Levitra enthält Vardenafil, das eine kürzere Wirkdauer als Tadalafil hat, dafür aber schnell einsetzt. Männer, die diskret bestellen möchten, suchen häufig nach levitra kaufen ohne rezept. Dabei spielt die rechtliche Lage in der Schweiz eine wichtige Rolle.

Tstboces.org

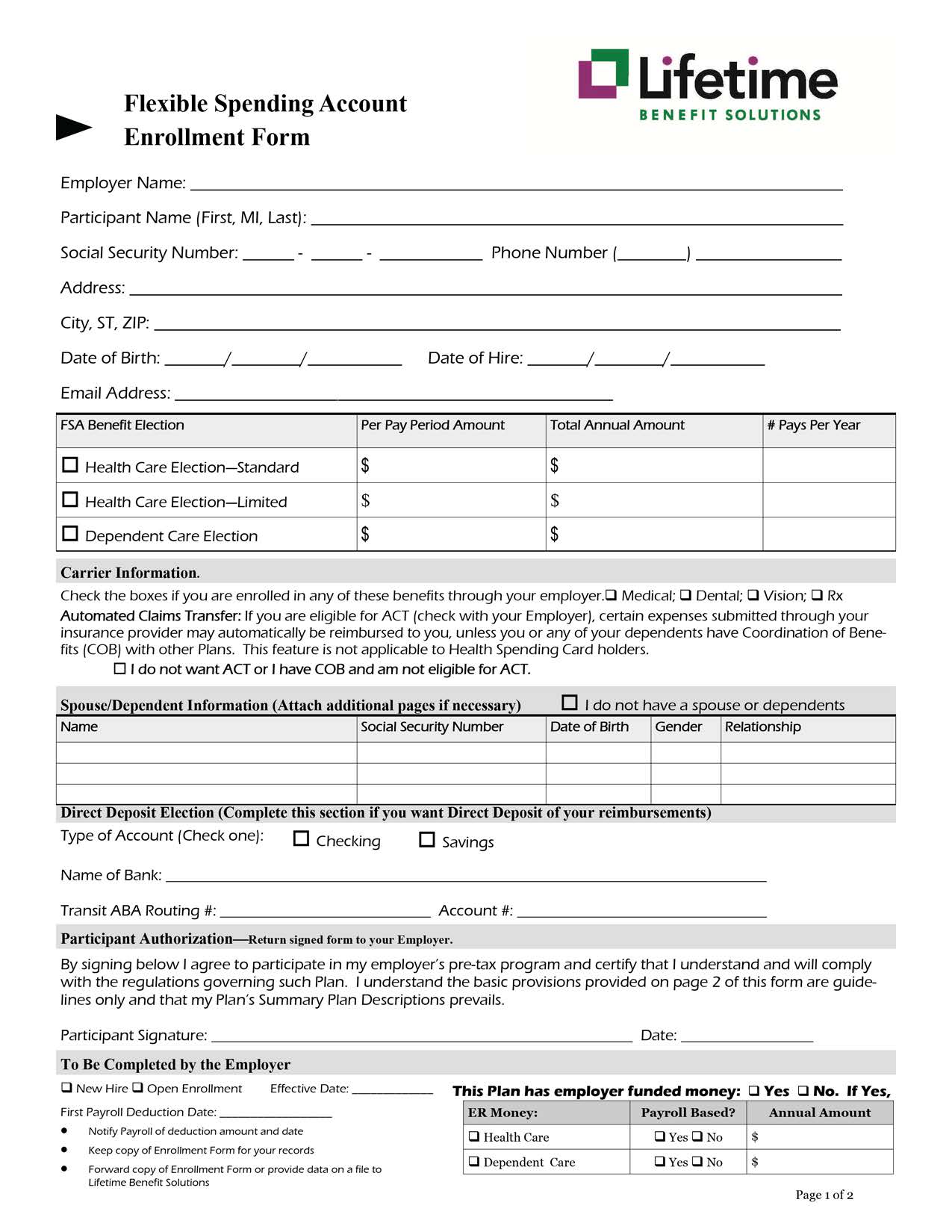

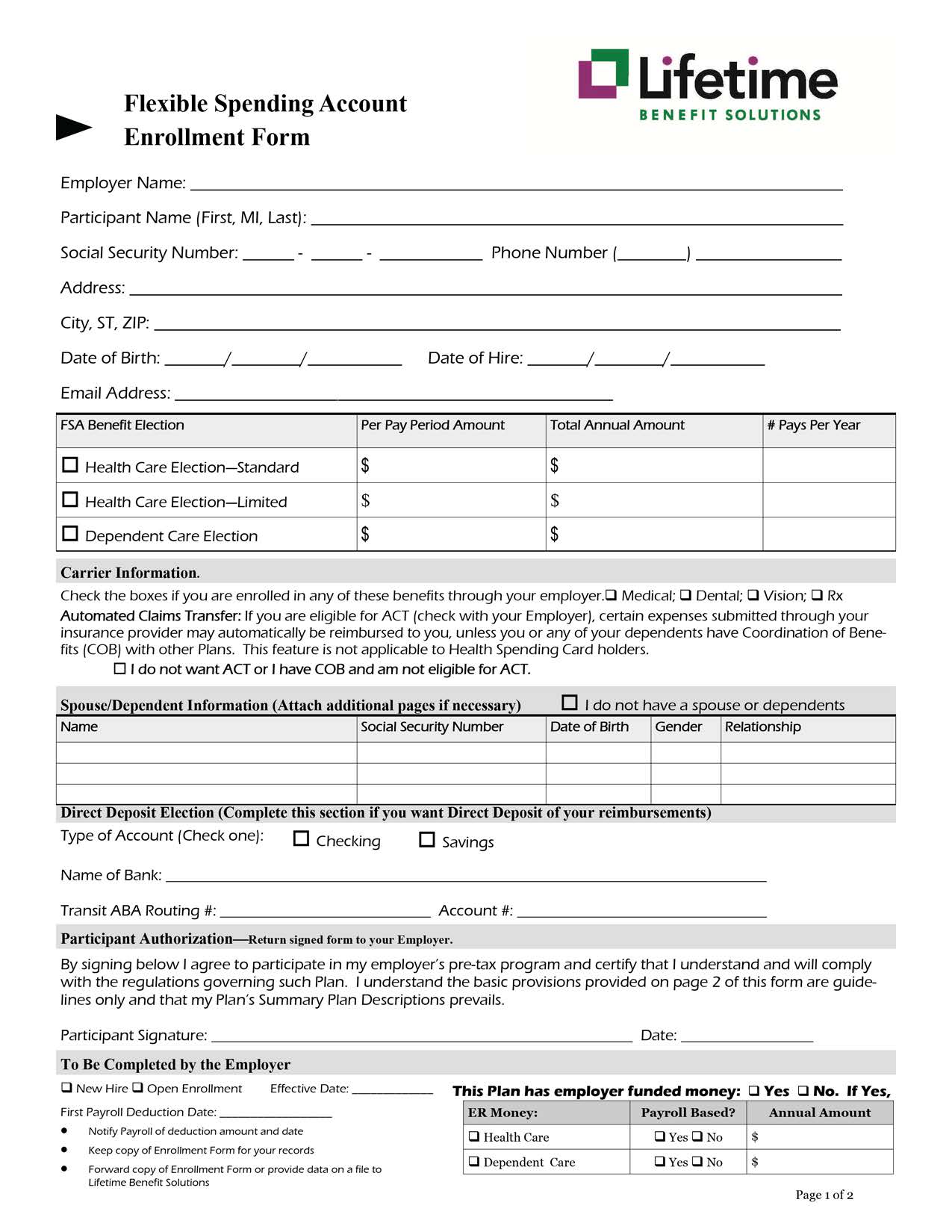

Flexible Spending Account (FSA)

• Significant savings• 24/7 web access• Fast, efficient, convenient• The benefit that benefits everyone

A Flexible Spending Account (FSA)

Estimate Your Expenses:

is an employee benefit plan established under IRC

You can maximize your FSA account by planning

Section 125 that allows you to pay for everyday health

ahead carefully and using this helpful tool. You

care, dependent care expenses and certain individual

may also use the FSA calculator on our website,

premium expenses with pre-tax dollars.

LifetimeBenefitSolutions.com. Some common items to consider are also listed in the chart:

An FSA saves you money by reducing your taxable income. The FSA amount you elect will be subtracted

Health Care Account

from your gross income. Federal, state and FICA taxes

are then calculated on the lower amount. When you (or your spouse or dependents) incur an eligible expense,

you'll receive reimbursement from the funds you've set

Dental Expenses not covered by insurance

aside from your paycheck.

Health Care Component:

Vision Expenses (Exams, Glasses, Lenses)

This account helps you save money on everyday out-

Hearing Expenses (Exams, Hearing Aids)

of-pocket medical expenses such as medical copays,

Prescription Drugs

coinsurance, prescription drugs, orthodontics, vision expenses, hearing aids, dental services, eligible

Eligible Over-the-Counter Items

over-the-counter (OTC) items and more. Qualifying

Diabetic Supplies

dependents for FSA purposes include children through

Therapy (Physical Therapy, Speech, Chiro)

the end of the year in which they turn 26.

Limited Purpose FSA:

A limited-purpose FSA is much like a general-purpose

Total Estimated Health Care Expenses

health FSA. The main difference is that the limited-purpose account is set up to reimburse only eligible

Dependent Care Account

FSA dental and vision expenses. These plans allow you

Payment to Dependent Care Facility

to contribute to an HSA as well.

Payment to Dependent Care Individual

Dependent Care Component ($5000 maximum):

Payment to Adult Care Provider

This account helps you save money on daycare

Total Estimated Dependent Care Expenses

expenses for dependent children and adults so you can work. Qualifying dependents include children

Total Health Care PLUS Dependent Care

under age 13, whom you claim as a dependent on your federal income tax return (special rules apply for

Know the Details:

divorced parents), a disabled spouse and any other

Be sure to budget for each account expense

dependent on your tax return who resides with you and

separately. Elections to and reimbursements from

is physically or mentally disabled.

these accounts cannot be blended. Also, a use-it-or-lose-it provision may apply, so plan ahead carefully.

Plan Ahead for your FSA!

You must re-enroll in this Plan each year. You cannot

Planning ahead is important when signing up for your

change your election during a Plan year unless you

company's FSA Plan and understanding the benefits

incur a qualifying life event, such as marriage/divorce,

offered is critical.

Read your Summary Plan Description (SPD) carefully to understand the specific terms of your Plan. The Plan

Document governs your rights and benefits under each Plan and is available through your employer.

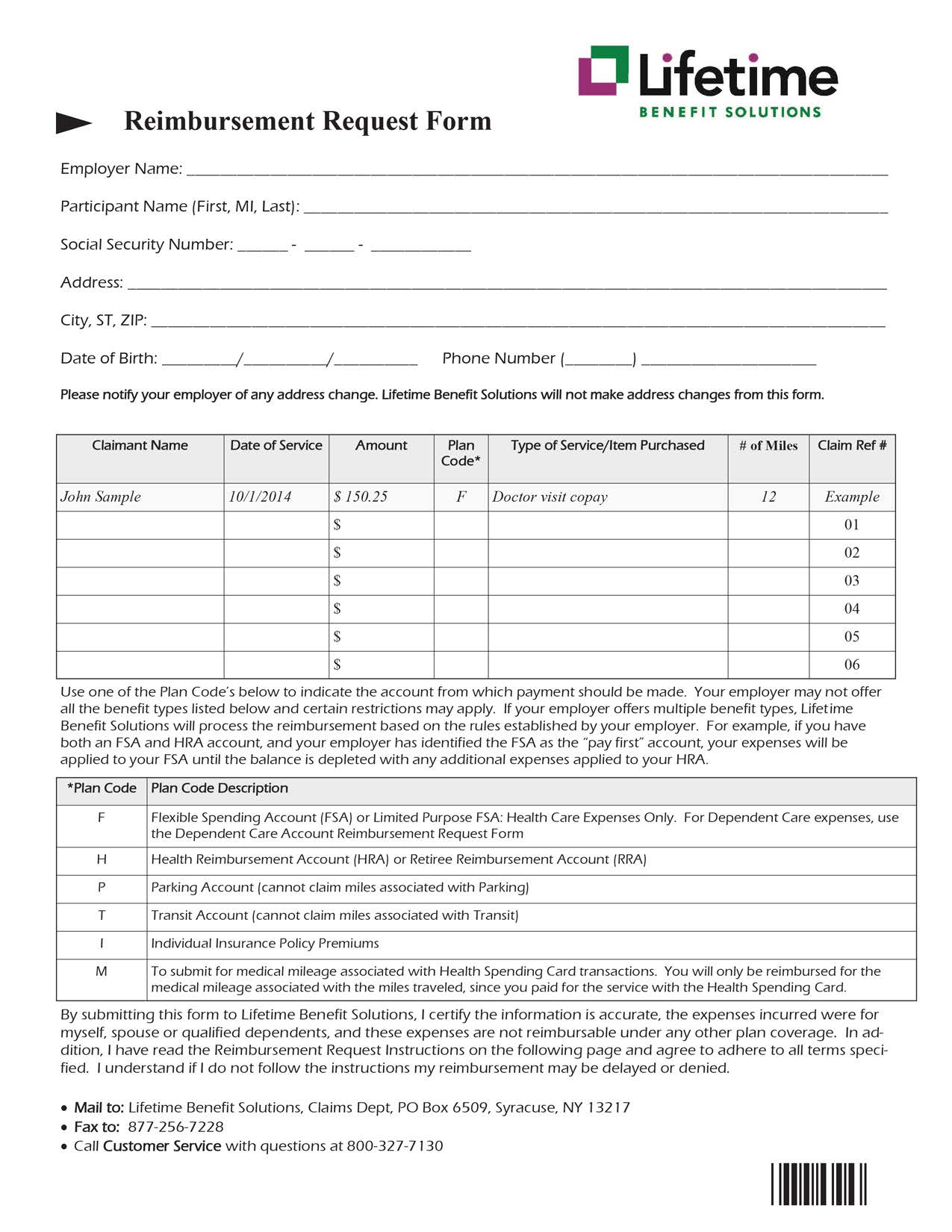

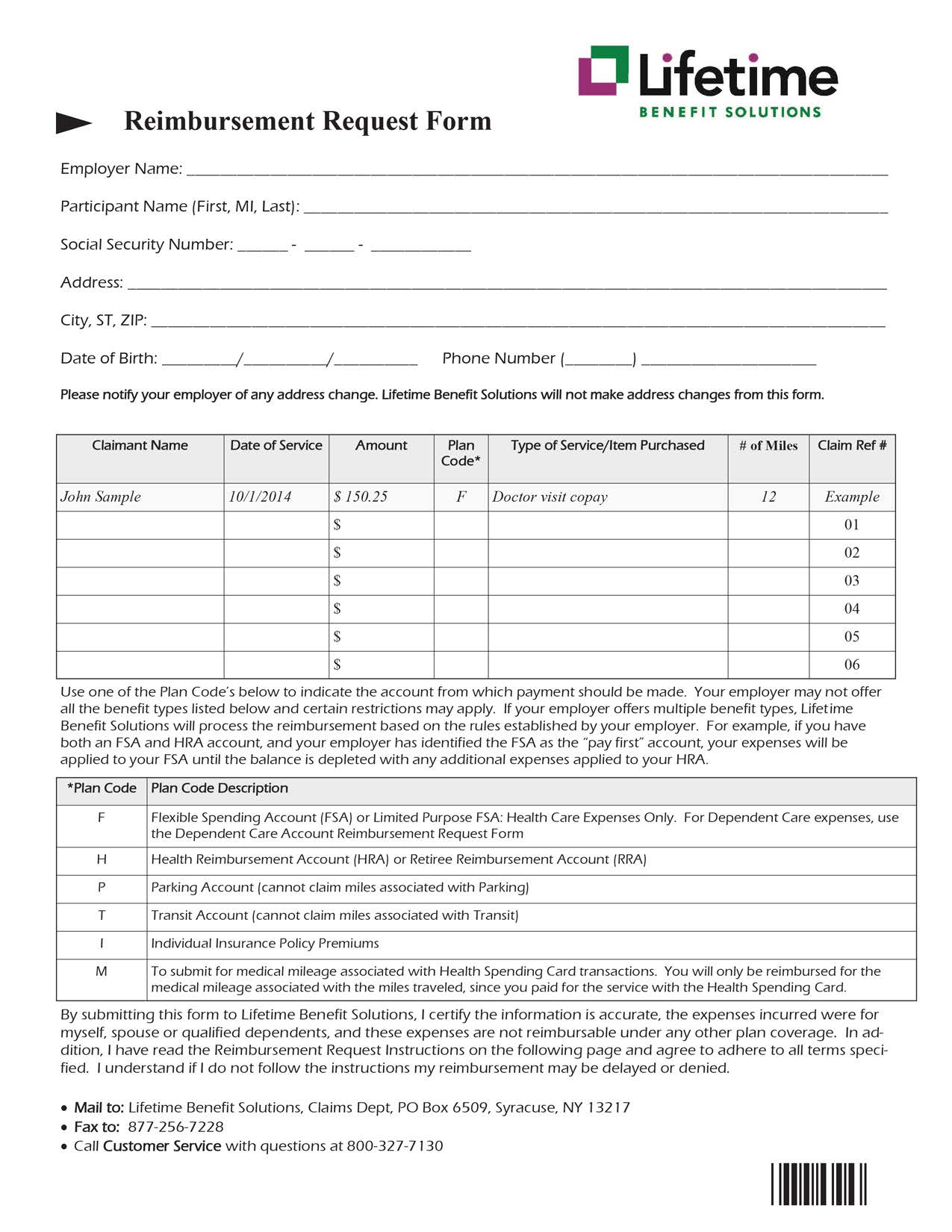

Claims Processing and

Claims deadlines apply. Be sure to carefully read your

Summary Plan Description (SPD) to understand the terms and deadlines associated with your Plan.

Customer Service: Most of your questions can be answered by visiting the website. If you prefer to speak with a customer service representative, call 800-327-7130 Monday-Thursday from 8am EST to 5pm EST and Friday from 9am EST to 5pm EST. You can also email our Customer Service department at

[email protected].

Go Direct or Go GreenReceive your reimbursement quicker, and avoid the $30 check minimum and a trip to the bank by completing a Direct Deposit form online.

Provide or update your email address online and help

Submit your claims online to receive the fastest

us go green. You'll receive only plan related information

reimbursement for an eligible out-of-pocket expense.

such as account statements, claim related information

Supporting receipts and documentation can be

and Request for Information (RFI) letters (for Card

scanned and attached to your online claim, or you can

email, fax or mail the required paperwork. Another option is to download a paper Reimbursement Request

form. Complete the form by itemizing your expenses

Our mobile app enables you to easily and securely

and following the instructions found directly on the

access your health care spending accounts. You can

form. Reimbursement Request forms and required

view account balances and detail, submit claims, and

documentation can either be mailed or faxed for

capture and upload pictures of your receipts anytime,

anywhere on iPhone, Android or tablet devices.

Web AccessView your account online 24/7 via LifetimeBenefitSolutions.com.

While online, you can:• Submit claims for reimbursement• View claims history• Sign up for Direct Deposit• Check your available balance• Access forms such as Direct Deposit, Certification of Medical Necessity,

Release of Information and various Reimbursement Request forms

• Enter your email address to receive important Plan related materials• Use our online services, such as our online calculator to estimate your

out-of-pocket expenses and our online eligible expense listing

To access your account online, visit LifetimeBenefitSolutions.com and click on the Participants link. Select Reimbursement Accounts: FSA/HRA/HSA/QTB then click on the green login button. For detailed instructions on how to view your account online, click on the link for Login Directions to Your Reimbursement Account located under the green login button. Your initial username will be your social security number (or whatever identifier your employer provides). Your password will be the first letter of your first name (lower case) followed by your five digit zip code.

Qualifying Health Care ExpensesAcupuncture

Drug overdose, treatment of

Occlusal guards to prevent

Eye examinations, eye

Taxes on medical services

Alcoholism treatment

glasses, equipment and

Telephone for hearing

Artificial limbs

Fluoridation services

impaired persons

Artificial teeth

Guide dog; other service

Television for hearing

Asthma treatments

impaired persons

Hospital services

Oxygen Physical exams

Braille books and magazines

Breast reconstruction surgery

Preventive care screenings

Transportation expenses

following mastectomy

Laser eye surgery; Lasik

for person to receive

Chelation therapy

Lodging at a hospital or

Psychiatric care

similar institution

Radial keratotomy

Tuition evidencing separate

Co-insurance amounts

Mastectomy-related

breakdown for medical

Medical alert bracelet or

Sleep deprivation treatment

Smoking cessation programs

Vision correction procedures

Dental treatment

Medical information

Stop smoking program

Drug addiction treatment

Medical records charges

Supplies to treat medical

Obstetrical expenses

Potentially Qualifying Health Care ExpensesA Certification of Medical Necessity Form must be completed by your physician.

AA meetings, transportation

Dyslexia treatment

Nutritionist's expenses

Fitness programs

Lactation consultant

Occupational therapy

Alternative healers

Gambling problem,

Personal trainer fees

Automobile modifications

Language training

Lead-based paint removal

Home improvements (such

Lodging of a companion

Ultrasound, prenatal

Books, health related

as exit ramps, widening

Long-term care services

Varicose veins, treatment of

Car modifications

doorways, elevator, etc.)

Veterinary fees (service

Childbirth classes

Hormone replacement

Mineral supplements

Weight loss programs

Ineligible Health Care ExpensesAppearance improvements

Electrolysis or hair removal

Late fees (e.g., for late

Funeral expenses

payment of bills for

Tanning salons and

Controlled substances in

Hair removal and transplants

medical services)

violation of federal law

Maternity clothes

Cosmetic procedures

Illegal operations and

Missed appointment fees

Qualifying Over-The-Counter (OTC) ItemsArthritis gloves

Eye drops (Example: Visine)

Orthopedic shoe inserts

Bandages (Examples:

Contact lenses, materials

Pregnancy test kits

Band- Aid, Curad, Ace)

Blood pressure monitoring

Glucose monitoring

Dentures, denture adhesives

Blood sugar test kits and

Diabetic supplies (including

Medical monitoring and

Carpal tunnel wrist supports

Ear wax removal products

This is not a comprehensive list and is subject to change at any time and without notice.

Potentially Qualifying OTC Expenses

Drug and Medicine items require a prescription completed by your physician and are not eligible for payment with the HealthSpending Card. Other items in this category require a Certification of Medical Necessity form completed by your physician.

Compression hose

Probiotics Rehydration

Cough suppressants

Holistic or natural healers,

solution (Example:

and drugs and medicines

Pediacare, Robitussin,

Allergy treatment products;

Incontinence supplies

Sinus medications (Example:

household improvements

Decongestants (Examples:

Insect bite creams and

to treat allergies

Dimetapp, Sudafed)

ointments (Examples:

Antacids (Examples: Maalox,

Benadryl, Cortaid)

Prilosec OTC, Zantac)

Diaper rash ointments and

Lactose intolerance tablets

Sunburn creams and

Antibiotic ointments (Exam-

creams (Example: Desitin)

(Example: Lactaid)

ples: Bacitracin, Neosporin)

Diarrhea medicine

Laxatives (Example: Ex-Lax)

Antihistamines (Examples:

(Examples: Imodium,

Medicines and drugs

Benadryl, Claritin)

Menstrual pain relievers

Throat lozenges (Examples:

Anti-itch creams (Examples:

Dietary supplements

Motion sickness pills

Cepacol, Chloraseptic)

Benadryl, Cortaid, Ivarest)

Eczema treatments

(Examples: Bonine,

Toothache and teething pain

Expectorants (Examples:

relievers (Example: Orajel)

Comtrex, Robitussin)

Nasal strips or sprays

Fiber supplements

Nutritional supplements

Pain relievers (Examples:

Wart remover treatments

Advil, Aspirin, Tylenol)

Claritin, an allergy drug

Hemorrhoid treatments

Yeast infection medications

Cold medicine (Examples:

Example: Preparation H)

Prenatal vitamins

The IRS has not yet released a

Comtrex, Sudafed)

detailed and brand specific list of drugs and medicine.

Ineligible OTC ExpensesDental floss

Feminine hygiene products

Diapers or diaper service

Shaving cream or lotion

Perfume, Cologne

Skin moisturizers, hand lotion

Eligibility rules for OTC items may change. Drug and Medicine items require a physician's prescription, and may not be purchased with a Health Spending Card. The ability to pay for eligible items with the Health Spending Card may vary by merchant and is dependent on the merchant's IIAS system.

This is not a comprehensive list and is subject to change at any time and without notice. Items listed in each category may be reclassified into another category depending on future IRS guidance.

Eligible Dependent Care Expenses• Care in your home, some-

• Education expenses for

• Day camp (not overnight)

one else's home, or in a

a child not yet in

expenses if the camp

daycare center for child care

kindergarten, such as

qualifies as a daycare

and/or eldercare. Licensing

nursery school expenses.

requirements may apply.

• Expenses paid to a relative

• FICA and FUTA payroll

• Registration fees for a

are eligible, however, the

taxes of the daycare

relative cannot be under

• Before and after school care

age 19 or a tax dependent.

for children under age 13.

Note: This is not a comprehensive list.

Source: http://tstboces.org/wp-content/uploads/2015/06/Flexible-Spending-Account-Enrollment-Kit.pdf

International Journal of Ophthalmology & Eye Science (IJOES) Epidemiology of Eales Disease in the Central Western India Shah MA*, Shah SM, Kalyani PJ, Shah AH, Shah PD, Pandya JS Drashti Netralaya, Dahod, Gujarat, India. Objective: To investigate the clinical features and propose a new staging system based on the clinicopathological correla-

Social Mishap Exposures for Social Anxiety Disorder: An Important Treatment Ingredient Angela Fang, Alice T. Sawyer, Anu Asnaani, and Stefan G. Hofmann, Boston University Conventional cognitive-behavioral therapy for social anxiety disorder, which is closely based on the treatment for depression, has been shownto be effective in numerous randomized placebo-controlled trials. Although this intervention is more effective than waitlist control group andplacebo conditions, a considerable number of clients do not respond to this approach. Newer approaches include techniques specificallytailored to this particular population. One of these techniques, social mishap exposure practice, is associated with significant improvement intreatment gains. We will describe here the theoretical framework for social mishap exposures that addresses the client's exaggerated estimationof social cost. We will then present clinical observations and outcome data of a client who underwent treatment that included such socialmishap exposures. Findings are discussed in the context of treatment implications and directions for future research.