Levitra enthält Vardenafil, das eine kürzere Wirkdauer als Tadalafil hat, dafür aber schnell einsetzt. Männer, die diskret bestellen möchten, suchen häufig nach levitra kaufen ohne rezept. Dabei spielt die rechtliche Lage in der Schweiz eine wichtige Rolle.

S101980100071.qxd

2001 · 2:142–149 Springer-Verlag 2001

J. Rovira1 · R.Tremosa1 · A. Gilabert2 · M.Torralba2

1 Grup de Recerca en Economia de la Politica Social,Universitat de Barcelona,Spain

2 Servei Català de la Salut,Unitat de Planificació Farmacèutica,Generalitat de Catalunya,Spain

The role of prices in drug

expenditure analysis

An application of price indexes for two therapeutic

groups in the Catalan Health Service (1991–1999)

The increase in pharmaceutical expen- sumption towards presentations or

diture is one of the main concerns of

products of a different price.

The objective of this article is to develop and

health managers, given both its relative

The first factor, a change in the price

apply several types of price indexes to the

importance in total expenditure and the

of the products, is not that relevant in

analysis of pharmaceutical expenditure to

difficulty in controlling its growth. Ex-

Spain and, thus, cannot explain the in-

improve the way traditional indexes adjust

penditure on personnel or equipment is

crease in pharmaceutical expenditure in

for innovation in drug supply.The Laspeyres

easier to control, as the availability of re-

recent years. It should be borne in mind

and Paasche indexes in the fixed and linked

sources for making that expenditure is

that all drugs financed by the Spanish

modalities were used. Price is defined as av-

subject to administrative procedures

National Health System are subject to a

erage expenditure at consumer price per

that require prior authorization. The use

price control system. This means that

daily defined dose (DDD).The empirical ap-

of a drug depends on a long list of deci-

the price of the drug at the time of its

plication is restricted to two therapeutic

sions (registration, price fixing, inclu-

launch, and any subsequent change,

groups, antipsychotics and antidepressants,

sion in public financing, inclusion in for-

must be authorized by the health au-

and to the pharmaceutical expenditure of

mularies of specific institutions, consid-

thorities. Revision of the price of a single

the Catalan Health Service in the period

eration in clinical guidelines, etc.).

drug hardly every happens. Changes are

1991–1999.The indexes can be computed

However, once those decisions have been

usually applied generally to the whole

from the information currently recorded in

made, supply is very elastic, in other

market. General increases in authorized

the administrative procedures of health care

words the laboratories will supply at a

prices have been infrequent and, in any

insurers, or from sample information provid-

given price, the maximum authorized

case, small, and have not even kept pace

ed by regular market surveys.The proposed

price for example, practically any quan-

with inflation. In some cases, general

method allows for controlling the effect of

tity that doctors decide to prescribe.

price reductions have even occurred.

several factors on average pharmaceutical

The increase and, in general, the

This pricing policy has led the phar-

price changes, specifically, the introduction

variation in pharmaceutical expenditure

maceutical industry to develop certain

of new drugs that show some degree of

on a product are a result of the simulta-

strategies to maintain or increase their

neous variation in two factors: the quan-

income and profitability. First, encour-

tity of units sold and the price of that

aging consumption, to increase the

product. When the expenditure relates

number of units sold. Second, to by-pass

to a heterogeneous group of products, as

the control of authorized prices, the

Pharmaceutical expenditure · Prices ·

when the total pharmaceutical expendi-

manufacturers opted for the introduc-

Laspeyres indexes · Paasche indexes

ture or that of a therapeutic group are

tion and promotion of new products,

being considered, the variation is thevariation in units sold multiplied by thevariation in the average price of those

Joan Rovira

units.As regards average price, its varia-

The World Bank, HDNHE, 1818 H Street NW,

tion may result from: (a) a change in the

Washington DC 20433, USA,

price of existing drugs, (b) a shift in con-

142 HEPAC 4•2001

HEPAC

2001 · 2:142–149 Springer-Verlag 2001

J. Rovira · R.Tremosa · A. Gilabert

that are strongly promoted to make

c. between different active sub-

consumers switch from the older ones

stances, albeit therapeutically

to the newer and more expensive prod-

equivalent, of a chemical family

El papel de los precios en el análisis del

ucts. This constitutes an indirect mech-

(or therapeutic subgroup);

gasto en medicamentos. Una aplicación

anism for achieving higher sale prices.

d. between different therapeutic

de índices de precios para dos grupos

As a result , the market is characterized

terapéuticos en la sanidad catalana

by a very high innovation rate (which of-

ten contributes little or no additional

Decision makers are usually interested

therapeutic value over products already

in determining the causes of the increas-

existing on the market) and a marked

es in expenditure or in average prices of

tendency to encourage a shift in pre-

drugs and the extent to which they are

El objetivo de este trabajo es desarrollar

scribing. This affects the second factor

justified (e.g., whether it is due to an in-

índices de precios de medicamentos que

in the increased expenditure: the aver-

crease in patients correctly treated or

permitan separar el efecto de distintos

whether it is a process of replacing

factores, especialmente la comercialización

This shift effect is evident if we ana-

cheap and effective existing products

de nuevos medicamentos que suponen

lyze the consumption of certain thera-

with newer, more expensive ones), so

distintos grados de innovación terapéutica,

peutic drug groups, such as antihyper-

that they can take measures to prevent

sobre los incrementos de precios y sobre el

tensives or antidepressants. In these spe-

non justified increases. The first step is

gasto. Se han utilizado los índices de

cific cases, consumption of new drugs is

to identify expenditure growth factors

Laspeyres y de Paasche en sus versiones fija

steadily growing, while the consumption

and the relative importance of each of

y encadenada, tomando como precio el

of older drugs is constant or even falling.

gasto medio a PVP (Precio de Venta al

This situation in the pharmaceuti-

The key question, then, is to what

Público) por DDD (Dosis Diaria Definida). La

cal industry has already been dealt with

extent does the increased expenditure

aplicación empírica se circunscribe a dos

extensively in the literature. Unlike oth-

reflect an increase in therapeutic benefit

grupos terapéuticos, antipsicóticos y anti-

er industrial sectors of rapid technolog-

or in patient well-being generally. The

depresivos, y al ámbito de la prestación

ical progress, such as computers or pes-

availability of suitable price indexes can

farmacéutica del Servei Català de la Salut en

ticides, where a generation of new prod-

provide the decision-maker with tools to

el periodo 1991–1999. Esta metodología

ucts clearly displaces a previous obso-

help him answer all these questions.

puede ser aplicada de forma rutinaria y

lete generation [3]. Moreover, very often

However, the preparation of suitable

automática a cualquier grupo terapéutico o

the growing number of drugs available

price indexes is no easy task [1, 10].

a la totalidad de los mismos, utilizando la

is not accompanied by real innovation

The objective of this work is to de-

información que recogen habitualmente las

in terms of significant therapeutic ad-

velop different types of prices indexes to

administraciones sanitarias en el proceso de

vance [6]. In fact, the government regu-

apply to drug expenditure analysis, that

facturación de los medicamentos o la

lation of pharmaceutical prices has in-

represent an advance over traditional in-

información muestral sobre consumo y

centivated companies in that sector to

dexes as regards the treatment of inno-

gasto de algunos estudios de mercado.

diversify their products, as a way to in-

vation. It is not our aim to determine

crease or, at least, maintain profits [2].

"the" correct index, but rather the most

To summarize, the increase in the

suitable one for each possible question

average price of drugs may be the result

or problem. More specifically, we want

Prestación farmacéeutica · Precios · Indices

of a number of factors:

to develop a set of indexes that will en-

de Laspeyres · Indices de Paasche

able us to quantify what part of the

1. "Pure" increases in the prices of

change in pharmaceutical expenditure

existing products.

is attributable to each of the factors re-

2. Appearance and increased consump-

sponsible for that change.

tion of new products with a higher

To be able to identify and quantify

than average price. These products

the factors determining drug expendi-

may involve a major or minor thera-

ture growth we need to have analytical

peutic innovation or may simply be

tools and data that enable us to separate

products equivalent to other exist-

the role of each factor. Price indexes are

ing, cheaper products.

the traditional tool for that purpose.

3. Shifts in consumption from low-cost

A price index is a measure of the

products to those of a higher price,

central trend in price changes for a giv-

which may or may not involve any

en group of products. The concept is

additional therapeutic benefit. These

rather simple. Its application, however,

shifts take place:

is more complex. First, from a theoreti-

a. between different presentations –

cal point of view, price averages should

route of administration, dose,

relate to homogeneous products; sec-

pack sizes of the same specialty;

ond, there is no single formula for aggre-

b. between brands of the same ac-

gating individual products (pharmaceu-

tive substance (active principle);

tical specialties) or for weighting them.

HEPAC 4•2001 143

These considerations are very impor-

existing on a given year and changes the

tant, especially in a market such as the

weighting each year according to

drug market with the high rate of intro-

In order to control the therapeutic nov-

current consumption. The fixed Laspey-

duction of new products mentioned

elty factor, we based ourselves not on the

res index is the most commonly used in

earlier, and where it is difficult to distin-

prices of the products per unit of sale,

the calculation of official price indexes

guish the additional therapeutic benefit

i.e., price per pack, but on the price per

such as the consumer price index (CPI).

of new commercial brands or new forms

DDD of each product, meaning each

Separate price indexes were con-

of presentation of existing products.

route of administration of an active

structed for each of the two therapeutic

(The question of how to account for

principle. (Using indicators such as price

groups chosen, antipsychotics and anti-

quality changes in building price index-

per pack poses the problem that in the

depressants (groups N05A and N06A,

es is addressed in the Appendix by

case of a shift in sales towards higher

respectively). It should also be noted that

means of a non pharmaceutical exam-

dose packs or packs with a larger num-

thanks to the data bases used, the index-

ber of tablets, the value of the indicator

es are based not on a sample of goods

In this work the empirical applica-

increases, which may wrongly suggest

but on all of them. This improves the

tion is limited to two therapeutic

that there has been a price increase.) Ac-

representativeness of the indexes con-

groups. The ultimate objective, however,

cording to the method used here, all ex-

siderably, whatever the type of index ap-

is to develop a method that can be ap-

penditures at consumer price on

plied routinely and automatically to any

products with the same active principle

group or to all of them on the basis of

and route of administration (distin-

Laspeyres indexes:

the information on pharmaceutical pay-

guishing, for example, between solid

fixed Laspeyres index

ments habitually compiled by the health

oral administration and oral in solution)

authorities of the Spanish state as part

are added together and divided by the

The formula used to calculate the Las-

of the invoicing process.

respective number of DDD.

peyres price index (IL), in its traditional

The prices obtained are incorporat-

version, is shown below:

Materials and methods

ed into the index weighted by their sharein the expenditure of the corresponding

I L = ∑ w

i0 i0

anatomic-therapeutic group. The prod-

i0

uct has also been defined, as an alterna-

i0 i0

A longitudinal descriptive study was

tive, in terms of active principle (for all

carried out of medical prescriptions

routes of administration) and even

where Pit is the price of the item – active

charged to the Catalan Health Service

chemical family. The greater the aggre-

principles by routes of administration,

(Servei Català de la Salut, SCS). The in-

gation criterion, the less sensitive the in-

active principles and therapeutic fami-

formation source was FAR 200 and FAR

dex is to changes in quality. The less dis-

lies or subgroups, "i" in the period "t";

413 lists from the IDMSIX program of

aggregated it is, the more it tends to pre-

Pi0 is the price of the item "i" in the ini-

the data processing application for mon-

suppose that any price change is attrib-

tial period; n is the number of items con-

itoring the pharmaceutical payments of

utable to an improvement in quality.

sidered for each aggregation level; qi0

the SCS. This program compiles infor-

The variables considered were ex-

are the quantities of the initial period

mation on all prescriptions invoiced to

penditure at consumer price and con-

(also called base period, which in the

the SCS. Two drug groups were selected

sumption in DDD. The price variable

case of the Laspeyres price index is al-

for study: N06, antidepressants and

used was expenditure per DDD, the re-

ways the first period) and wi0 are the

N05A, antipsychotics.Annual consump-

sult of dividing total expenditure at con-

weightings of each item in the base peri-

tion was studied for the period

sumer price by consumption in DDD of

od (this quotient shows the weight of

total prescriptions for each level of ag-

each item considered in relation to total

The degree of therapeutic innova-

gregation considered. The aggregation

expenditure for the therapeutic group

tion was determined according to the as-

levels used in the analysis were: (a) ac-

for the first period).

sessment published in the quasi official

tive principle by route of administration;

The calculation of the fixed Laspey-

drug journal of the Spanish National

(b) active principle; anatomic-therapeu-

res index uses fixed weightings, which

Health Service, Therapeutic Informa-

tic subgroup (c) or substitutive sub-

are those of the base year (in our case,

tion; specialties for which consumption

group (which ultimately corresponds to

1991). Thus, successive price changes cal-

had already been recorded in 1991 (at the

that of chemical family).

culated are always weighted by the per-

start of the study) were assigned a spe-

For the calculation of price indexes

centage expenditure of the item in the

cial code, since although they might

we considered the Laspeyres and Paa-

first year of the period in question.

have been innovative at the time they

sche indexes, in two of their modalities:

It should be borne in mind that the

were introduced, that characteristic was

fixed and chained index [5]. In the fixed

Laspeyres index implies acceptance that

not relevant for analyzing innovation

modality, the Laspeyres index uses con-

the distribution of consumption in the

during the study period 1991–1999. Fi-

sumption in the first year for the

initial year is representative of the whole

nally, the source for assigning the daily

weightings, while the Paasche index us-

period, a very restrictive assumption in

defined dose (DDD), was the WHO "ATC

es consumption in the last year of the

the case of the pharmaceutical con-

Index with DDD 1999."

period. The chained modality, on the

sumption analyzed here, in which con-

other hand, includes all products

siderable inward and outward flows take

144 HEPAC 4•2001

year considered, and is therefore moreappropriate in a consumption groupwith a high rate of innovation.

This index, then, pulls together both

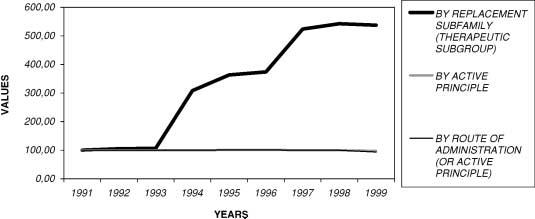

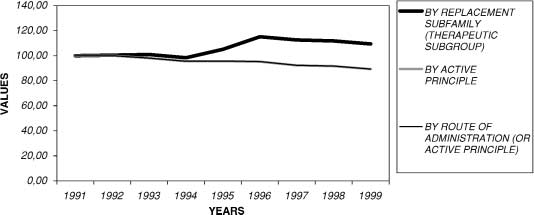

the items that already existed in 1991 andthose which in subsequent years havebeen created and incorporated into drugconsumption statistics. Figures 1 and 2show the results of calculating the Paa-sche index in its fixed version for bothdrug groups.

Calculating the Paasche price index

presents one difficulty, namely, deciding

Fig. 1 � Fixed Paasche index: antipsychotics

what assumption to make on the pricesof the products that were not marketed

place, especially in active principles and

ically different from 1991, so it is point-

after the beginning of the period, for the

routes of administration (a simple com-

less considering 1991 as the weighting

years before their introduction. Of the

parison between percentage expendi-

two possible options, considering a price

tures for these two categories between

zero or projecting the entry price back

the first and last year illustrates this

to 1991, we leaned towards the second. If

point well), resulting in a considerable

we want to study price change, the sec-

change in distribution of consumption

Fixed Paasche index

ond option makes more sense than the

between 1991 and 1999.

first: in the first case a substantial price

So in 1991 some of the items that

The formula used for calculating the

increase is assumed in the year of ap-

will have considerable weight in total ex-

Paasche price index (IP), in its tradition-

pearance, while in the second case it is

penditure in 1999 do not even figure, as

al version, is shown below:

assumed that until the product appears,

they had not yet been introduced. This

there are no price increases.

is the case for some active principles in

I P = ∑ w

the antipsychotic drug group: Olanza-

Antipsychotics. As regards antipsychotic

i0

pine increases from 0% in 1991 to 51.7%

drugs, we can see in the Paasche index, at

in 1999, and Risperidone from 0% to

the level of the replacement subgroup,

36.1%; as for antidepressants, Paroxetine

where Pit is the price of the item "i"in the

steep growths in the years 1994 to 1999,

increases from 0% in 1991 to 31.5% in

period "t"; Pi0 is the price of the item "i"

which can be related clearly to the intro-

1999, and Venlafaxine from 0% to 8%.

in the initial period; n is the number of

duction of new active principles (*Table

The calculation assumption of the fixed

items considered for each aggregation

1). The appearance on the market of Ris-

Laspeyres index is certainly restrictive:

level; qit are the quantities for the final

peridone (tablets) in 1994 explains the

not existing in the first year of the peri-

period (also called base period, which in

190% growth in the price index for anti-

od analyzed means not being considered

the case of the Paasche price index is al-

psychotics: it increases from a value of

in any subsequent year.

ways the last period); and wit are the

106 to 308, the base value in 1991 being

On the other hand some items ap-

weightings of each item in the same pe-

100 (Risperidone will finally represent

pear in 1991 with a large weighting that

riod. This quotient shows the weight –

32% of total expenditure in this thera-

will end up having a very small weight

the relative importance – of each item

peutic group in 1999). On the other hand

in total expenditure for 1999. This is the

considered in relation to the total expen-

in 1997 the introduction of Olanzapine

case for some active principles in the an-

diture of the therapeutic group in the

(tablets) will explain the 40% growth in

tipsychotic drug group: Levopromazine

last period.

the Paasche index for the same antipsy-

decreases from 9.8% in 1991 to 1.0% in

The calculation of the Paasche in-

chotics, from 373 in 1996 to 523 in 1997

1999; Thioridazine decreases from 19.7%

dex also uses fixed weightings, which in

(Olanzapine will finally represent 51% of

to 1.5%; Haloperidol decreases from

this case are those of the last year. Ac-

total expenditure in this therapeutic

23.3% to 2.1% and Sulpiride from 16.5%

cordingly, successive price changes are

group in 1999, being the main active

to 1.7%; and as regards the antidepres-

always weighted by the percentage of the

principal of antipsychotic drugs). As we

sant drugs, Clomipramine decreases

item in question referred to the last year

said at the beginning, drug prices are

from 13.7% in 1991 to 2.1% in 1999 and

of the period considered. The fixed

regulated or controlled by the Adminis-

Fluoxetine decreases from 54.7% to

Paasche index, although it also involves

tration: this explains why, once they have

accepting the very restrictive assump-

been launched, their price is maintained

For the two drug groups considered

tion, as with the fixed Laspeyres index,

or even falls, and we have very few active

the fixed Laspeyres price index calculat-

that the distribution over the period is

principles that show a clear price in-

ed, which shows little price change, is

maintained and that, accordingly, the

crease over the years. It is at the moment

neither very relevant nor very appropri-

weighting for 1 year is representative of

of introduction, when a new active prin-

ate: given the high rate of products go-

the whole period, at least ends up pull-

ciple enters the market, that the ratio be-

ing in and out, the market in 1999 is rad-

ing together all items existing in the last

tween its total expenditure and quantity

HEPAC 4•2001 145

to calculate the price indexes of somepharmaceutical products.

The formula used for the Paasche

index (IP) in them is as follows:

I P = ∑ w

, −1

, −1 = nt−1

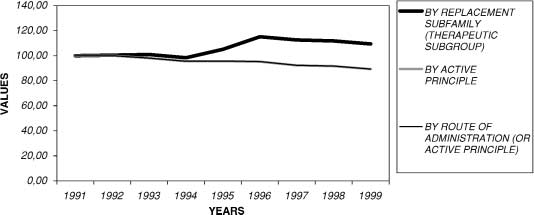

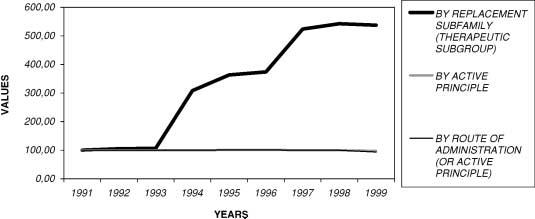

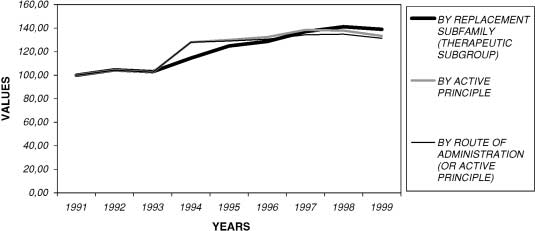

Fig. 2 � Fixed Paasche index: antidepressants

it is the price of the item "i" in the

period "t"; Pi,t-1 is the price of the item"i" in the period prior to "t" (t-1); n is the

(DDD) leaps upwards.And it is this quo-

principle: Fluoxetine starts being sup-

number of items considered for each ag-

tient between expenditure and quantity

plied in solution, despite the fact that it

gregation level; qib are the quantities of

that gives a higher price than that of the

has been available in tablet form since

the item "i" in the base period "b", and

other existing active principles, which

1991; given the price at which it enters

this "b" may be equal to the initial peri-

brings about the spectacular growth in

the market (which also falls over the

od, the previous period (t-1) or any oth-

the general level of prices of the thera-

years), this innovation does not cause a

er period; wi, t-1 indicates the weightings

peutic group. Consequently, stimulated

substantial growth in the index for anti-

of each item in the previous period, t-1;

by the introduction of these two active

depressants either. Finally, it is the intro-

and finally, IPt-1 is the value of the chained

principles (Olanzapine and Risperi-

duction of Venlafaxine in 1995 that caus-

Paasche index also corresponding to the

done), which between them represent

es a small growth in the price index in

previous period.

nearly 90% of pharmaceutical expendi-

the next 2 years: although its price falls

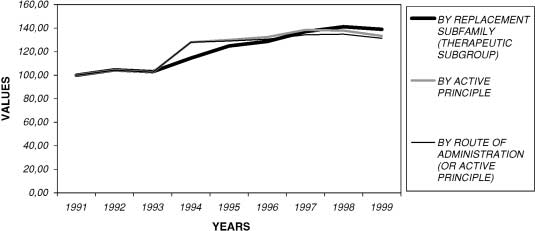

Tables 3 and 4 (*) show the result of

ture of the whole antipsychotic drug

in the end, the price level at which it en-

these calculations, figures 3 and 4 repres-

group in 1999, the fixed Paasche index

ters the market pushes the index up by

ent the trends in those indexes for the

increases from a value of 100 in 1991 to

three aggregation levels considered. For

537 in 1999, a combined growth of over

antipsychotics (*Table 3), the chained in-

500% in just 8 years. Figure 1 shows the

Chained Paasche index

dex increases from a value of 100 in 1991

Paasche index of the antipsychotic

to 139 in 1999. The evolution of this index

group at the levels of replacement sub-

To overcome the limitations of price in-

shows the same leaps as those recorded

group, active principle and active princi-

dexes with fixed weighting we use

in Table 1, although in a smaller propor-

ple by route of administration. It can be

chained indexes. These are used, for ex-

tion: the entry of Risperidone in 1994

seen that it is only at the first aggrega-

ample, in cases where the items consid-

and Olanzapine in 1997 are responsible

tion level that we observe the large

ered move in and out at high rate. The

for the subsequent jumps in the price in-

growth in price index: when a new ac-

formula for this index is the one used by

dex. It can be seen that in this chained

tive principle or route of administration

the Bureau of Labor Statistics (BLS) to

calculation modality, unlike the fixed, the

enters the market, its value is 100; and

calculate the Medical Care Price Index

price indexes at the level of active princi-

given that the majority of prices are

(MCPI). It is also the one used by the Na-

ple and route of administration also re-

maintained or tend to fall once they are

tional Bureau of Economic Research

flect the impact of the introduction of

on the market, the price index does not

(NBER), in its more recent publications,

therapeutic novelty: the index value for

pick up the effect of the entry of the newproduct on the average price of the itemfor the other two lower aggregationlevels, as it projected the entry priceback to 1991.

Antidepressants. As regards antidepres-

sants, the introduction of new active

principles does not cause increases in

the Paasche price index (with one excep-

tion).As a whole, this fixed index for an-

tidepressants increases from a value of

100 in 1991 to 109 in 1999 (*Table 2). In

1992 the appearance of Paroxetine hard-

ly alters the general Paasche index of the

group. In 1994 there appears a new route

of administration of an existing active

Fig. 3 � Linked Paasche index: antipsychotics

146 HEPAC 4•2001

from Table 8 that, after falling from a val-ue of 100 in 1991 to 98.9 in 1999, the priceindex now falls to 89.4.

As the prices of drugs, once

introduced in the market, are controlledby the government and because of theway in which the industry (with the ad-ministration's approval) has respondedto that control, traditional price index-es, such as the fixed Lapeyres index, donot provide valid and relevant informa-tion. These indexes show small increasesor no increase at all, a totally different

Fig. 4 � Linked Paasche index: antidepressants

picture from the one drawn from thetrends in average price per prescription,

1 year is affected (corrected) by its value

price index were, therefore, the active

which habitually records a notable, sus-

in the previous year. And as regards an-

principles which involved a notable

tained growth, particularly in our case

tidepressants, we can see a slight fall in

therapeutic innovation (in particular

for antipsychotics (nearly 700%). By us-

the chained price index, of barely 1% be-

Olanzapine and Risperidone).When the

ing a fixed Paasche index, on the other

tween 1991 and 1999, after slight increas-

active principles of levels B and C (Sert-

hand, the growth of prices of antipsy-

indol pastilles, Zuclopenthixol pastilles,

chotic products shows an increase from

solution and parenteral depot) are elim-

a value of 100 in 1991 to 537 in 1999: stim-

Accounting for therapeutic innovation

inated, the price index increases

ulated by the introduction of two active

in price indexes

somewhat less than in the previous case.

principles, Risperidone in 1994 and

Table 7 shows an increase in value from

Olanzapine in 1997 (which between

In this section we attempt to analyze

100 in 1991 to 111 in 1999; so level C pro-

them cornered nearly 90% of pharma-

price trends eliminating the possible ef-

ducts have a slight deflationary effect.

ceutical expenditure for the whole anti-

fects of innovation. To do so price index-

In the case of antidepressants, there

psychotic therapeutic group in 1999), the

es are calculated eliminating, first, prod-

is a slight difference between the index

overall growth of the therapeutic group

ucts introduced over the period which

for products as a whole and the index re-

is over 500% in just 8 years. Finally, us-

involve some therapeutic contribution,

sulting after eliminating the products

ing the Paasche index in its chained ver-

and second, new products which do not

classed as reasonable therapeutic inno-

sion, it increases by nearly 40 %, and the

involve any relevant therapeutic contri-

vation (i.e., Moclobemide, the only level

periods of price increase coincide with

bution over existing products.

B product). The price index, which be-

the years in which the above therapeu-

Tables 5-8 (*) show the results of

fore fell from 100 in 1991 to 98.9 in 1999,

tic novelties were introduced.

considering two categories or levels of

now falls to 96.9: this minimal difference

This phenomenon is not observed

innovation, B (reasonable therapeutic

is because in 1999 Moclobemide,

with antidepressants. In terms of aver-

innovation) and C (practically no thera-

launched in 1992, has a weight of less

age price the increase is 84 % between

peutic innovation), in accordance with

than 1 % of total expenditure for its ther-

1991 and 1999, although calculating the

the criteria and subsequent cataloguing

apeutic group. On the other hand, it is

fixed Paasche index for antidepressants

by the Ministry of

when the level C active principles (Cita-

shows an increase from a value of 100 in

lopram, Mirtazapine, Nefazodone, Re-

1991 to 109 in 1999. In this case, too, it is

ic/documentos). Figures 5 and 6 repres-

boxetine, Paroxetine, Sertraline y Venla-

the introduction of new products (Par-

ent the consideration of those levels for

faxine) are eliminated that the price in-

oxetine 1992; Fluoxetine sachets 1994;

the aggregation level of chemical family.

dex falls considerably. It can be seen

Venlafaxine 1995) that pushes this index

It is in the antipsychotic group that

we see the most notable difference be-tween the price index with total prod-ucts and those that are left after elimi-nating the three active principles con-sidered of level B. In Table 5 we see thatwhen those principles (Olanzapine, Ris-peridone and parenteral Zuclopenthix-ol) are eliminated the increase in pricesin this therapeutic group is considerablyreduced: with all products, between 1991and 1999, the index grew from 100 to 139,and without those products, only from100 to 109. The products responsible fora large part of the growth in the (total)

Fig. 5 � Antipsychotics, linked Paasche index, and innovation level

HEPAC 4•2001 147

Moreover, to enable us to separate

the different factors responsible for theincrease in average prices and, in the lastinstance, expenditure on drugs, it wouldbe helpful to develop for each therapeu-tic group a set of indexes with the fol-lowing aggregation levels: (a) pharma-ceutical specialty, (b) active principle byroute of administration, (c) active prin-ciple, (d) chemical family. In future, im-provements in quality should be identi-fied and assigned monetary values on a

Fig. 6 � Antidepressants, linked Paasche index, and innovation level

product by product basis, so as to deter-mine what proportion of the price in-creases are attributable to those im-

upwards, albeit to a far lesser extent). Fi-

(fixed Paasche) destroys homogeneity

provements or whether they are pure

nally, using the Paasche index in its

but achieves greater representativeness.

price increases. This information would

chained version, the index in question

Given the trends experienced be-

enable us to diagnose the causes behind

shows a slight price fall of 1% between

tween 1991 and 1999 in the composition

trends in expenditure and to create a ra-

1991 and 1999.

of the therapeutic groups considered

tional basis for future policies.

An attempt was also made to relate

(with some active principles, especially

the increase observed in the fixed Paa-

among the antipsychotics, that did not

Acknowledgements. This work was awarded

sche indexes to the level of innovation

exist in 1991, but which represent a very

a research prize by the "Sociedad Españolade Farmacéuticos de Atención Primaria." The

represented by the different therapeutic

high percentage of total expenditure in

authors are grateful for the initiative and sup-

innovations considered. In the case of

1999), it makes more sense to try to base

port of Josep Lluís Segú in the preparation

antipsychotics there is a notable corre-

on the Paasche price index any conclu-

and development of the project.

lation between the growth in prices and

sions about the evolution of the prices.

the active principles involving reason-

However, using this index poses in its

Appendix: price indexes and

able innovation: by eliminating the three

turn several problems. For instance,

active principles of level B only (Olanza-

there is no clear criterion for treating the

pine, Risperidone and parenteral Zuclo-

prices of products that did not exist at

The treatment of changes in the quality

penthixol) the growth in prices in this

the beginning of the period: if they are

of products over time is a problem com-

therapeutic group between 1991 and

given a zero value, price growth will be

mon to all price indexes. The more usu-

1999 is reduced from 40% to 10%. In the

overestimated. If they are assigned the

al price indexes, such as the CPI, are Las-

case of antidepressants, however, there

price of the first period in which they

peyres indexes which reflect trends in

is practically no difference between the

appear, an underestimation is likely to

the prices of a basket of goods represen-

price indexes for the actives principles

occur.Another practical problem is that

tative of consumption in the initial base

as a whole and the remainder once the

using the Paasche index routinely and

period. If the basket is not changed, it

principle classed as a reasonable inno-

continuously over time means that the

gradually loses its representativeness

vation (Moclobemide) is excluded; it is

weightings will vary each year, and so

over time and, as a result, so does the in-

when the level C active principles (Par-

the index should be recalculated annual-

dex. But updating the basket by intro-

oxetine, Sertraline and Venlafaxine) are

ly for the whole period. The results of

ducing new products and removing

excluded that the price index for this

any analysis could change if repeated in

those products no longer consumed

group falls nearly 8 percentage points

a subsequent period.

poses its own problems.

between 1991 and 1999.

Obviously, this is not ideal if the in-

In theory, price indexes should re-

The above results demonstrate that

dex is to be used as a basis for adminis-

flect trends of a set of goods that pro-

the choice of price index is an essential

trative decisions, negotiations, etc.

vides the consumer with a particular

question in the analysis of trends in

utility. Let us suppose that instant coffee

prices and pharmaceutical expenditure.

replaces traditional coffee in the family

The choice of a particular index implies

shopping basket. The price of normal

certain specific assumptions regarding

The optimum solution to the selection of

coffee is 500 Ptas/kg and the price of in-

the representativeness of the products

a valid and reliable price index, at least in

stant coffee is 1000 Ptas. Let us suppose,

chosen and the homogeneity of con-

the context of our study, seems to point

furthermore, that those prices have re-

sumption over time. Basing the price in-

towards the application of chained Las-

mained unchanged for the whole of the

dex on products existing at the begin-

peyres indexes, which in the case of

period in question. If at any given mo-

ning of the period (fixed Laspeyres) im-

pharmaceuticals does not pose the infor-

ment the price of the former is simply

proves homogeneity at the expense of

mation problems that would arise with

replaced by the price of the latter, one is

representativeness, while taking the

other goods, since data on consumption

implicitly accepting that the two goods

weightings of the last period considered

are usually available, making it easy to

are homogeneous (i.e., the same prod-

calculate weightings year by year.

uct) and that their price has doubled.

148 HEPAC 4•2001

Obviously, the products are not homo-

Unfortunately, in other cases the sit-

geneous and consumers may prefer the

uation is more confusing. Let us suppose

advantages of instant coffee, so the price

now that coffee beans at 500 Ptas/kg are

Boskin MJ, et al (1998) Consumer prices,

difference should be attributed to the

replaced by ground coffee at 1000

the consumer price index and the cost of

improved quality and should not be re-

Pta/kg.Although ground coffee may im-

living. J Econ Perspect 12:3–26

flected in the price index. In economic

ply an improvement in quality, it would

Borrell J-R (1999) Pharmaceutical price

terms, the individual is obtaining in-

be hard to accept that such an improve-

regulation. A study of the impact of the

creased utility from the new basket in

ment could justify such a large price in-

rate-of-return regulation in the U.K.

which traditional coffee has been re-

crease. This would be even more doubt-

Cockburn IM, Anis AH (1998) Hedonic analysis

placed by instant. Consequently, a new

ful if the conditions within the coffee

of arthritis drugs. National Bureau of Economic

basket should be created which includes

market were not those of a competitive

Research working paper 6574

instant coffee.

market. Part of the increase could be a

Fernandez-Cornejo J, Jans S (1995) Quality

The argument could be further

pure price increase due, for example, to

adjusted price and quantity indices for pesti-

complicated if we suppose that making a

changes in supply and demand. If we

cides. Am J Agricultural Econ 77:645–659

cup of coffee requires 10 g of traditional

substitute the new product in the con-

Frank RG, Berndt ER, Busch SH (1998) Price

coffee and only 5 g of instant. In that case

sumption basket and start the index

indexes for the treatment of depression.

National Bureau of Economic Research

it could be argued that the relevant unit

with a new base, we will have underval-

working paper 6417

of product is not price per kilogram but

ued the real price increase.

García MA, et al (2000) Adopción de los nuevos

the cost of the coffee necessary to make

There are, of course, theoretical

medicamentos por los médicos prescriptores.

one cup. Under these suppositions, the

methods for differentiating the pure

El medico innovador. Rev Atención Primaria

price of coffee would have remained con-

price increase part from the part attrib-

stant (20 Ptas per cup). In fact it could be

utable to quality changes. For example,

Gerdtham U, et al (1997) Price indices of drugs

argued that the price had fallen, as part

one could estimate the cost of grinding

and the switching to new drugs.

of the new price corresponds to an im-

the coffee or consumers' willingness to

Griliches Z, Cockburn I (1994) Generic and

provement in quality of the product.

pay more for this feature of the product.

new goods in pharmaceutical price indexes.

However, the adjustment methods are

Am Econ Rev 5:1213–1232

not easy and will no doubt be subject to

Ministerio de Sanidad y Consumo (1992)

Información Terapéutica del Sistema Nacionalde Salud, 16:222

Ruiz-Castillo J, Ley E, e Izquierdo M (1999)

*Tables 1 to 8 are available at URL:

La mesura de la inflació a Espanya. Colleció

d'Estudis Econòmics. Caixa d'Estalvis i Pensions

de Barcelona "la Caixa",no 17

HEPAC 4•2001 149

Source: http://www.eco.ub.es/~tremosa/HEPAC.pdf

Risiken bei nichtmedizinischem Gebrauch von CannabisEva Hoch, Udo Bonnet, Rainer Thomasius, Florian Ganzer, Ursula Havemann-Reinecke, Ulrich W. Preuss Cannabis wurde vor kurzem in einigen US-Bundes- staaten zum Gebrauch in der Freizeit legalisiert. Hintergrund: Cannabis ist die am häufigsten konsumierte illegale Droge welt- Gleichzeitig verbessert sich der wissenschaftliche

UTILISER LES VIVACES: UN FLEURISSEMENT DURABLE ET ÉCONOME EN Luc Gallé - Présentation vivaces 2016 SOMMAIRE Qu'est-ce qu'une plante vivace ? POURQUOI CHOISIR DES PLANTES VIVACES ? Leurs attraits INTERET DES VIVACES EN ESPACES-VERTS LA PLANTATION D'UN MASSIF DE VIVACES