The first set of potential entrants is defined for each drug

market by including only those firms that are in business as exclusivity expires (Data Set 1).

The criteria might seem arbitrary at first, yet they turn out to predict generic entry decisions

very well. 672 out of 724 generic entries are correctly identified, i.e. a fraction of 92.8% of

all generic entries between 2002 and 2007. The criteria should be similarly apt to identify

potential entry candidates which eventually refrained from entry. A further restriction of

entry candidates may be warranted as not all of those firms were similarly likely to have

decided upon each of the 75 entry opportunities. Morton (1999) finds that generic firms

30 Kyle (2007) determines market entry opportunities in a similar context. See also Kyle (2006).

31 As of 2007 reimport firms have supplied only a minor fraction of 3.9% of all generic retail forms.

therapeutic and drug form experiences influence generic entry decisions positively. Two

further sets of potential entrants are created for each and every drug market to account for

potential entrants' experiences. The second set of potential entrants limits entry candidates

in the first set of potential entrants to those firms which prove to be experienced in the

relevant fields of indication as exclusivity expires, having marketed a positive number of

retail forms in given therapeutic fields (Data Set 2). The third set of potential entrants

lastly restricts the second set of entry candidates to those firms which additionally have

expertise in manufacturing the relevant drug form(s) as exclusivity expires, having launched

a positive number of particular drug forms (Data Set 3). Table 2 below summarizes the sets

of criteria employed, providing an overview of the three data sets which were generated.

Table 2: Outline Data Set Construction

Firms in Data Set 1

Firms in Data Set 2

which are active in the

with drug form experi-

forms ≥50%) supplying

relevant field(s) of indi-

ence (NFC1).

at least 50 retail forms

cation (ATC2).

(no reimport firms).

Potential Entrants

Notes: Statistics for generic entries refer to the 48 drug markets experiencing generic entry by 2007, whereas statistics

for potential entrants and statistics for zero-entries are presented for all 75 drug markets in the sample. Latter statisticsare additionaly disaggregated by drug markets with (48) and without (27) generic entry.

With an increasing limitation of the total number of potential entrants from data set 1

to data set 3, the average and median number of potential entrants declines notably.32 The

same applies to the number of zero-entries and sample sizes. There are on average about 100,

37 and 34 potential entrants for one drug market. Given that there are around 50-60 generic

firms in Germany, and given that innovative pharmaceutical firms would supply generic

drugs in various instances (acis Arzneimittel GmbH, 2007), too, these numbers appear to be

reasonable. Between 2002 and 2007, 48 drug markets experienced generic entry. A total of

724 generic entries occurred in the given time period. Approximately 15 generic firms entered

into one drug market. Appendix [B] provides an overview of the distribution of generic

entries and negative entry decisions (zero-entries) over the 75 drug markets. Depending on

the established criteria for sets of potential entrants, a fraction of 9.6%, 26% and 29% of the

various entry opportunities are realized. Morton (1999) examines 123 firms and 363 drug

markets (drug and drug form combinations) and uses a similar methodology, yet somewhat

different criteria to identify potential entrants. Having created substantially more entry

opportunities in each of the three data sets (N1=42059, N2=33979, N3=23811), Morton

(1999) finds that only a fraction of 2%, 3.5% and 7% of observations experience generic

entry. As such, my criteria are not necessarily less restrictive than the criteria employed in

the previous study.33 In general, the more restrictive criteria I employ, the smaller become

not only the sets of potential entrants assigned to drug markets but also the fractions of

correctly predicted generic entry decisions. Some generic firms enter unknown therapeutic

fields and a few firms also launch new drug forms. Using the second (third) set of criteria to

identify potential entrants, 78.7% (76.5%) of generic entry decisions are correctly predicted.

Any of the criteria employed to identify potential entrants in the specific drug markets seem

to predict generic entry decisions sufficiently well. Therefore, any of the criteria should be

similarily suitable to identify generic firms which decided not to enter. Using all of the three

data sets in the empirical analysis allows me to verify the robustness of results.

32 Whenever firms which are not tracked in the sets of potential entrants enter markets, the total number

of potential entrants increases from 101 to 127, and to 126 respectively.

33 Examining 1444 unique molecules produced by 278 firms in 134 therapeutic classifications over the time

period 1980-1999 in 28 European countries, Kyle (2007) identifies 299567 entry opportunities (drug-country-class-year observations), out of which 7,630 had a product launch (2.5%).

Empirical Implementation

Using the three cross-sectional micro data sets, I examine the impact of early entry

on independent generic entry decisions. Generic first-movers have been shown to enjoy a

long-lasting competitive advantage over subsequent generic entrants (Caves et al., 1991;

Grabowski and Vernon, 1992; Hollis, 2002) as a result of doctors', patients' and pharmacists'

switching costs (see Section 2 & 3). Along those lines, early entry is likely to diminish the

expected profitability of subsequent generic entry (EUC, 2009). As generic manufacturers

are uncertain about competitors' entry decisions until shortly before competitors obtain

market approval, generic firms can only form expectations about the event of early entry

when deciding upon the conduct of bio-equivalence studies and market entry. The underlying

assumption made in all related studies is that generic firms are apt to forsee the occurence

of early entry (Hollis, 2003; Reiffen and Ward, 2005; Berndt et al., 2007a,b). Given its

frequency – firms presumably learning from past experiences – this assumption appears to

be reasonable. The hypothesis which the empirical model fundamentally relies on, is specified

below. I make no further assumptions about the size of the early entry effect.

Hypothesis: Early entry prior to loss of exclusivity has a significantly negative effect

on independent generic entry decisions (deterrence effect).

Both generic entry and early entry are dichotomous variables. One observes market entry

but not the profits generic firms or early entrants (original drug producers) expected to reap

upon entry (latent variable), which in turn motivated firms' entry decision. For the majority

of generic firms early entry is practically "exogenously" given, i.e. they have no means to

directly influence original drug producers' decisions. Yet, there is no reason to believe that

early entry is truly exogenous. The set of drug markets in which early entry occurs is not

a random selection of markets (Hollis and Liang, 2006; FTC, 2009). Unobserved factors

determine expected market profits, and thus both the likelihood of generic and early entry.

For instance, therapeutic innovations change the future competitive landscape and may

let entry into a certain market appear less attractive than observed market characteristics

suggest. On the contrary, long-term clinical studies may reveal that a substance is very

effective in a specific therapeutic field, and entry becomes more attractive. Demographic

trend projections possibly affect expected profits as well. If generic and early entry occur in

selective drug markets which are more attractive than given market characteristics suggest

– the most likely scenario –, there will be a spurious correlation between early entry and

generic entry decisions. The selection effect may understate the effect of early entry, basically

counterbalancing the presumably negative effect of early entry. In other words, the early

entry dummy may to some extent pick up drug markets' (unobserved) attractiveness.

Ignoring endogeneity issues, I estimate a univariate probit model in the first step to

obtain a basic insight into the impact of early entry (eei) on the generic entry decision of

firm j in market i (gij). As previous empirical studies on generic entry (Hurwitz and Caves,

1988; Morton, 1999; Hudson, 2000; Saha et al., 2006; Moreno-Torres et al., 2009), I control

for pre-entry market size, the duration of monopoly, the number of off-patent substitute

active ingredients, therapeutic field, drug form and year fixed effects (X). I also account

for potential entrants' capabilities, i.e. their therapeutic and drug form experiences (Cij).

Firms' experiences influence generic entry decisions strongly (Morton, 1999; Kyle, 2006). In

all regressions standard errors are robust to heteroscedasticity and clustered – firms' entry

decisions are arguably not independent. The univariate probit model is specified below.

gij = 1[g∗ > 0] where g∗

ijα + δeei + ǫij

In order to allow for a correlation (ρ) between generic entry and early entry decisions

over the error terms and to provide evidence for selection, I estimate a recursive bivariate

probit model in the second step. The bivariate probit model is a natural extension to the

univariate probit model. The error terms ǫij and µi are assumed to be distributed bivariate

normal, with E(ǫij) = E(µi) = 0, V ar(ǫij) = V ar(µi) = 1 and Cov(ǫij, µi) = ρ. Evans and

Schwab (1995) adopt this empirical approach in a seminal paper. Various studies in health

economics trying to gauge the impact of a binary endogenous treatment on a binary out-

come rely on the recursive bivariate probit model (Goldman et al., 2001; Jones et al., 2006).

Bhattacharya et al. (2006) conduct a Monte Carlo exercise to evaluate the consistency of

multivariate probit, two-stage probit and two-stage least squares estimators when examin-

ing the impact of a binary treatment on a binary outcome in a non-randomized setting.

Bhattacharya et al. (2006) point out that the results argue in favor the multivariate probit,

especially when the average probability of the dependent variable is close to 0 or 1, or when

the data generating process is not normal. The identification strategy in the bivariate probit

model relies on the assumption of normality and the fact that I am modeling sequential

entry decisions. Exclusion restrictions are not necessarily required to achieve identification

in recursive bivariate probit models (Wilde, 2000; Greene, 2008)34. I do impose one exclu-

sion restriction, however, to improve identification. As early entry decisions are arguably

motivated by original drug producers' financial distress, I add a count of each original drug

producers' further losses of exclusivity in the time period 2002 to 2007 as instrumental vari-

able to the early entry equation (I). Past losses of exclusivity are included. Original drug

producer's financial distress is expected to have a positive effect on the likelihood of early

entry. Original drug producers who do not experience many patent expiries in the given time

period are ceteris paribus financially better off and depend less on current income streams

and their preservation. Out of the 19 originators in the sample, 11 originators conclude early

entry agreements facing on average 3.4 further losses of exclusivity, whereas the remaining

8 originators experience on average only 0.5 further losses of exclusivity between 2002 and

2007. The number of original drug producers' further losses of exclusivity is exogenously

given, forming only a small subset35 of all entry opportunities in the given time period. The

high frequency of early entry suggests that original drug producers primarily make use of

early entry arrangements to mitigate the loss of monopoly profits. Original drug producers'

advertising efforts in a given market are known to decline around the time of patent expiry

and to drastically decline thereafter (Berndt et al., 2003; Janakiraman et al., 2008; EUC,

2009), suggesting that advertising is not an alternative channel through which original drug

producers' financial distress would impact independent generic entry decisions.

If, after controlling for other observed drug market and firm characteristics, Financial

Distress is correlated with generic firms' unobserved propensity to enter into a given market,

it will not provide a valid exclusion restriction. One straightforward way to address this

35 Original drug producers face on average 2.2 further losses of exclusivity between 2002 to 2007.

issue, yet not a formal test, is to include the instrumental variable in the single-equation

probits. Single-equation models are misspecified if there is selection, but they still offer a

a clear sense of the patterns in the data (Evans and Schwab, 1995). Besides this tentative

empirical evidence for the suitability of the instrument, I conduct a likelihood-ratio test of

the restricted versus unrestricted recursive bivariate probit model showing that the instru-

ment improves identification and the model's goodness of fit. The recursive bivariate probit

model's specification is given below. It is identical to the univariate probit model except

for the second equation – the early entry decision eei – which is now additionally to be

estimated. Due to lack of variation in the data, drug form effects are not accounted for in

the early entry equation. Early entry occurs in drug markets with oral drug form use only.

gij = 1[g∗ > 0]

1β1 + Cijα + δeei + ǫij

eei = 1[ee∗ > 0] where ee∗ = X

The dependent variable of particular interest in all regressions is Generic Entry, denot-

ing the market entry decision of an independent generic firm. Generic Entry is coded as

0-1 dummy and it takes on the value one if an independent generic firm decides to enter a

specific drug market post loss of exclusivity. The Early Entry dummy regressor – introduced

to generic entry equations to examine the effect of early entry on generic entry decisions –

similarly takes on the value one if a generic version of the original drug is launched in a

specific drug market prior to loss of exclusivity. Pre-Entry Market Size is a fundamental

control variable in generic (early) entry equations (Berndt et al., 2007a; Fisher Ellison and

Ellison, 2007; Reiffen and Ward, 2007). Pre-Entry Market Size denotes the annual revenues

in logarithms in a given market two calendar years prior to loss of exclusivity (evaluated at

producer prices, in e Mio). I use a lagged version of the variable to avoid endogeneity issues.

Monopoly Duration and Substitutes are two further, important control variables in generic

(early) entry equations. Monopoly Duration measures the number of years from the original

drug's first market approval to loss of exclusivity. Previous studies have shown that the

effective duration of monopoly has a negative effect on generic entry, mainly arguing that

original drug producers' goodwill stocks are larger (Hurwitz and Caves, 1988; Hudson, 2000).

Substitutes proxies the intensity of off-patent competition in therapeutic fields, indicating

the number of off-patent substitute active ingredients available in a particular therapeutic

field. Whenever off-patent drugs fall into the same ATC2 class as the drug in question,

they are counted as substitutes36, a common approach in the literature (Kyle, 2007). The

intensity of off-patent competition is assumed to affect generic (early) entry decisions neg-

atively (Moreno-Torres et al., 2009). The variables Field Experience and Form Experience

are introduced in generic entry equations to account for potential entrants' capability to

enter specific markets. Field Experience serves a proxy for potential entrants' therapeutic

experience, denoting the number of retail forms the generic firm has launched in the relevant

therapeutic fields prior to loss of exclusivity. Similarly, Form Experience is a count of the

number of retail forms the generic firm has marketed of a specific drug form, proxying the

firm's drug form experience. A summary of all definitions is provided in Table 3 below.

Table 3: Definition of Variables

0-1 dummy variable,=1 if independent generic firms decided to enterdrug market post loss of exclusivity (patent or SPC expiry).

0-1 dummy variable,=1 if early entry occurs prior to loss of exclusivity.

Pre-Entry Market Size

Annual drug market revenues in logarithms two calendar years prior toloss of exclusivity, in e Mio., evaluated at producer prices.

Monopoly Duration

Number of years from dugs' market approval to loss of exclusivity.

Count of off-patent substitute active ingredients, listed in the same ther-apeutic field(s) (ATC2 classes) by the time exclusivity expires.

Count of potential entrants' retail form launches prior to loss of exclu-sivity, in therapeutic field(s) (ATC2 Classes) the drug is applicable in.

Count of potential entrants' retail form launches prior to loss of exclusiv-ity, using the particular drug's routes of administration (NFC2 Classes).

Financial Distress

Count of further losses of exclusivity which original drug producers' ex-perience between 2002 and 2007.

Therapeutic Field

0-1 dummy variable,=1 if drug is applicable in therapeutic field prior toloss of exclusivity (ATC1 Classes: 13 ATC1 dummies).

0-1 dummy variable,=1 if drug has been primarily administered orally,parenterally or topically prior to loss of exclusivity.

0-1 dummy variable,=1 if loss of exclusivity occurs in 2002, · · · , 2007.

Remember that the variable Financial Distress is introduced in early entry equations only,

providing an exclusion restriction and facilitating identification in recursive bivariate probit

regressions. Financial Distress indicates the number of further losses of exclusivity original

drug producers' have to face in the time period 2002 to 2007. The more financial losses

36 Of course, substances in the same ATC2 class are not necessarily perfect substitutes. Nevertheless, one

obtains a first insight into the degree of off-patent competition in a certain therapeutic field; see Kyle (2007).

original drug producers experience, the larger is presumably the likelihood of early entry.

Therapeutic field, (drug form)37 and year fixed effects are accounted for by introducing sets

of dummy variables to generic entry and early entry equations. Other variables measuring,

for instance, substances' therapeutic applicability, or the number of losses of exclusivity

(entry opportunities) in a given year, proved insignificant. Hence, only a parsimonious set

of variables is presented. Summary statistics for data set 3 are presented in Table 4 below.

Appendices [C1] and [C2] provide summary statistics for Data Sets 1 and 2.

Table 4: Summary Statistics Data Set 3

Pre-Entry Market Size (e Mio.)

Pre-Entry Market Size (log)

Monopoly Duration

Financial Distress

Given the different composition of the three data sets (Section 4), the distribution of

variables differs. For instance, with the number of zero-entries decreasing from Data Set

1 to Data Set 3, the fraction of positive generic decisions increases. So does the fraction

of generic entry decisions affected by early entry. The fraction of positive generic entry

decisions amounts to roundabout 29% in Data Set 3. About 24% of generic entry decisions

are affected by early entry. The average generic entry decision is made for a drug market

with pre-entry revenues of e 37.5 Mio., where original drug producers enjoyed a duration of

monopoly of about 11.9 years38, and faced roughly three further losses of exclusivity between

2002 and 2007. Potential entrants decide upon drug launches in therapeutic fields with on

average 54 off-patent, available substitutes prior to drugs' loss of exclusivity. Before entry

opportunity arose, potential entrants marketed on average 26 retail forms in the relevant

therapeutic fields, and 179 retail forms using the specific drug's routes of administration.

37 As early entry occurs in drug markets with oral drug form use only, drug form fixed effects cannot be

controlled for in early entry equations.

38 Grabowski and Kyle (2007) find similar average market exclusivity periods for the same time interval.

In order to provide basic insights into the impact of early entry on independent generic

entry decision, a univariate probit model, ignoring any endogeneity issues, is estimated at

first. An overview of the estimates obtained from each of the three data sets is given in Table

5 below. Coefficients look remarkably similar, even though the composition of the data sets

varies. Univariate probit estimates indicate that early entry has an adverse effect on generic

entry decisions, the size and precision of the estimate notably decreasing from Data Set 1 to

Data Set 3. The early effect obtained for Data Set 3 is not significant anymore.

Table 5: Univariate Probit – Coefficients

Data Set 1 (N=7517)

Data Set 2 (N=2804)

Data Set 3 (N=2531)

Early Entry (0/1)

Market Size (log)

Monopoly Duration

Therap. Field (0/1)

Year Expiry (0/1)

Prob > chi2(23)

* p<0.05, ** p<0.01, *** p<0.001

Notes: An observation in the regression is the decision of a generic firm to enter a drug market post loss of

exclusivity (generic entry). Heteroskedasticity-robust and clustered standard errors in parentheses. Oral drugs inparasitology and sense organs with loss of exclusivity in 2002 form the reference group in generic entry equations.

Generic entry decisions are significantly and positively influenced by pre-entry market

sizes in turn, regardless which regression estimates one refers to. Monopoly Duration also

has a significantly positive impact on independent generic entry decisions, which is a rather

striking result. Previous studies show that the effective duration of monopoly has a nega-

tive effect on generic entry, arguing that original drug producers' goodwill stocks are larger

(Hurwitz and Caves, 1988; Hudson, 2000). One explanation for the different result is that

the two earlier studies rely on data from the 80s and 90s. Given the recent institutional and

legal changes in Germany (e.g. the enforcement of the Aut-idem regulation in 2002), the

U.S. and many other pharmaceutical markets to foster generic substitution, the length of the

exclusivity period may not necessarily serve as a good proxy for the accumulated goodwill

of pioneers anymore.39 The various initiatives taken to promote generic substitution likely

neutralized pioneers' reputation advantage, and as a result generic firms will benefit first and

foremost if medications are well-established. The number of available off-patent substitutes –

a measure of the intensity of off-patent competition – appears to affect independent generic

entry decisions negatively. The effect of Substitutes is significant except for the estimate

obtained for Data Set 1. Both therapeutic and drug form experience encourages generic

entry. The effects are generally positive and significant. Therapeutic field, drug form and

year fixed effects are significant in any of the univariate probit regressions.

Remember that if generic entry and early entry occur in selective drug markets which

are more attractive than given market characteristics suggest, there will be a spurious cor-

relation between early entry and generic entry decisions, i.e. univariate probit estimates will

be inconsistent. In order to allow for a correlation between generic entry and early entry

decisions through unobservables, I estimate a recursive bivariate probit model in the second

step. The variable Financial Distress is added as instrument to the early entry equation to

facilitate identification. Univariate probit estimates provide tentative empirical evidence that

Financial Distress provides a valid exclusion restriction. Once added to the single-equation

probit regressions, it turns out not significantly impact generic entry decisions. Appendix

[D] presents the estimates. Note also, that the exclusion restriction is not required to achieve

identification, yet it improves identification notably. Appendix [E-1] provides the bivariate

probit estimates, relying on a functional form identification strategy. The recursive bivari-

ate probit estimates are generally robust to the identification strategy pursued, i.e. results

do not critically hinge on the exclusion restriction. Likelihood-ratio tests of the restricted

39 Results are robust to the exclusion of Monopoly Duration from generic entry and early entry equations.

versus unrestricted bivariate probit model suggest, however, that the inclusion of the instru-

ment improves the identification and the model's overall goodness of fit. The results of the

Likelihood-ratio tests are reported in Appendix [E-2]. As Financial Distress appears to be a

suitable instrument, improving the bivariate probit model's identification, I confine the fol-

lowing interpretation of results to the estimates of the unrestricted recursive bivariate probit

model. Table 6 provides the according estimates. The (residual) correlation between generic

and early entry decisions, denoted by the correlation coefficient ρ, is large and significantly

positive. Wald–Tests show that the null hypothesis of ρ = 0 can be rejected.

Table 6: Recursive Bivariate Probit – Coefficients

Data Set 1 (N=7517)

Data Set 2 (N=2804)

Data Set 3 (N=2531)

Early Entry (0/1)

Market Size (log)

Monopoly Duration

Financial Distress

Therap. Field (0/1)

Year Expiry (0/1)

Prob > chi2(36)

Wald Test: chi2(1)

Prob > chi2(1)

* p<0.05, ** p<0.01, *** p<0.001

Notes: In columns (1), (3) and (5) an observation in the regression is the decision of a generic firm to enter a drug market post

loss of exclusivity (generic entry). In columns (2), (4) and (6) the occurrence of early entry prior to loss of exclusivity denotes thedependent variable. Heteroskedasticity-robust and clustered standard errors in parentheses. Oral drugs in parasitology and senseorgans with loss of exclusivity in 2002 form the reference group in the generic entry equation. The Wald Test is conducted for thenull hypothesis of ρ = 0, i.e. absence of correlation in the model.

The finding is robust to the various criteria established for identifying potential entrants.

Unobserved factors (favorable market characteristics) appear to stimulate both independent

generic and early entry decisions, suggesting that there is a selection effect, or in other words,

that early entry is endogenous. Univariate probit estimates turn out to be inconsistent. The

coefficient of early entry is significantly negative in any of the bivariate probit regressions.

Unless selection is accounted for, the early entry dummy apparently picks up drug markets'

(unobserved) attractiveness, counterbalancing and weakening its negative effect on indepen-

dent generic entry. The coefficient of Financial Distress generally has the expected sign, the

effect turning out to be highly significant. The more financial losses original drug producers

experience between 2002 and 2007, the larger is the likelihood of early entry. The sign and

relative size of all other coefficients in the generic entry equation changes little in comparison

to the univariate probit estimates. Generic entry decisions are strongly driven by pre-entry

revenues (Pre-entry Market Size). The length of the exclusivity period (Monopoly Duration)

also has a significantly positive impact on independent generic entry decisions. Substitutes

– the number of available off-patent substitutes measuring the intensity of off-patent com-

petition – generally affects independent generic entry decisions negatively. Both therapeutic

and drug form experience encourages generic entry. Early entry decisions in turn are also

strongly driven by Pre-entry Market Size. The duration of monopoly affects early entry

decisions positively, providing further evidence that Monopoly Duration is not necessarily a

good proxy for pioneers' goodwill but rather another market value correlate. Early entry

decisions also appear to be negatively affected by the intensity of off-patent competition.

The effect of Substitutes is negative, mostly significant, yet smaller in size. Therapeutic

field, drug form and year effects are significant in any of the bivariate probit regressions.

Table 7 provides the average marginal effects obtained from the univariate and recursive

bivariate probit regressions. The interpretation of average marginal effects facilitates the

assessment of the size and economic relevance of the early entry effect. Average marginal

effects are reported for the 16 drug markets experiencing early entry between 2002 and

2007, i.e. for the subset of generic entry decisions affected by early entry. The prevailing

assumption is that generic manufacturers are apt to correctly anticipate early entry given

drug markets' characteristics and past experiences. As a result, early entry impairs generic

entry only in drug markets which experience early entry. Appendix [F] provides the average

marginal effects computed for all drug markets. The results and conclusions are similar.

Table 7: Univariate & Recursive Bivariate Probit – Average Marginal Effects

Data Set 1 (N=1581)

Data Set 2 (N=633)

Data Set 3 (N=599)

Dep.: Generic Entry

Early Entry (0/1)

Market Size (log)

Monopoly Duration

* p<0.05, ** p<0.01, *** p<0.001

Notes: Average marginal effects are reported for the subset of sixteen drug markets experiencing early entry between 2002

and 2007. Average marginal effects presented for the univariate (recursive bivariate) probit model denote average, ceterisparibus changes in the likelihood of independent generic entry (conditional on early entry having occured).

The (relative) size of average marginal effects is generally robust to the micro data em-

ployed, i.e. the estimates obtained from Data Set 1, Data Set 2 and Data Set 3 reveal a

consistent pattern. Univariate probit estimates suggest that early entry lowers the marginal

probability of generic entry by about 4% on average. Except for the estimate obtained for

Data Set 3, the average marginal effects are significant at least at the 5% level. Given

the (residual) correlation between generic entry and early entry decisions, univariate pro-

bit regressions do not provide consistent estimates, whereas the recursive bivariate probit

estimates are consistent. Unlike the average marginal effects obtained from the univariate

probit model, the average marginal effects reported for the bivariate probit model denote

changes in conditional and not marginal probability of generic entry. When determining

the average marginal effect of early entry in the recursive bivariate probit model, interest

lies in the average change in the probability of generic entry conditional on early entry hav-

ing occurred (P (G = 1 E = 1)) and the counterfactual – early entry having not occurred

(P (G = 1 E = 0)). The average marginal effects of the other covariates similarly denote

changes in probability of generic entry given that early entry occurred (P (G = 1 E = 1)). I

compute standard errors of the average marginal effects using the delta-method (Papke and

Wooldridge, 2005). The relative size of average marginal effects reported for the univariate

and recursive bivariate probit models tends to be similar. The average marginal effect of

early entry obtained from the recursive bivariate probit regressions is insignificant at a 5%

(10%)40 level, however. Accounting for selection, I obtain even stronger evidence that early

entry does not significantly lower incentives for independent generic entry. The recursive

bivariate probit estimates prove again that Pre-entry Market Size has the strongest impact

on generic entry decisions. A mere 1% increase in drug markets' pre-entry revenues induces

on average a 14-18% increase in the (conditional) probability of independent generic entry.

In drug markets experiencing early entry a one standard deviation increase in pre-entry

revenues relative to mean pre-entry revenues corresponds to a 4.25% (Data Set 1: 4.5%)

increase in pre-entry revenues, boosting the likelihood of generic entry by roughly 60-76%.

Furthermore, the (conditional) probability of generic entry tends to increase on average

by 0.3% (0.07%) with each retail form launch prior to loss of exclusivity in drug relevant

therapeutic fields (using the particular drug's routes of administration). Morton (1999) finds

positive effects from therapeutic and drug form experience of a similar magnitude. Given

the variation in potential entrants' experience (retail form launches), the economic effect of

either therapeutic or drug form experience may not be negligible. A one standard deviation

increase in the number of retail form launches in relevant therapeutic fields41 increases the

likelihood of generic entry by 6.5-9.4%. Similarly, a one standard deviation increase in the

number of retail form launches in relevant therapeutic fields42 increases the likelihood of

generic entry up to 18.4%. An increase in the duration of the exclusivity period by one

year in turn raises the (conditional) probability of generic entry by 2-4% on average. Given

a standard deviation of 1.75 years, the effect tends to be small. Lastly, an increase in the

number of off-patent substances by one, reduces the generic entry probability by about 0.1-

40 The average marginal effect obtained for Data Set 2 is marginally significant at a 10% level.

41 The standard deviation amounts to 21.8, 30.7 and 31.4 retail form launches in Data Set 1, 2, and 3.

42 The standard deviation amounts to 126, 258.3 and 262.4 retail form launches in Data Set 1, 2, and 3.

0.3% on average. The effect turns out to be modest given the variation43 in the number of

off-patent substitutes. The results suggest overall that independent generic entry is primarily

influenced by drug markets' pre-entry revenues. Early entry turns out to have no significant

effect on generic entry decisions. Figure 2 displays the generic entry patterns in the high-

revenue drug markets experiencing early entry. The generic entry patterns observed confirm

the notion that drug markets' pre-entry revenues stimulated generic entry greatly.

Figure 2: Generic Entry in Drug Markets experiencing Early Entry

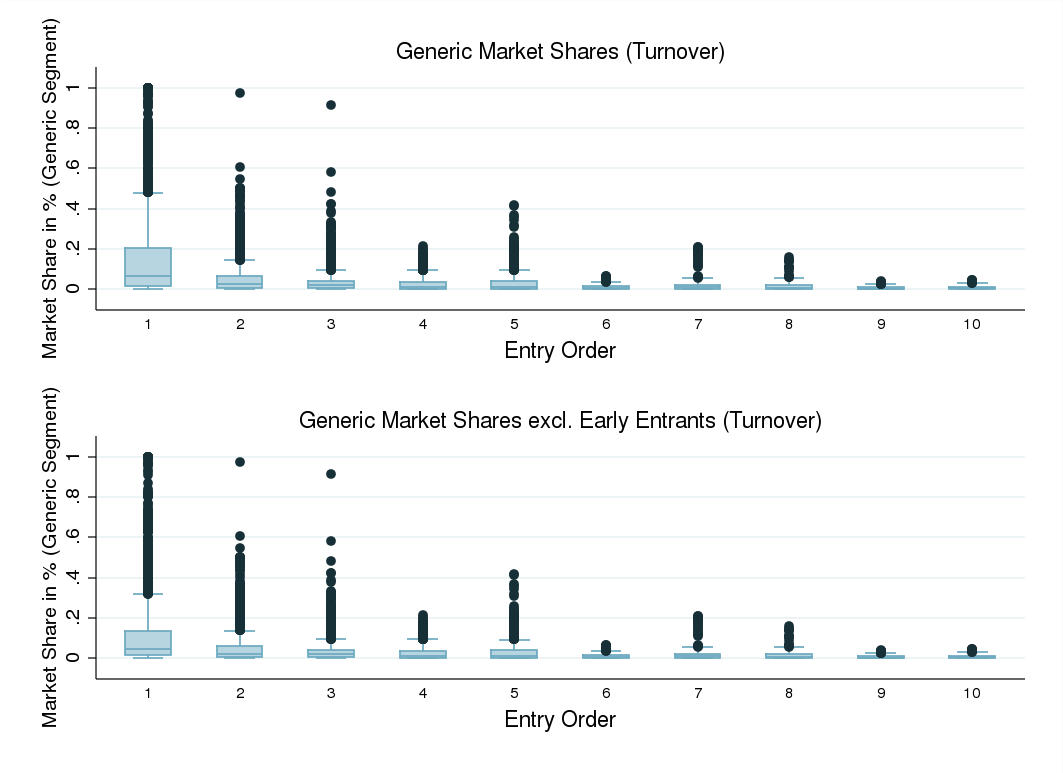

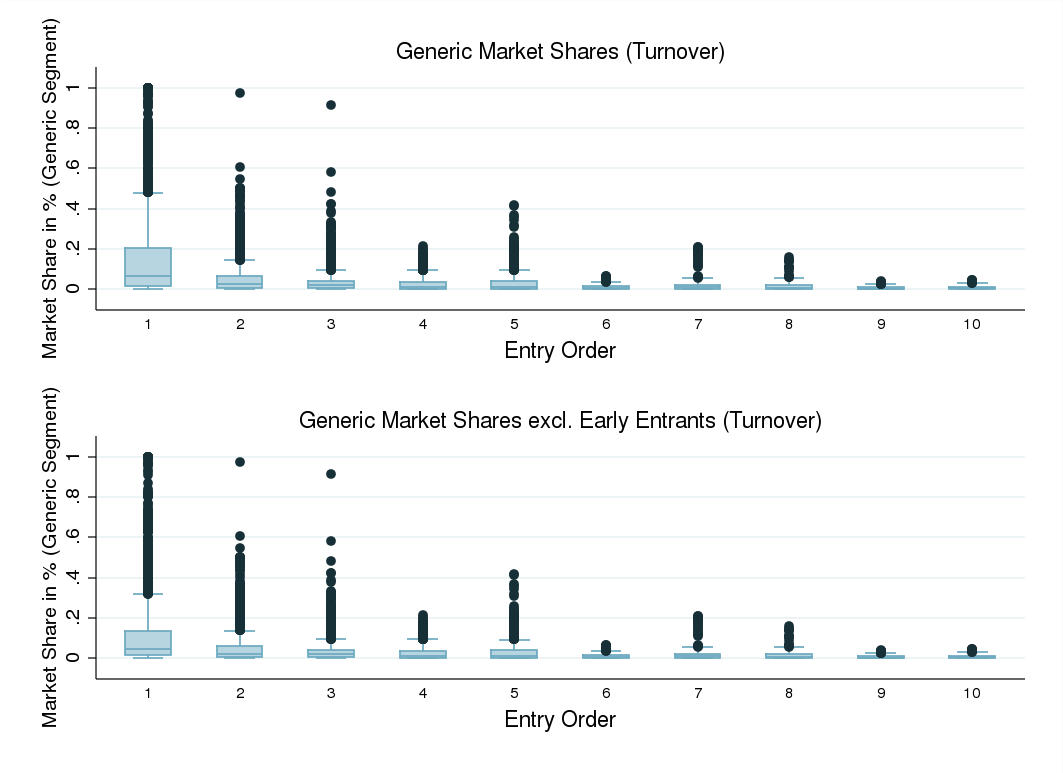

I computed generic firms' market shares in the bestseller segment – the dosage and drug

form yielding the largest generic revenues by 2007 – for drug markets experiencing at least

one year of off-patent competition. Comparing the turnover and revenue market shares of

first-movers entering post loss of exclusivity and those of early entrants, the latter appear

to obtain a considerably larger market share with respect to both turnover and revenue.

Multiple first generic entry, occurring in the majority of drug markets in Germany post loss

of exclusivity, appears to reduce first-mover advantages. Plotting turnover market shares

of generic firms against firms' order of entry – including and excluding early entrants in

the sample of firms – one finds that generic first-movers entering post loss of exclusivity

43 The standard deviation amounts to roughly 34, 37 and 37 substances in Data Set 1, 2, and 3.

tend to nevertheless have a considerable market share advantage over subsequent entrants.

Thus, even first-movers entering post loss of exclusivity pose a threat to subsequent generic

entrants' profits. Appendix [G] provides the according graphs. This finding may in turn

explain why early entry does not significantly deter independent generic entry. Examining

the US pharmaceutical market, Berndt et al. (2007a) find that additional generic entrants

after the first four or five generic entrants do not significantly affect long-run generic-to-

brand price ratios. A relevant implication of this finding is that a reduction in the number

of independent generic firms as a result of early entry is unlikely to substantially impair

generic price competition, unless it results in fewer than four or five generic entrants. The

generic entry patterns in the majority of drug markets satisfy this criterion, suggesting that

the welfare effects of early entry are most likely to be minor. The monotonistic relationship

of early entry and pre-entry market revenues – intermediate-sized and high-revenue markets

experience early entry proportionally more often – indicate also that original drug producers

authorized generic entry prior to loss of exclusivity first and foremost fueled by rent-seeking

rather than strategic entry-deterrence motives (Fisher Ellison and Ellison, 2007).

This study provides recent empirical evidence on the impact of early entry – also known

as authorized, branded or pseudo-generic entry – on independent generic entry decisions

accounting for the endogeneity of early entry decisions. The results strongly suggest that

independent generic entry decisions are primarily influenced by drug markets' pre-entry

revenues. Early entry turns out to have no significant impact on independent generic entry

decisions. Originators appear to authorize generic entry prior to loss of exclusivity to extract

generic profits rather than to deter generic entry. The European Commission's survey of

originators conducted in course of its Pharmaceutical Market Sector Inquiry supports this

conclusion. Generic first-movers have been shown to enjoy a long-lasting advantage over

subsequent generic entrants (Caves et al., 1991; Grabowski and Vernon, 1992; Hollis, 2002) as

a result of doctors', patients' and pharmacists' switching costs. Some economists accordingly

argue that anticipated early entry has an anti-competitive, deterring effect on independent

generic entry. Based on a unique micro data set comprising pharmaceutical market and

exclusivity data, I examine the impact of early entry on independent generic entry decisions

in the German pharmaceutical market within the time period 2002-2007. If generic and

early entry occurs in selective drug markets which are more (or less) attractive than given

market characteristics suggest (Hollis and Liang, 2006; FTC, 2009), there will be a spurious

correlation between early entry and generic entry decisions. Accounting for the endogeneity

of early entry decisions, I employ unique micro data and estimate univariate and recursive

bivariate probit models of entry. Recursive bivariate probit estimates indicate that early

entry decisions are endogeneous, rendering univariate probit estimates inconsistent. The

identification strategy in the bivariate probit model relies on the assumption of normality

and the fact that I model sequential entry decisions. As early entry decisions are arguably

motivated by pioneers' financial distress, I add a count of each original drug producers'

further losses of exclusivity between 2002 and 2007 as an instrumental variable to the early

entry equation which improves identification. Regardless of the identifying assumption made,

I find no evidence that early entry significantly reduces the likelihood of generic entry.

Drug markets' pre-entry revenues influence both independent generic entry and early

entry decisions most strongly. Just like previous related studies on generic entry, I also show

that the degree of off-patent competition affects generic entry decisions negatively, whereas

firms' therapeutic and drug form experiences encourage generic entry. Monopoly duration

surprisingly influences generic entry decisions positively and not negatively, indicating that

the length of the exclusivity period is not necessarily a good proxy for pioneers' accumulated

goodwill stock as suggested by Hurwitz and Caves (1988); Hudson (2000). Generic manufac-

turers appear to benefit first and foremost if medications are well-established. Government

scrutiny targeting early entry would be appropriate if small drug markets turned out to

experience early entry more frequently in the future. Further research is also warranted to

assess the welfare effects of early entry. Early entry may not impair generic entry decisions,

yet it could adversely affect competition in off-patent pharmaceutical markets. Gauging the

impact of early entry on generic manufacturers' prices and market shares, and the rate of

price erosion, are important areas of research which I intend to examine in the future.

[A-1] Brand Market Share post Generic Entry – Pfizer (Norvasc)

[A-2] Losses of Exclusivity, Early Entry & Generic Entry 2002–2007

[B] Allocation of Generic Entries and Zero-Entries to Substances

[C-1] Summary Statistics Data Set1

Pre-Entry Market Size (e Mio.)

Pre-Entry Market Size (log)

Monopoly Duration

Financial Distress

[C-2] Summary Statistics Data Set2

Pre-Entry Market Size (e Mio.)

Pre-Entry Market Size (log)

Monopoly Duration

Financial Distress

[D] Univariate Probit (incl. Instrument) – Coefficients

Data Set 1 (N=7517)

Data Set 2 (N=2804)

Data Set 3 (N=2531)

Early Entry (0/1)

Market Size (log)

Monopoly Duration

Financial Distress

Therap. Field (0/1)

Year Expiry (0/1)

Prob > chi2(24)

* p<0.05, ** p<0.01, *** p<0.001

Notes: An observation in the regression is the decision of a generic firm to enter a drug market post loss of

exclusivity (generic entry). Heteroskedasticity-robust and clustered standard errors in parentheses. Oral drugs inparasitology and sense organs with loss of exclusivity in 2002 form the reference group in generic entry equations.

[E-1] Recursive Bivariate Probit (excl. Instrument) – Coefficients

Data Set 1 (N=7517)

Data Set 2 (N=2804)

Data Set 3 (N=2531)

Early Entry (0/1)

Market Size (log)

Monopoly Duration

Therap. Field (0/1)

Year Expiry (0/1)

Prob > chi2(35)

Wald Test: chi2(1)

Prob > chi2(1)

* p<0.05, ** p<0.01, *** p<0.001

Notes: In columns (1), (3) and (5) an observation in the regression is the decision of a generic firm to enter a drug market post

loss of exclusivity (generic entry). In columns (2), (4) and (6) the occurrence of early entry prior to loss of exclusivity denotes thedependent variable. Heteroskedasticity-robust and clustered standard errors in parentheses. Oral drugs in parasitology and senseorgans with loss of exclusivity in 2002 form the reference group in the generic entry equation. The Wald Test is conducted for thenull hypothesis of ρ = 0, i.e. absence of correlation in the model.

[E-2] Likelihood-ratio test: Restricted vs. Unrestricted Model

Data Set 1 (N=7517)

Data Set 2 (N=2804)

Data Set 3 (N=2531)

[F] Univariate & Rec. Bivariate Probit – Avg. Marginal Effects (All Drugs)

Data Set 1 (N=7517)

Data Set 2 (N=2804)

Data Set 3 (N=2531)

Dep.: Generic Entry

Early Entry (0/1)

Market Size (log)

Monopoly Duration

* p<0.05, ** p<0.01, *** p<0.001

Notes: Average marginal effects are reported for the 75 drug markets experiencing a loss of exclusivity between 2002

and 2007. Average marginal effects presented for the univariate (recursive bivariate) probit model denote average, ceterisparibus changes in the likelihood of independent generic entry (conditional on early entry having occured).

[G] Generic Market Shares & Entry Order (Bestseller Segment)

Accenture (2005). "Die Bedeutung der Generikaindustrie f¨

ur die Gesundheitsversorgung in

acis Arzneimittel GmbH (2007). "Generika in Deutschland." Company Website.

Berndt ER, Kyle MK, Ling DC (2002). "Deregulating Direct-to-Consumer Marketing of

Prescription Drugs: Effects on Prescription and Over-the-Counter Product Sales." Journalof Law and Economics, 45(2), 691–723.

Berndt ER, Kyle MK, Ling DC (2003). "The Long Shadow of Patent Expiration: Generic

Entry and Rx-to-OTC Switches." NBER Studies in Income and Wealth v.64 - ScannerData and Price Indexes, pp. 229–273.

Berndt ER, Mortimer R, Bhattacharjya A, Parece A, Tuttle E (2007a). "Authorized Generic

Drugs, Price Competition, and Consumers' Welfare." Health Affairs, 26(3), 790–799.

Berndt ER, Mortimer R, Parece A (2007b). "Do Authorized Generic Drugs Deter Paragraph

IV Certifications? Recent Evidence." Working Paper.

Bhattacharya J, Goldman DP, McCaffrey DF (2006). "Estimating Probit Models with Self-

Selected Treatments." Statistics in Medicine, 25, 389–413.

Caves RE, Whinston MD, Hurwitz M, Pakes A, Temin P (1991). "Patent Expiration, Entry,

and Competition in the U.S. Pharmaceutical Industry." Brookings Papers on EconomicActivity. Microeconomics, 1991, 1–66.

EUC (2008). "European Commission: Pharmaceutical Sector Inquiry – Preliminary Report."

EUC (2009). "European Commission: Pharmaceutical Sector Inquiry – Final Report."

Evans WN, Schwab RM (1995). "Finishing High School and Starting College: Do Catholic

Schools Make a Difference?" The Quarterly Journal of Economics, 110(4), 941–974.

Fisher Ellison S, Ellison G (2007). "Strategic Entry Deterrence and the Behavior of Phar-

maceutical Incumbents Prior to Patent Expiration." NBER Working Paper No. W13069.

FTC (2002). "Federal Trade Commission: Generic Drug Entry Prior to Patent Expiration

– An FTC Study."

FTC (2009). "Federal Trade Commission: Authorized Generics – An Interim Report."

Goldman DP, Bhattacharya J, McCaffrey DF, Duan N, Leibowitz AA, Joyce GF, Morton

SC (2001). "Effect of Insurance on Mortality in an HIV-Positive Population in Care."Journal of the American Statistical Association, 96, 883–894.

Grabowski HG, Kyle MK (2007). "Generic Competition and Market Exclusivity in Phar-

maceuticals." Managerial and Decision Economics, 28, 491–502.

Grabowski HG, Vernon JM (1992). "Brand Loyalty, Entry, and Price Competition in Phar-

maceuticals after the 1984 Drug Act." Journal of Law and Economics, 35, 331–350.

Greene WH (2008). Econometric Analysis – Sixth Edition. Pearson Prentice Hall.